Why the U.S. Housing Market Recovery Won’t End Well

Housing-Market / US Housing Nov 12, 2013 - 06:21 PM GMT Michael Lombardi writes:

The news headlines are saying the U.S. housing market is witnessing robust growth and flipping homes for profit is back.

Michael Lombardi writes:

The news headlines are saying the U.S. housing market is witnessing robust growth and flipping homes for profit is back.

While many are now saying there is growth in the U.S. housing market and that it will continue, I disagree with them, based on many different factors…all of which I want my readers to know about.

Yes, home prices have gone up, but that’s about it for positive developments. The housing market still suffers, and there are problems that need to be fixed before it sees a full-on recovery.

The delinquency rate on single-family residential mortgages in the U.S. remains staggeringly high. In the second quarter of this year, it was 9.41%. Yes, again; it has declined from its peak of 11.27% in the first quarter of 2010, but it’s still almost 140% higher than its historical average of 3.94%! (Source: Federal Reserve Bank of St. Louis web site, last accessed November 8, 2013.)

As I have been harping on about in these pages; institutional investors jumped into the U.S. housing market buying residential homes in bulk, and as a result, prices increased. But we didn’t see first-time home buyers run towards the housing market—an increase in first-time home buyers is essential for any economic recovery.

According to the National Association of Realtors, in September, first-time home buyers accounted for 28% of all existing home sales in the U.S. Meanwhile, investors were behind one-third of all existing home sales! (Source: National Association of Realtors, October 21, 2013.)

The “U.S. Economic and Housing Market Outlook” report issued in October by the Office of the Chief Economist at Freddie Mac said, “According to our forecast, the U.S. economy will add less than 1 million housing units in 2013, and around 1.5 million in 2014, significantly below normal levels.” (Source: “U.S. Economic and Housing Market Outlook,” Freddie Mac, October 2013.) In simple words, it suggests demand for new homes in the U.S. isn’t strong.

With all this, I believe homebuilder stocks face a precarious future ahead. Since May, when we heard the Federal Reserve was debating tapering its quantitative easing program, homebuilder stocks shed value—and I would not be surprised to see them fall further.

Don’t buy into this housing market rebound. It’s not real. It is fueled by investors. I’ve never seen a housing market recovery that wasn’t fueled by people who bought houses to live in them. Like the stock market, this will not end well.

Michael’s Personal Notes:

Consumer confidence in the U.S. economy is falling fast. This phenomenon will bring key stock indices lower. But sadly, no one is really talking about this. “Buy, buy, and buy even more” is the theme among stock advisors. Optimism is increasing, and so is stock market risk.

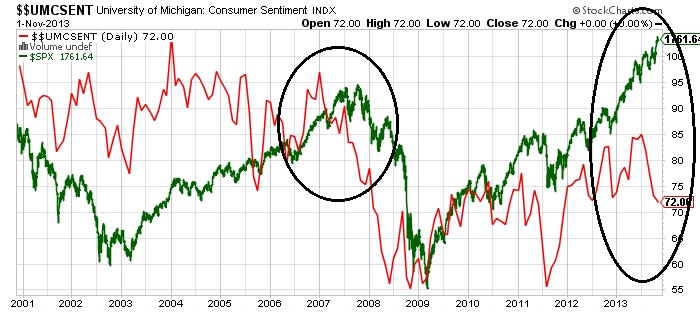

The Thomson Reuters/University of Michigan Consumer Sentiment Index, a measure of consumer confidence in the U.S. economy, has fallen to a level not seen since December of 2011. This gauge of consumer confidence fell to 72.0 in November from 73.2 in October. (Source: Reuters, November 8, 2013.)

With that said, please take a look at the chart below of consumer confidence as plotted with the University of Michigan Consumer Sentiment Index in red and the S&P 500 in green. Pay close attention to the circled areas.

Chart courtesy of www.StockCharts.com

Generally, the chart above shows consumer confidence and key stock indices have had a direct relationship since 2001. In fact, at times, consumer confidence acts as a leading indicator of where key stock indices will head.

But since the beginning of this year, this relationship has gone the wrong way! As consumer confidence fell, key stock indices continued to march to new record highs! Just add the divergence between consumer confidence and the key stock indices to my long list of why this stock market shouldn’t be going up.

Consumer confidence predicts where consumer spending will go. If consumers in the U.S. economy are pessimistic about their future, it is very likely they will pull back on their spending. As a result, companies sell less, produce less, and earn lower profits—which eventually results in lower stock prices.

Dear reader, my skepticism towards the key stock indices just grows and grows daily! The higher they go, the harder they will eventually fall.

The fundamentals that drive key stock indices higher are missing. Third-quarter earnings show the continuation of troubling trends—lower company revenues but higher profits. Financial engineering, mostly in the form of stock buyback programs, can only go on for so long. In fact, we are already starting to hear companies provide negative guidance about their fourth-quarter corporate earnings.

My conviction remains the same: key stock indices are running on nothing but freshly printed money provided by the Federal Reserve. This money is setting up the stock market for big disappointment.

Michael Lombardi, MBA for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.