VIX Appears Finished, is the SPX Too? Black Friday?

Stock-Markets / Stock Markets 2013 Nov 15, 2013 - 10:29 AM GMT Earlier I suggested that the SPX would probably stay glued to the top at least throughout the morning. The fact is, it lasted all day. The head fake usually stops at or very near the Cycle Top. In this case, it turned 5 waves into 9 waves through the extension of the rally.

Earlier I suggested that the SPX would probably stay glued to the top at least throughout the morning. The fact is, it lasted all day. The head fake usually stops at or very near the Cycle Top. In this case, it turned 5 waves into 9 waves through the extension of the rally.

Tomorrow is day 262 in a very mature Master Cycle and a Cycle Pivot day, to boot. The last time this happened was in July 21, 2011, when the indexes peaked, then proceeded to decline impulsively for 19 calendar days (12.9 market days). A similar decline starting tomorrow would go to December 3.

The 2010 Flash Crash lasted 13 calendar days from top to bottom. That encompassed two weekends, so the actual market days were 8.6, with only 2 days beneath the 50-day moving average. A decline such as this would extend to November 27 (the day before Thanksgiving!).

Either date for a low would be ironic, since the week of Thanksgiving is supposed to be the most positive week of the fall season for equities. Traders in-the-know are expecting a very chaotic market when it all cuts loose. I wonder wat this portends for Black Friday???

VIX finally appears to have made its Minute Wave [v] low. This is most likely the end of the head fake move at “the squeeze” in the Trading Bands. The VIX appears coiled to spring up dramatically from its low.

Could it happen tomorrow?

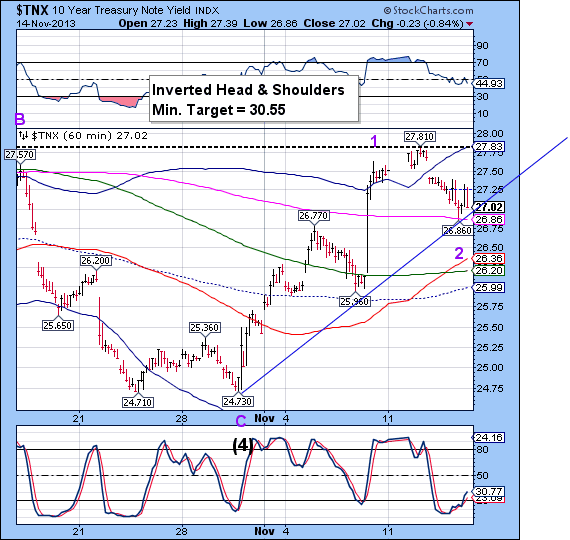

TNX is ready to spring up from its trendline and the 50-day moving average to begin a Minor Wave [3] at or near 30.55. This certainly would be a jolt to the markets, since the prior high in TNX was 29.84 on September 4.

Note the truncation of Minor Wave C at the bottom of the chart. TNX is in such a hurry to go higher that it isn’t finishing its retracements.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.