Code Red - The Unintended Consequences of ZIRP, Zero Interest Rates Policy

Interest-Rates / US Interest Rates Nov 17, 2013 - 06:25 PM GMTBy: John_Mauldin

Yellen's coronation was this week. Art Cashin mused that it was a wonder some senator did not bring her a corsage: it was that type of confirmation hearing. There were a few interesting questions and answers, but by and large we heard what we already knew. And what we know is that monetary policy is going to be aggressively biased to the easy side for years, or at least that is the current plan. Far more revealing than the testimony we heard on Thursday were the two very important papers that were released last week by the two most senior and respected Federal Reserve staff economists. As Jan Hatzius at Goldman Sachs reasoned, it is not credible to believe that these papers and the thinking that went into them were not broadly approved by both Ben Bernanke and Janet Yellen.

Yellen's coronation was this week. Art Cashin mused that it was a wonder some senator did not bring her a corsage: it was that type of confirmation hearing. There were a few interesting questions and answers, but by and large we heard what we already knew. And what we know is that monetary policy is going to be aggressively biased to the easy side for years, or at least that is the current plan. Far more revealing than the testimony we heard on Thursday were the two very important papers that were released last week by the two most senior and respected Federal Reserve staff economists. As Jan Hatzius at Goldman Sachs reasoned, it is not credible to believe that these papers and the thinking that went into them were not broadly approved by both Ben Bernanke and Janet Yellen.

Essentially the papers make an intellectual and theoretical case for an extended period of very low interest rates and, in combination with other papers from both inside and outside the Fed from heavyweight economists, make a strong case for beginning to taper sooner rather than later, but for accompanying that tapering with a commitment to an even more protracted period of ZIRP (zero interest rate policy). In this week's letter we are going analyze these papers, as they are critical to understanding the future direction of Federal Reserve policy. Secondly, we'll look at what I think may be some of the unintended consequences of long-term ZIRP.

We are going to start with an analysis by Gavyn Davies of the Financial Times. He writes on macroeconomics and is one of the more of the astute observers I read. I commend his work to you. Today, rather than summarize his analysis, I feel it is more appropriate to simply quote parts of it. (I will intersperse comments, unindented.) The entire piece can be found here.

While the markets have become obsessively focused on the date at which the Fed will start to taper its asset purchases, the Fed itself, in the shape of its senior economics staff, has been thinking deeply about what the stance of monetary policy should be after tapering has ended. This is reflected in two papers to be presented to the annual IMF research conference this week by William English and David Wilcox, who have been described as two of the most important macro-economists working for the FOMC at present. At the very least, these papers warn us what the FOMC will be hearing from their staff economists in forthcoming meetings.

The English paper extends the conclusions of Janet Yellen's "optimal control speeches" in 2012, which argued for pre-committing to keep short rates "lower-for-longer" than standard monetary rules would imply. The Wilcox paper dives into the murky waters of "endogenous supply", whereby the Fed needs to act aggressively to prevent temporary damage to US supply potential from becoming permanent. The overall message implicitly seems to accept that tapering will happen broadly on schedule, but this is offset by super-dovishness on the forward path for short rates.

The papers are long and complex, and deserve to be read in full by anyone seriously interested in the Fed's thought processes. They are, of course, full of caveats and they acknowledge that huge uncertainties are involved. But they seem to point to three main conclusions that are very important for investors.

1. They have moved on from the tapering decision.

Both papers give a few nods in the direction of the tapering debate, but they are written with the unspoken assumption that the expansion of the balance sheet is no longer the main issue. I think we can conclude from this that they believe with a fairly high degree of certainty that the start and end dates for tapering will not be altered by more than a few months either way, and that the end point for the total size of the balance sheet is therefore also known fairly accurately. From now on, the key decision from their point of view is how long to delay the initial hike in short rates, and exactly how the central bank should pre-commit on this question. By omission, the details of tapering are revealed to be secondary.

Yellen said as much in her testimony. In response to a question about QE, she said, "I would agree that this program [QE] cannot continue forever, that there are costs and risks associated with the program."

The Fed have painted themselves into a corner of their own creation. They are clearly very concerned about the stock market reaction even to the mere announcement of the onset of tapering. But they also know they cannot continue buying $85 billion of assets every month. Their balance sheet is already at $4 trillion and at the current pace will expand by $1 trillion a year. Although I can find no research that establishes a theoretical limit, I do believe the Fed does not want to find that limit by running into a wall. Further, it now appears that they recognize that QE is of limited effectiveness with market valuations where they are, and so for practical purposes they need to begin to withdraw QE.

But rather than let the market deal with the prospect of an end to an easy monetary policy (which everyone recognizes has to draw to an end at some point), they are now looking at ways to maintain the illusion of the power of the Federal Reserve. And they are right to be concerned about the market reaction, as was pointed out in a recent note from Ray Dalio and Bridgewater, as analyzed by Zero Hedge:

"The Fed's real dilemma is that its policy is creating a financial market bubble that is large relative to the pickup in the economy that it is producing," Bridgewater notes, as the relationship between US equity markets and the Fed's balance sheet (here and here for example) and "disconcerting disconnects" (here and here) indicate how the Fed is "trapped." However, as the incoming Yellen faces up to her "tough" decisions to taper or not, Ray Dalio's team is concerned about something else – "We're not worried about whether the Fed is going to hit or release the gas pedal, we're worried about whether there's much gas left in the tank and what will happen if there isn't."

Dalio then outlines their dilemma neatly. "…The dilemma the Fed faces now is that the tools currently at its disposal are pretty much used up, in that interest rates are at zero and US asset prices have been driven up to levels that imply very low levels of returns relative to the risk, so there is very little ability to stimulate from here if needed. So the Fed will either need to accept that outcome, or come up with new ideas to stimulate conditions."

The new ideas that Bridgewater and everyone else are looking for are in the papers we are examining. Returning to Davies work (emphasis below is mine!):

2. They think that "optimal" monetary policy is very dovish indeed on the path for rates.

Both papers conduct optimal control exercises of the Yellen-type. These involve using macro-economic models to derive the path for forward short rates that optimise the behaviour of inflation and unemployment in coming years. The message is familiar: the Fed should pre-commit today to keep short rates at zero for a much longer period than would be implied by normal Taylor Rules, even though inflation would temporarily exceed 2 per cent, and unemployment would drop below the structural rate. This induces the economy to recover more quickly now, since real expected short rates are reduced.

Compared to previously published simulations, the new ones in the English paper are even more dovish. They imply that the first hike in short rates should be in 2017, a year later than before. More interestingly, they experiment with various thresholds that could be used to persuade the markets that the Fed really, really will keep short rates at zero, even if the economy recovers and inflation exceeds target. They conclude that the best way of doing this may be to set an unemployment threshold at 5.5 per cent, which is 1 per cent lower than the threshold currently in place, since this would produce the best mix of inflation and unemployment in the next few years. Such a low unemployment threshold has not been contemplated in the market up to now.

3. They think aggressively easy monetary policy is needed to prevent permanent supply side deterioration.

This theme has been mentioned briefly in previous Bernanke speeches, but the Wilcox paper elevates it to center stage. The paper concludes that the level of potential output has been reduced by about 7 per cent in recent years, largely because the rate of productivity growth has fallen sharply. In normal circumstances, this would carry a hawkish message for monetary policy, because it significantly reduces the amount of spare capacity available in the economy in the near term.

However, the key is that Wilcox thinks that much of the loss in productive potential has been caused by (or is "endogenous to") the weakness in demand. For example, the paper says that the low levels of capital investment would be reversed if demand were to recover more rapidly, as would part of the decline in the labour participation rate. In a reversal of Say's Law, and also a reversal of most US macro-economic thinking since Friedman, demand creates its own supply.

This concept is key to understanding current economic thinking. The belief is that it is demand that is the issue and that lower rates will stimulate increased demand (consumption), presumably by making loans cheaper for businesses and consumers. More leverage is needed! But current policy apparently fails to grasp that the problem is not the lack of consumption: it is the lack of income. Income is produced by productivity. When leverage increases productivity, that is good; but when it is used simply to purchase goods for current consumption, it merely brings future consumption forward. Debt incurred and spent today is future consumption denied. Back to Davies:

This new belief in endogenous supply clearly reinforces the "lower for longer" case on short rates, since aggressively easy monetary policy would be more likely to lead to permanent gains in real output, with only temporary costs in higher inflation. Whether or not any of this analysis turns out to be justified in the long run, it is surely important that it is now being argued so strongly in an important piece of Fed research.

Read that last sentence again. It makes no difference whether you and I might disagree with their analysis. They are at the helm, and unless something truly unexpected happens, we are going to get Fed assurances of low interest rates for a very long time. Davies concludes:

The implication of these papers is that these Fed economists have largely accepted in their own minds that tapering will take place sometime fairly soon, but that they simultaneously believe that rates should be held at zero until (say) 2017. They will clearly have a problem in convincing markets of this. After the events of the summer, bond traders have drawn the conclusion that tapering is a robust signal that higher interest rates are on the way. The FOMC will need to work very hard indeed to convince the markets, through its new thresholds and public pronouncements, that tapering and forward short rates really do need to be divorced this time. It could be a long struggle.

On a side note, we are beginning to see calls from certain circles to think about also reducing the rate the Fed pays on the reserves held at the Fed from the current 25 basis points as a way to encourage banks to put that money to work, although where exactly they put it to work is not part of the concern. Just do something with it. That is a development we will need to watch.

The Unintended Consequences of ZIRP

Off the top of my head I can come up with four ways that the proposed extension of ZIRP can have consequences other than those outlined in the papers. We will look briefly at each of them, although they each deserve their own letter.

- The large losses from the continued financial repression of interest rates on savers and pension funds

Simply put, ultra-low interest rates mean that those who have saved money in whatever form will be getting less return on that money from safe, fixed-income investments. We're talking about rather large sums of money, as we will see. Ironically, this translates into a loss of consumption power when the Federal Reserve is supposedly concerned about consumption and requires increased savings at a time when the Fed is trying to boost demand. This is robbing Peter to favor an already well-off Paul.

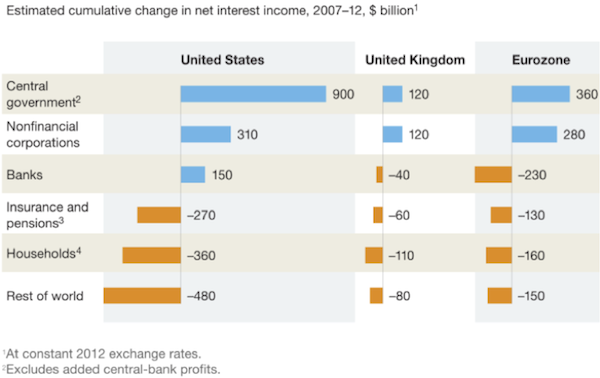

A new report from the McKinsey Global Institute examines the distributional effects of these ultra-low rates. It finds that there have been significant effects on different sectors in the economy in terms of income interest and expense. From 2007 to 2012, governments in the Eurozone, the United Kingdom, and the United States collectively benefited by $1.6 trillion, both through reduced debt-service costs and increased profits remitted by central banks (see the chart below). Nonfinancial corporations – large borrowers such as governments – benefited by $710 billion as the interest rates on debt fell. Although ultra-low interest rates boosted corporate profits in the United Kingdom and the United States by 5% in 2012, this has not translated into higher investment, possibly as a result of uncertainty about the strength of t he economic recovery, as well as tighter lending standards. Meanwhile, households in these countries together lost $630 billion in net interest income, although the impact varies across groups. Younger households that are net borrowers have benefited, while older households with significant interest-bearing assets have lost income.

McKinsey estimates that households in the US have lost a cumulative $360 billion. Meanwhile, banks and businesses have done very well.

This loss of household income requires tightened spending by retirees and means that those facing retirement have to spend less and save more in order to make sure they will have enough to live on. It also requires the older generation to work longer, which is demonstrably keeping jobs away from the younger generation, as I've documented clearly in past letters.

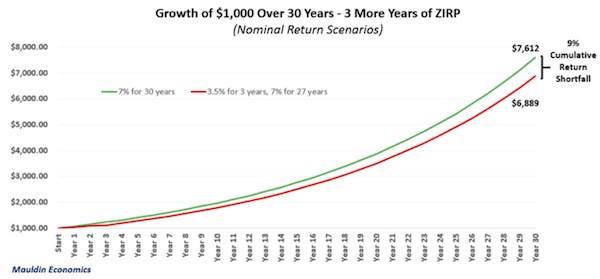

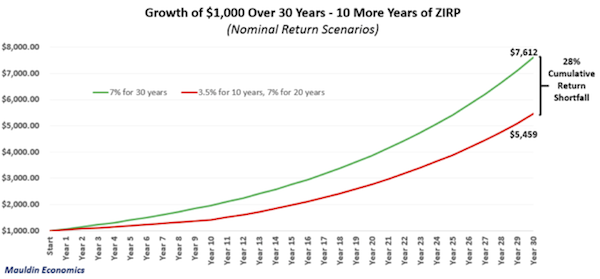

ZIRP means that the pension funds and insurance companies responsible for your annuities are making significantly less on their portfolios than they had hoped. There are lots of ways to express this loss, but I will offer three charts that will give us some indication of the magnitude of the loss over a period of 30 years.

Most public pension funds work with some variation of the traditional 60-40 portfolio, that is to say, 60% in equities and 40% in fixed income. They also target anywhere from 7 to 8.5% returns from their portfolios over the next 30 years in order to be able to generate the money they will need to pay retirees. The amount of assets they have today in their accounts is quite small in comparison to future requirements, and thus they are depending upon the magic of compound interest in order to be able to deliver the needed pension funds to their clients.

The next three graphs show what happens if interest rates are held near zero for 3 more years, 6 more years, and 10 more years. I assume that in the low-interest-rate environment returns from investment portfolios will be less than 3.5% after expenses and then rise back to the more typical (but optimistic) 7% level. What we see is that there are significant cumulative return shortfalls after 30 years because of the initial period of low interest rates, with the shortfalls ranging from 9% to 28% of the final needed assets, depending on how long ZIRP persists. Those losses can be made up only by additional contributions from retirees and/or governments or by some magical increase in expected returns.

Please note that there is nothing critical about the assumptions of 3.5% or 7% – you can make whatever assumptions you like, but the simple fact is that there will be a cumulative shortfall in later years as a result of a ZIRP environment in the initial years. Thus pensions will require more funding by the pensioners at some point, which means that their future consumption will be reduced. Once again we are borrowing from our future in order to finance ephemeral consumption today.

- The creation of a carry trade and misallocation of capital

There is no question in my mind that many of my friends in the hedge fund and investment world will see an extended zero interest rate policy as a gift horse. If you tell a rational investor that he or she will be able to borrow money at very low rates for four or five years, then you are inviting all manner of financial transactions to take advantage of low borrowing rates. If, as an investor, you can borrow at 3% and get a 6% return, then a modest four times leverage gets you a 12% return on your capital. The financial engineering made possible by guaranteed low rates is really rather staggering. Whole books could be (and probably are being) written about all the ways to take advantage of such an environment. But also, the overall return from risk assets will be reduced as investors look to create carry trades and leverage up. So the very policy of encouraging investors to move out the risk curve in fact reduces the returns on the risks taken, especially for the ave rage investor who can't take advantage of the financial engineering available to sophisticated investors. Wall Street makes a bundle, and Main Street gets stuck with higher risks and lower returns.

This is simply a trickle-down monetary policy by another name. The Federal Reserve hopes to inflate wealth assets and thereby encourage the wealthy to spend more, which will somehow trickle down to the average investor and worker on Main Street. This approach exacerbates the rich/poor divide even further. This is not a design flaw or an unintended consequence; it is the very essence of the policy. The fact that significant research shows that the wealth effect is minimal seems to be lost in the policy debates. This is infuriating beyond my ability to adequately express my frustration, but it is a clear result of the capture of the Federal Reserve by academic economists and the implementation of the interesting theory that 12 people can make better decisions than the market can about the value of money and the proper environment for investments. This is the philosopher king writ large.

As Dylan Grice wrote so eloquently this week in the Outside the Box I sent you,

From these observations can be derived a straightforward corollary on economic policy makers: trying to control a variable you can't measure (inflation) with a tool you don't fully understand (money) in a complex system with hidden, unobservable and non-linear interrelationships (the economy) is a guaranteed way to ensure that most things which happen weren't supposed to happen.

- What happens when the velocity of money turns around?

We have no credible idea what drives movement in the velocity of money. As the chart shows below, it topped out in the '90s and has been dropping rather precipitously ever since. Charts that estimate the velocity of money back to the beginning of the 20th century show that we are close to all-time lows. One of the things we do know is that the velocity of money is mean-reverting. It will begin to go back up. The fact that it is been dropping has allowed the Federal Reserve to print money in a rather aggressive fashion without stimulating inflation. When the velocity of money starts back up, inflation could become a problem rather quickly. I have no idea when that might happen or why it would start to happen anytime soon. But one day it will happen. That's just the way of things. Central banks that might be comfortable with 2-3% or even 4% inflation will find themselves dealing with much higher inflation than they had anticipated. Janet Yellen told u s she would be capable of raising rates to fight inflation if need be, just as Volcker did. Let's hope she doesn't have to prove it.

- The misallocation coming from rates being held below the natural rate of interests

I have written on this in the past. When interest rates are held lower than the "natural rate of interest," it becomes more efficient for companies and investors to use money for financial transactions such as buying other companies rather than for productive purposes such as increasing capacity and competing for customers and sales. Why take the risk of competition, which is fraught with problems, when it is so much cheaper to simply borrow money and buy your competition? There is a reason that so many industries have effectively ended up as duopolies since the advent of low rates 12 years ago. While ZIRP makes money for those who have access to capital and for those who can sell their assets, it does not create new productive capacity and thus jobs, let alone help to create more efficient markets and pricing.

Psst, Buddy, Would You Like to Buy a Model?

As Jonathan Tepper and I write in Code Red, the Fed has elaborate models of the economy, which they use to make projections about its performance. Sadly, the Fed's forecasting track record is very poor. Now, they are giving us models in the papers we reviewed that suggest the proper direction of monetary policy is toward an extended regime of ZIRP.

Think about that for a minute. We are about to base our monetary policy once again on models built by a Fed that has repeatedly struck out in the forecasting game and whose models do not inspire great confidence. Like previous policy approaches, this new one is almost sure to produce unintended consequences and market disturbances.

The best and the brightest assure us they have the situation under control. How's that working out with regard to Obamacare?

As investors and money managers, we have no choice but to play the cards we are dealt. Demanding new cards is not an option when you don't own the dealer or make the rules of the game. There are ways to play even the poorest of hands, but it would be nice not to have to try to manufacture returns from so little, with the rules of the game thwarting your efforts.

Code Red on Its First Best-Seller List

Code Red made the Wall Street Journal best-seller list this weekend. Thanks to all of you who bought the book and made that happen. The reviews are quite positive so far. Fixed-income maven Richard Lehman over at Forbes wrote a very nice piece about Code Red this past weekend. I am pleased that he spoke so well of it.

If you read only one book on finance this year, read Code Red: How To Protect Your Savings From the Coming Crisis by John Maudlin and Jonathan Tepper. It is a recounting of current Federal Reserve Bank's "Code Red" policies for dealing with its mandate of promoting full employment while maintaining financial stability. The Code Red moniker is intended to draw attention to the unprecedented nature of those policies and the dangers we face when they are finally undone.

He goes on to say,

The book finishes with the most important chapters, what you can do to protect yourself from the almost certain negative fallout these policies will produce. This section alone makes the book a must read…. The authors see the end of a long secular bear market, but on the brink of a new secular bull market. Despite their dour outlook for the short term, they are basically bullish on America.

"But," he concludes, "no book review is considered complete without saying something negative; so, I think they should have titled it Code Blue." We'll come to you next time for a title, Richard.

This link will take you to a short video of Jonathan and me discussing the book. I think you will enjoy it.

Thanksgiving, New York, and Geneva

I am back home for two weeks and watching the construction of my new digs come together. It now looks like, with a final surge involving scores of workers working 18 hours a day, we will be in place by Thanksgiving, even if some work will continue to be done throughout the following month. I have to confess to going up every few hours to check on progress and make small decisions. This has been quite a process to watch. It does indeed seem to come together rapidly at the end. In theory, my move-in date is next weekend. We will see where I am sitting as I write to you next week.

I will go to New York the first week of December for a speech and meetings and maybe a little walking around. New York city is rather magical in December, my favorite time to be there. And maybe by that time my winter clothes can be out of storage. Then I am off the next week to Seattle for a day to speak for my partners at Altegris, and after that I turn around and fly to Geneva, in what will make for a long day of travel. I'll be home for Christmas. My daughters are already planning how to decorate the new apartment for the holidays, and as a practical matter I am going to have to relent and buy a "fake" Christmas tree. If you know of a very realistic tree, I would be interested in hearing your suggestion.

It is late and my editors, Charley & Lisa Sweet, are waiting in Kansas City for me to send this on. They'll post it to the website before heading off tomorrow to pick up some goats in Missouri and Kentucky and drive them back to Georgia. Given the trouble they have gone to, these must be some very special goats. I am almost afraid to ask.

Have a great week. I see family and a lot of moving in my coming week.

Your thinking about mushrooms and prime rib analyst,

John Mauldin

subscribers@MauldinEconomics.com

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2013 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.