The Fed’s Dilemma, What Would Yellen Do?

Interest-Rates / US Federal Reserve Bank Nov 11, 2013 - 07:29 AM GMTBy: John_Mauldin

The US Senate Banking Committee will hold hearings on Thursday, November 14, on the nomination of Janet Yellen for Federal Reserve chair. There will be the usual softball questions, for example, "Do you think high unemployment is a problem in the United States and if so what do you intend to do about it?" (which allows a senator to express his concern over unemployment and for the nominee to agree that it's a problem). Or the always popular question, "What is the basis under which you would continue to hold interest rates at their current low level?" – as if she would answer anything other than, "Any future policy decision is of course data-dependent" or some variation on that response. Boring.

The US Senate Banking Committee will hold hearings on Thursday, November 14, on the nomination of Janet Yellen for Federal Reserve chair. There will be the usual softball questions, for example, "Do you think high unemployment is a problem in the United States and if so what do you intend to do about it?" (which allows a senator to express his concern over unemployment and for the nominee to agree that it's a problem). Or the always popular question, "What is the basis under which you would continue to hold interest rates at their current low level?" – as if she would answer anything other than, "Any future policy decision is of course data-dependent" or some variation on that response. Boring.

There have been a flurry of new research papers this week by Federal Reserve economists, IMF economists, and even Paul Krugman, all suggesting various policy responses going forward, but none suggesting a return to normal any time soon. I would be far more interested in getting a response from Yellen to some of that research, but even the questions raised in those papers don't get to the real heart of the matter. So today, let's pretend we are prepping our favorite Banking Committee senator (members here) for his or her few questions. What would you like to know? In this week's letter I offer a few questions of my own.

First a brief caveat. Each of the questions below deserves multiple pages of background. I get that. There is only so much I can write in one letter. Further, some of the questions are intended to provide an insight into Yellen’s thinking and what research she considers to be relevant. Those are more the "inquiring minds wants to know" type of question. And since Senator Rand Paul is not on the committee, I have omitted some of the questions he might ask. Not that they aren't interesting and shouldn't be asked, but there is only so much space.

What Questions Would You Ask Janet Yellen?

Secondly, I know for a fact that a few Senators on this committee and even more of their staff members read my letter from time to time. I would expect that to be the case this week. I also know that I have some of the smartest and most thoughtful readers of any writer I know. If you want to address a committee staffer about questions you think your senator should be asking Janet Yellen, the comments section at the end of this letter would be an appropriate place to do so. Your comments will get read. Be polite, offer links to supporting documents, and have fun. I'm sure I've missed several important questions, including ones you'll think I should have listed, so this is your opportunity to get them in front of the right people. Whether they will get asked is a different matter entirely, of course.

Finally, I am assuming that Yellen will be confirmed. While I would favor a Fed chair with a different economic philosophy, that is not going to happen. So rather than fantasizing about what is not going to happen, let's think about what we would like to actually learn.

Conveniently, Ray Dalio and his team at Bridgewater penned an essay this week highlighting the Fed's dilemma. I offer a few key paragraphs and a chart or two as a setup to my list of questions. Turning right to their very prescient comments:

In the old days central banks moved interest rates to run monetary policy. By watching the flows, we could see how lowering interest rates stimulated the economy by 1) reducing debt service burdens which improved cash flows and spending, 2) making it easier to buy items marked on credit because the monthly payments declined, which raised demand (initially for interest rate sensitive items like durable goods and housing) and 3) producing a positive wealth effect because the lower interest rate would raise the present value of most investment assets (and we saw how raising interest rates has had the opposite effect).

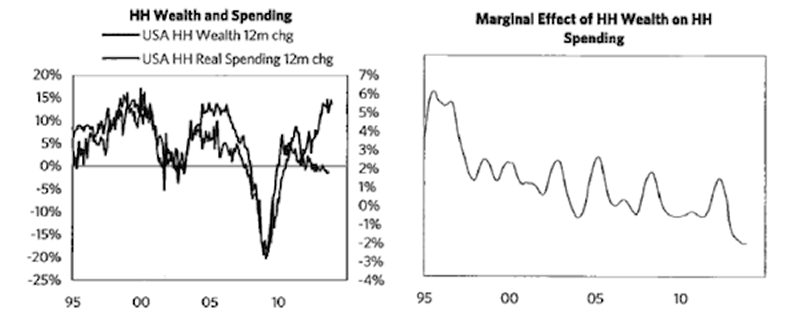

All that changed when interest rates hit 0%; "printing money" (QE) replaced interest-rate changes. Because central banks can only buy financial assets, quantitative easing drove up the prices of financial assets and did not have as broad of an effect on the economy. The Fed's ability to stimulate the economy became increasingly reliant on those who experience the increased wealth trickling it down to spending and incomes, which happened in decreasing degrees (for logical reasons, given who owned the assets and their decreasing marginal propensities to consume). As shown in the charts below, the marginal effects of wealth increases on economic activity have been declining significantly. The Fed's dilemma is that its policy is creating a financial market bubble that is large relative to the pickup in the economy that it is producing. If it were targeting asset prices, it would tighten monetary policy to curtail the emerging bubble, whereas if it were targeting economic conditions, it would have a slight easing bias. In other words, 1) the Fed is faced with a difficult choice, and 2) it is losing its effectiveness."

(In the following charts HH stands for "Household.")

We expect this limit to worsen. As the Fed pushes asset prices higher and prospective asset returns lower, and cash yields can't decline, the spread between the prospective returns of risky assets and those of safe assets (i.e. risk premia) will shrink at the same time as the riskiness of risky assets will not decline, changing the reward-to-risk ratio in a way that will make it more difficult to push asset prices higher and create a wealth effect. Said differently, at higher prices and lower expected returns the compensation for taking risk will be too small to get investors to bid prices up and drive prospective returns down further. If that were to happen, it would become difficult for the Fed to produce much more of a wealth effect. If that were the case at the same time as the trickling down of the wealth effect to spending continues to diminish, which seems likely, the Fed's power to affect the economy would be greatly reduced.

With that as a setup, let's turn to our hypothetical hearing. (Insert a picture of your favorite senator here.) With the hope that we will get a glimpse of what a Janet Yellen chairmanship of the Fed will actually look like, let's think about what we would like to know:

Vice-Chairman Yellen, thank you for agreeing to attend this hearing. We have already interviewed you extensively for your present position, so I believe that most members of the committee and Senate already believe that you are qualified to be chairperson. Therefore I would like to use this opportunity to learn a little more about the thinking that goes on with regard to Federal Reserve monetary policy. In the spirit of the transparency that has been a hallmark of the Bernanke Federal Reserve, I would like you to shed a little light on the thinking and philosophy that will guide the Federal Reserve under the chairmanship of Janet Yellen. Here are a few questions that I believe we would all like answers to.

- There were three papers delivered by highly regarded economists at Jackson Hole this summer that suggested that quantitative easing had no significant effect and that "forward guidance" was the actual effective policy. At about that time, economists from the regional reserve bank at which you were president (San Francisco) also published a paper suggesting the same thing. This past week major Federal Reserve staff economists, as well as other economists, reiterated this view and proposed a different set of policies. This growing discussion begs the following question: Do you agree with these papers and believe the quantitative easing has exceeded its usefulness, especially in its current rather massive form? If not, can you point us to research that supports your view, other than theoretical analysis?

- The Federal Reserve balance sheet is currently at $4 trillion. At the current pace it is expanding by roughly $1 trillion per year.

- Is there a theoretical limit in your mind as to the size to which the Fed's balance sheet should be allowed to grow? If so, what is that amount? Simply saying that this number would be dependent upon future economic data would imply that you have no true idea of the limit and are making up the rules as you go along. Perhaps we are indeed in unexplored territory for monetary policy and it is appropriate to adjust policies based upon unfolding economic events; but if that is the case, what are the guidelines you would use?

- Given the time lag required to realize the impact of monetary policy upon the economy, at what point and by what standard might you determine that the balance sheet of the Federal Reserve had reached its limit and that any further stimulus must be the responsibility of the Congress and the executive branch?

- Is there a discussion within the Federal Reserve that balance-sheet expansion has the potential to produce an asset bubble?

- There seems to be an emerging consensus that it would be inappropriate for the Federal Reserve to pursue quantitative easing indefinitely at the levels we see today. There must be an endpoint, but the question of course is, when? Last May, Chairman Bernanke suggested that the Fed might begin to taper in the coming months. Market reactions worldwide were decidedly negative, and many members of the FOMC and Board of Governors were at great pains in the following weeks to suggest that tapering would be either very gradual or postponed altogether. Even so, the markets seemed to assume that a small reduction in the amount of quantitative easing would be announced at the September FOMC meeting. There was quite a lot of surprise when there was no tapering at all. The decision not to taper brings up several questions:

- What data was the Federal Reserve looking at that caused it to back away from even a small reduction in the amount of quantitative easing?

- Given that the balance sheet of the Federal Reserve is $4 trillion, what was the thought behind not reducing the ongoing increase of the balance sheet by a mere $10 billion a month?

- All things considered, $10 billion would seem a rather negligible amount. Were you concerned that the economy might not be able to handle even such a small reduction in quantitative easing?

- Recent papers from Federal Reserve economists and others suggest that QE (i.e., the large-scale purchase of assets) is not as effective as forward guidance and that the FOMC should indicate that interest rates will be held at very accommodative levels as far out as 2017, in contrast to the current guidance that suggests rates will be allowed to rise gradually beginning in late 2014, or more likely in 2015.

- What do you think of this view?

- If you agree with this, are you concerned that such a policy shift might encourage a dollar "carry trade"? By that I mean that banks and other financial institutions might be encouraged to borrow in dollars to invest in all manners of financial engineering projects, especially overseas, given that the cost of borrowing would be so cheap. This is different from traditional banking in that it would not foster lending for productive domestic purposes such as the expansion of plants or the purchase of productivity-enhancing equipment.

- Given the problems we have seen with carry-trade currencies, especially the Japanese yen, how far out do you think forward guidance should go?

- Again, viewing the experience of Japan, carry-trade currencies seem to strengthen unduly, apart from natural trade and investment flows. Further, given the extraordinary developments in energy production in the United States and the reduction in the trade deficit, it is quite possible the dollar could strengthen rather dramatically on its own. Do you agree that positioning the dollar as a potential carry-trade currency would strengthen the dollar? Is that a good thing in your view?

- Given that the strength of the dollar is at least nominally (policy-wise) in the purview of the US Treasury Department, what kind of coordination with the Treasury do you think would be appropriate in extending forward guidance for a very-low-rate regime into 2017?

- Chairman Bernanke and others have clearly hoped there would be a wealth effect from current monetary policy. By wealth effect I mean that if asset prices rise, people are encouraged to spend money, and the positive effects trickle down to the lower echelons of the economy.

- There has been a significant amount of research which suggests that the wealth effect is no longer operative in the United States. Do you agree with this?

- If you do believe in the wealth effect, where is the research, beyond theoretical models, that supports your view?

- If you do not agree that current monetary policy is in effect a trickle-down monetary policy, then what do you believe is the transfer mechanism from quantitative easing to the general public?

- Chairman Ben Bernanke has explicitly taken credit for the rise in the stock market from his policies of quantitative easing. Do you think he's right? In pursuing QE, has the Federal Reserve taken upon itself an implicit third mandate, that is, to support the level of the stock market? Should that be the Fed's responsibility?

- When the Federal Reserve begins to taper, or even suggests it will begin to taper, it appears that the markets will react negatively; yet reactions from Federal Reserve Board of Governors members seem to suggest that the Fed is extraordinarily concerned about a negative market reaction and subsequent negative effects on the economy. UBS strategist Beat Siegenthaler wrote this last week:

The Fed seems to be facing two major risks: first, premature tapering disrupting markets and triggering global turmoil across asset classes, thereby threatening the fragile economy recovery; second, delayed tapering further fueling asset price bubbles, which could burst eventually and do major damage.

The September decision suggested a Fed more worried about the fragile recovery than about the potential for asset bubbles and other longer term problems associated with extended liquidity injections. Whereas it had originally assumed that a gradual tapering would result in a gradual market reaction, it now appears that the situation is much more binary. If so, the hurdles for tapering might be substantially higher than originally thought.

- Do you agree with that assessment, and if not, why?

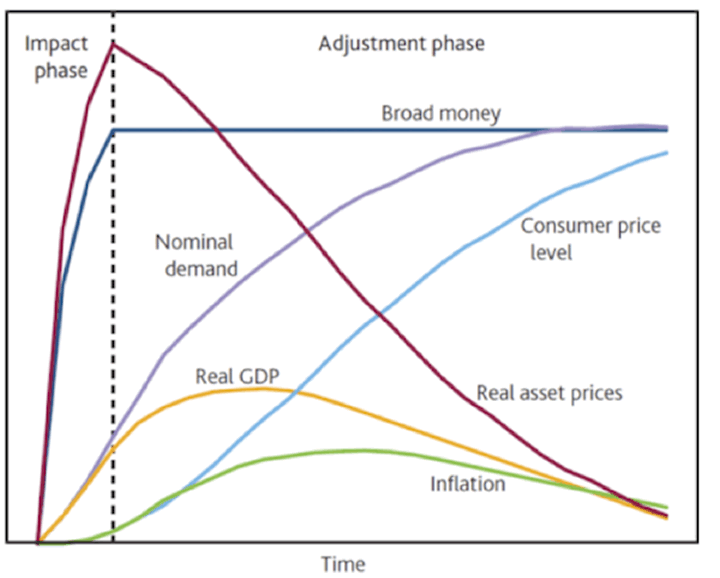

- The Bank of England published the following chart in Q3 2011. It tells the story of their expectation that while QE was in operation there would be a massive rise in real asset prices, but that this would dissipate and unwind over time, starting at the point at which the asset purchases were complete. It also suggests that they felt it possible that real asset prices would fall after the withdrawal of quantitative easing. Did the Federal Reserve hold internal discussions (such as those evidently held at the Bank of England) regarding what would happen with the withdrawal of QE? Given the recent market response to the suggestion of tapering, was the possibility of a fall in asset prices accounted for in your decision to pursue quantitative easing?

Has the Federal Reserve has, in reality, created a form of "monetary trap" for itself through its extensive use of quantitative easing? That is, do you see a way in which the Federal Reserve can exit QE without having a negative effect on the stock market, at least initially? And should the Federal Reserve care?

- The current philosophy of the Federal Reserve seems to be that monetary easing is stimulative of consumer spending and therefore of the economy in general. This improvement is apparently supposed to be transmitted through lower interest rates for housing and for leveraged borrowing that facilitates consumer spending (on autos and other durable goods) as well as lower interest rates for businesses, which hopefully encourage spending on plants and facilities to increase productivity and boost employment. However, lower interest rates also mean that investors and pensioners get less income, so they must reduce their spending. I assume it is not the policy or the suggestion of the Federal Reserve that retired individuals should increase the level of risk they take on in the deployment of their retirement savings; but if the Fed seeks to increase the assets of those who hold equity in the stock market, an unintended consequence may be to penalize savers at the very moment in their lives when they need higher interest rates to be able to maintain their lifestyles.

- Explain to us the economic rationale behind artificially lowering rates for an extended period of time, which penalizes savers at the expense of equity holders.

- Do you believe that consumer spending fostered by quantitative easing is greater than the consumer spending lost by decreased returns to savers and investors on their fixed-income investments? Is there any data that suggests this is turning out to be the case?

- If there is a greater good for the economy at large in pursuing massive QE, can you show us the research that proves it and explain why retirees should be content with your policies?

- Do you have suggestions for those who have saved all their lives and are now being forced to either reduce their standard of living or dip into their savings?

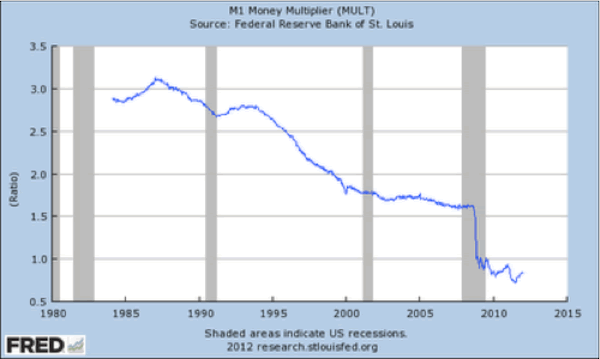

- If reserve injections by the Federal Reserve were evenly distributed throughout the economy, then the money multiplier would be higher and more stable. This has not happened, as evidenced by the graph below. Further, the availability of loans to middle-level banks and businesses does not seem to have risen. How has QE helped these banks and firms?

- The Federal Reserve has a dual mandate to achieve the stability of the purchasing value of money and to foster an environment that affords full employment. If the money multiplier is inordinately low and if it should begin to revert to what was its norm prior to the Great Recession, there would seem to be a serious potential for the return of higher-than-acceptable inflation.

- As chairperson of the Federal Reserve, which of the two mandates would you consider to be a higher priority in a time of rising inflation?

- Are you prepared, as Chairman Volcker was in the early '80s, to raise interest rates in order to protect the value of money, in spite of the harm it caused to employment? As a follow-on, I would also like to know what, if anything, you would have done differently from Chairman Volcker.

- Federal Reserve economic forecasts have proven notoriously inaccurate, historically speaking. Indeed, some have suggested that random models would have produced better results than those upon which the Fed relies.

- How can we trust your models and your policy projections when the Fed’s forecasts have been so wrong for so many years? Why does the Fed persist, to this day, in the use of models that have been so consistently bad at predicting the future?

- Will you be basing your monetary policy on projections generated by existing, clearly faulty models, or do you anticipate a change in the construction of your models?

- Finally, let us turn to the employment mandate.

- Can you explain to us precisely how monetary policy is supposed to work to improve employment? What is the transfer mechanism from quantitative easing to higher employment?

- If you were designing a central bank system from scratch, would you include an employment mandate? Where do you think the primary responsibility for establishing an environment for full employment should rest, with the federal government or the Federal Reserve?

The Questions That Will Not Be Asked

The above questions will start the discussion, but I'm well aware that some of the questions I would really like to ask will have no chance to make it into the dialogue. These go to the very concept of a central bank. In my latest book, Code Red, I fully acknowledge the need for a central bank, but my view of its purpose is quite a bit more limited than is envisioned in the current manifestation. How can 12 men and women sit on a committee and think they can fine-tune the economy without creating imbalances and unintended consequences? Central banks should be for emergencies and for regulating banking institutions and making sure the playing field is level. They should not be responsible for the fate of the players on the field.

Current central bank policy has rewarded bankers and holders of assets. In an environment where everyone seems to be increasingly worried about the divide between the 1% and the 99%, our central bank has designed and implemented a policy that is explicitly rewarding the 1% to the detriment of savers and retirees. It is the rich who have assets and the poor who have liabilities. If you are looking for a reason why the spread between the rich and the poor is widening, one driver (and I admit there are others) is the central bank policies of the developed world.

Let me end by sharing the sentiments expressed by Ben Hunt this week after he had read the numerous academic papers that have recently been released. I totally share this sentiment, and he expresses it well:

I started writing this email as a detailed analysis of three monetary policy papers recently published by various Fed functionaries, papers that give a peek into how the Fed thinks about their role in the world and that have received some significant attention this week by our media arbiters of taste in articles such as "Fed Forward Guidance Proves Effective, NY Fed Research Says" and "Fed Study: Rate Peg Off Mark." Interpreting the meaning and impact of papers like this (and the media narrative around them) is a bread and butter topic for Epsilon Theory posts, as I feel a duty to read and report on these papers so you don't have to. It's not a pleasant duty.

Frankly, these papers frustrate me to tears, as they are written as post hoc "scientific" justifications of value-laden social assumptions and policy conclusions, not as an honest search for a truth that's larger than the local bureaucratic imperative. They're also … boring. As is the long analysis I wrote. So let's skip all that and go straight to the conclusion.

Spoiler Alert! The Fed believes that they are saving the world, and that any problems that persist in the world can be eliminated by doing more of what they've been doing and doing it for longer. I know this comes as a complete surprise to anyone who's been paying the least amount of attention over the past few years, but there you have it. That's what these papers say.

These papers say nothing that is terribly novel or interesting in terms of their content or intended purpose. The only interesting thing is how much media attention they are receiving and what that means. The triumphal procession of these papers is a reminder that the academic and bureaucratic capture of the Fed is complete, and that leads to what are (to me, anyway) much more interesting questions than the inside baseball topics of what these papers might imply for Yellen's policy preferences:

1) Has the academic and bureaucratic capture of US monetary policy been duplicated in other policy areas, such as national security and healthcare?

2) Is there a common academic and bureaucratic response across these policy areas to the economic and political duress of the past 10 years, such that emergency policy actions against immediate threats have been transformed into permanent insurance programs against future and potential threats?

3) Is this the common thread woven through the three most important and controversial policies of our day: QE, Obamacare, and NSA eavesdropping?

4) Are there useful lessons to be drawn from the last time we went through such a wholesale redefinition of the *meaning* of government policy, back in the 1930s?

5) What are the structural consequences for markets and investing that stem from this redefinition?

My answers: yes, yes, yes, yes, and I'm trying to figure it out.

These days it's hard to find income in all the usual places. What's the solution? Go where banks don't go. Please join me and my partners at Altegris for a special Mauldin Circle webinar event, "Where is the Smart Money Finding Income?" on Tuesday, November 19, at 1:00 PM EST/10:00 AM PST. My Altegris partners recently created a vehicle in order to invest with an opportunistic institutional credit manager, Drawbridge Special Opportunities Advisors, an affiliate of Fortress Investment Group. Drawbridge Special Opportunities Advisors' five complementary credit strategies provide the potential for maximum flexibility across credit cycles. I believe that this manager's track record and investment thesis, allied with Altegris' unique structure, is something that qualified purchasers seeking income need to hear about now.

If you are a qualified purchaser or a licensed investment advisor and have already registered with the Mauldin Circle (and are in the US), you will shortly be receiving an invitation to attend. If you have not, I invite you to go to www.mauldincircle.com and register today, so you can hear from a manager that thinks "outside of the fixed-income box." Upon qualification by my partners at Altegris, you will receive an email invitation. I apologize for limiting this discussion to qualified purchasers and investment advisors, but we must follow the rules and regulations. In this regard, I am president and a registered representative of Millennium Wave Securities, LLC, member FINRA.

New York, Ringing the NASDAQ Bell, and Home

I will be flying to New York next Tuesday to join in the closing-bell ceremony that afternoon at the NASDAQ. A firm that I have a small association with will be celebrating the creation of a new ETF with the symbol ROBO, which is an ETF comprising of robotic, 3D-printing, and automation stocks. I will be writing more about this in the future, as I'm quite excited about it, but ask your advisor before you make a decision.

I will be doing some media of course while I am in NYC, but I expect to be back in Dallas Thursday evening, where I will get to read about the Yellen confirmation hearings. I am NOT expecting fireworks.

I do hope to return to more progress on my new apartment construction. I have committed to move out of my current leased place before Thanksgiving, and I fully intend to have the family and friends over for Thanksgiving; but if you were to drop by the place this weekend, you would walk away thinking I am irrationally optimistic to believe it can be finished in time. Major components are still being shipped, not even in the queue to be installed yet. A finely choreographed finale is taking shape, with workers coming and going in droves. I am excited that we are getting closer to the finish line.

I am somewhat amazed at the level of technology that has been designed into the place. Every light, media player, sound system, (powered!) curtain, security system, door lock, and fan switch can be controlled from an iPad mini. The kids are already anticipating the movie and sports watching. And there is full agreement that we will be doing more cooking and less restaurant visiting in the future. I have been kind of hoping that the new place will be a family magnet, and it may indeed turn out that the reality will be more time with the kids and grandkids. That was part of the design, so to speak.

The letter is running later than usual, so I will end here and hit the send button. Have a great week. It is Melissa's birthday this weekend, so Sunday brunch is at a new Italian place launched by chefs from Naples. I see pizza in my future.

Your wondering how the Fed gets changed analyst,John Mauldin

subscribers@MauldinEconomics.com

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2013 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.