The Stocks Bull Market No One Believes In

Stock-Markets / Stock Markets 2013 Nov 17, 2013 - 01:24 PM GMTBy: Clif_Droke

Despite a string of new all-time highs, many investors are sitting out what has been one of the most impressive stock market rallies in years. A “buyer’s strike” has materialized this year in which value-oriented investors have deemed the market to be too expensive. Their collective response: taking no action while the bull market passes them by.

Highlighting the shrinking participation rate among value investors, an article appearing in last week’s issue of Businessweek explained the mentality behind the buyer’s strike. Value investors look for stocks considered to be cheap relative to a company’s earnings prospects, cash flow or assets. The last time value managers sat on their hands during an impressive market rally was in 2007 prior to the credit crash. A contrarian might quickly draw parallels between now and then, but really there is little comparison to be made. In 2007 the rate of public participation in stocks was quite high versus a relatively low direct participation rate today.

Value managers look for bear market or young bull markets to put their money to work but tend to eschew committing large sums of capital in maturing bull markets. The problem with this strategy is that a maturing bull market can remain mature for a long time before eventually giving way to the next bear market. The likelihood is high that these sidelined investors will be tempted back into a rising market before this bull has ended.

Piper Jaffrey’s Craig Johnson believes the S&P 500 will reach his conservative upside target of 1,850 before the end of the year. He points out that equities are currently the only game in town now that bonds look dicey and gold is going nowhere. He told Yahoo’s Breakout that the bullish case for stocks is based on a slow-growth economy and lack of investment alternatives. He also pointed out that almost no one believes in the sustainability of this bull market. That’s reason enough, from a contrarian’s perspective, to expect further gains before the bull has reached full maturity.

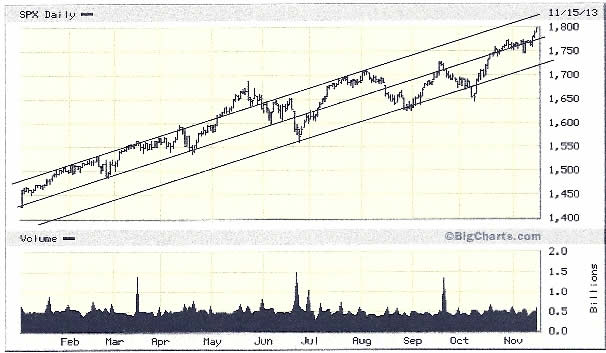

Johnson’s very reasonable upside target of S&P 1,850 should be reached by the end of the year. This is very much a trending market and it’s clear that the major indices, including the SPX, are respecting the trend channels. Investor sentiment remains optimistic, yet it’s not at frenzied levels normally associated with an imminent reversal.

As for this being a trend-traders market, many investors who pride themselves on being the “smart money” tend to sneer at trend trading. What they don’t realize is that trading methodologies are cyclic in their effectiveness. Trend trading wasn’t a particularly effective tool during the early stages of the bull market in 2009-2011. Yet it has worked wonderfully for the better part of the last two years. Moreover, it isn’t being overly utilized by individual traders which is a good sign for its continuity (at least until the crowd embraces it).

It’s also clear that the S&P 500 Index is respecting the parameters of a long-term parallel trend channel. The upper trend channel boundary happens to coincide closely with the 1,850 level mentioned by Piper Jaffrey’s Johnson. A failure to at least test the upper channel boundary before the next major correction gets underway would be surprising given the levels of skepticism out there. It remains, for all intents and purposes, the bull market no one believes in.

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets. Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you're buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the "smart money" pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you'll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.