Positive Trends Continue to Drive the Stock Market

Stock-Markets / Stock Markets 2013 Nov 08, 2013 - 09:47 AM GMTBy: Donald_W_Dony

The S&P 500 has enjoyed one of the best prolonged upward trends of any global stock index over the past 55 months. And that long term trend shows no signs of slowing down.

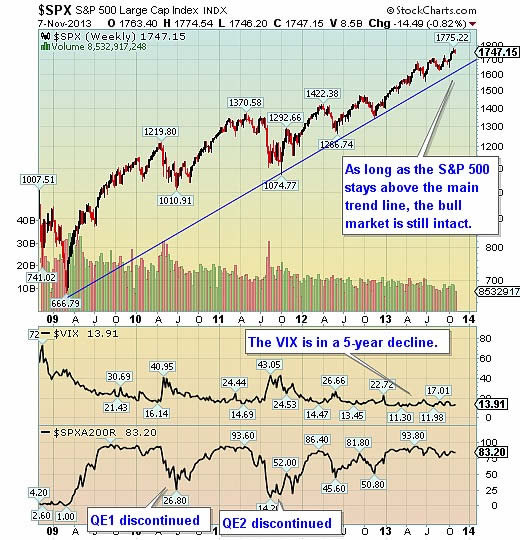

On a 5-year perspective, the U.S. index is continuing to trade above its primary trend line. Only a decline below this line would suggest the bull market is finished (Chart 1).

The Volatility Index (VIX) moves in the opposite direction to the S&P 500. Year-to-date the VIX has been in the low risk range of 10-18. Over the past three years, the VIX has only moved into the moderate risk range of 18-40 four times. Two of those times were when the previous QE programs were discontinued.

From a shorter term (one year) viewpoint, the S&P 500 is anticipated to pullback in November. This retracement should be similar to the last three corrections (June, August and October).

During the last three corrections, the VIX remained largely in the low risk zone and the percentage of advancing stocks continued stay above 74%. Both very positive signs of a continuing rising market (Chart 2).

This anticipated pullback in the S&P 500 should be no different.

Bottom Line: The bull market in the S&P 500 is expected to continue into Q1 2014. The U.S. index is, however, anticipated to pullback in November down to 1700 (a 2.0%-2.5% decline) before advancing again.

The year-end target for the S&P 500 remains at 1790.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2013 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.