Interbank Market Fails to Respond to UK Interest Rate Cut

Interest-Rates / Credit Crisis 2008 Apr 12, 2008 - 06:59 PM GMTBy: Nadeem_Walayat

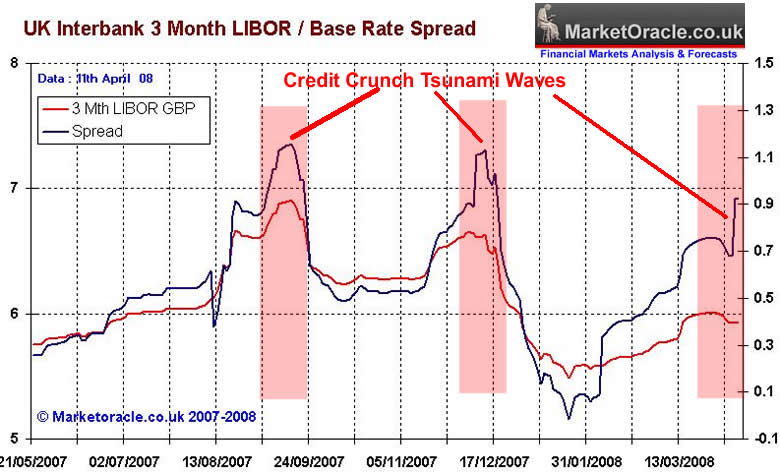

Following Thursdays UK interest rate cut to 5% from 5.25%, which followed unprecedented action by the Bank of England in providing £15 billion in liquidity to the UK banking system in recent weeks. So far the interbank market has failed to respond to these actions, which saw the 3 Month Libor rate / base rate spread expand to recent credit crunch extremes as illustrated by the below graph.

Following Thursdays UK interest rate cut to 5% from 5.25%, which followed unprecedented action by the Bank of England in providing £15 billion in liquidity to the UK banking system in recent weeks. So far the interbank market has failed to respond to these actions, which saw the 3 Month Libor rate / base rate spread expand to recent credit crunch extremes as illustrated by the below graph.

This means that the banks are extremely reluctant to pass on Thursdays rate cut to customers. Some of the tactics deployed by banks to confuse customers, is to raise interest rates before the interest rate decision and then cut by the same amount following the rate cut, thus no net change.

However the continuing credit crisis has eroded banks balance sheets to such an extent that some banks even went so far as raising interest rates on some mortgage products following the rate cut.

The chancellor of the exchequer, Alistair Darling, alarmed by the failure of the banks to respond to the rate cut and extra liquidity took the step of publicly calling for the banks to do their part by cutting interest rates charged to borrowers -

"The announcement by the Bank of England this week that it is cutting interest rates will reduce pressure, and I hope banks and building societies will pass that on. What I am saying to the banks is we have helped them... therefore it is time to ensure that the banks themselves help both individual businesses and mortgage holders by ensuring they pass on these interest rate reductions."

Clearly the banks deepening aversion to risk and lending is in advance of much worse to come as the UK housing market showed clear signs in recent statistics of embarking upon a bear market to rival that of the early 1990's. The banks actions are signaling preparations in advance of a UK recession, when the number of bad debts is expected to surge which will hit the already weakened banking sector hard.

Therefore the banks are only likely to respond to fundamental changes rather than short-term Bank of England fixes. These fundamental changes take the form of stabalising US and UK Housing markets, and an economy that is expanding at trend growth rather than slowing towards GDP contraction. Neither of these conditions is likely to occur for the next 18 months or so.

By Nadeem Walayat

Copyright © 2005-08 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 120 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Attention Editors and Publishers! - You have permission to republish THIS article if published in its entirety, including attribution to the author and links back to the http://www.marketoracle.co.uk . Please send an email to republish@marketoracle.co.uk, to include a link to the published article. Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.