Obamacare Taxes Will Hit Your Wallet January 1st

Politics / Taxes Nov 07, 2013 - 03:10 PM GMTBy: Money_Morning

Tara Clarke writes: Even if Obamacare hasn't altered your insurance coverage, it will affect your taxes. The new healthcare law brings the largest set of tax law changes this country has seen in more than 20 years.

Tara Clarke writes: Even if Obamacare hasn't altered your insurance coverage, it will affect your taxes. The new healthcare law brings the largest set of tax law changes this country has seen in more than 20 years.

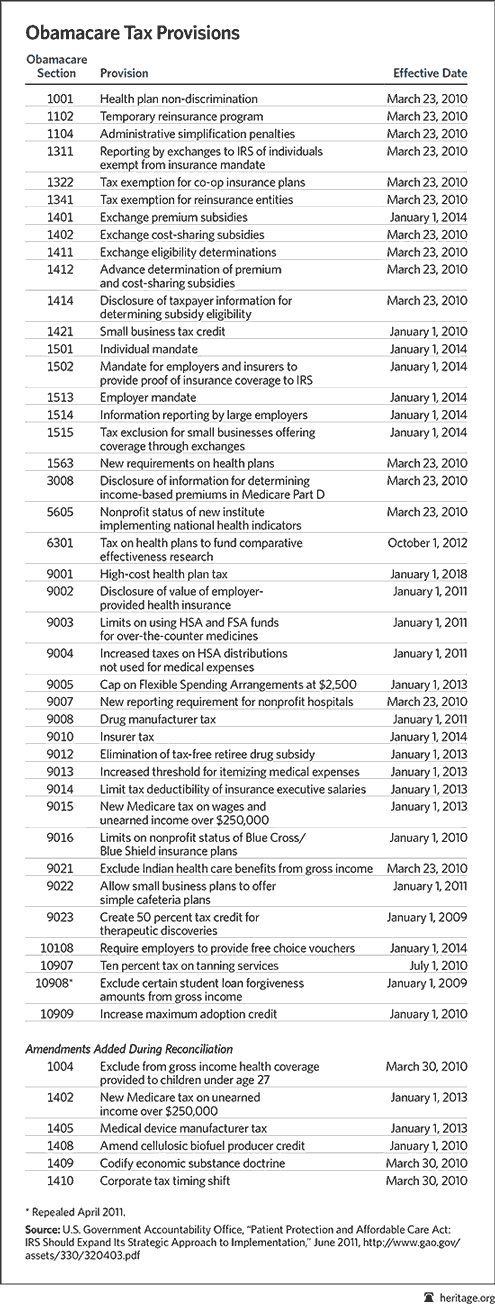

According to the Government Accountability Office, the IRS must implement a total 47 statutory provisions under Obamacare. And Obamacare's $1 trillion in total tax increases will hit drug companies, Health Savings Accounts, health insurers, employer-based health insurance, and more.

The administration says these taxes are absolutely essential to fund Obamacare.

"Revenue provisions contained in the legislation are designed to generate $438 billion to help pay for the overall cost of health care reform," according to the Treasury Inspector General.

The GAO cited this as a "massive undertaking" that will also involve "extensive coordination" across "multiple agencies and external partners."

[Even better - American citizens are expected to entrust the bulk of this "massive undertaking" to the recently slimed Internal Revenue Service (IRS). Last month, despite the release of damning emails from her account, Director of the IRS Exempt Organizations division Lois Lerner retired with full pension and benefits.]

So what are these provisions, and how will they affect you?

The 47 Obamacare Tax Changes

While some of the Obamacare taxes have already been put in place, there are seven more that will kick into effect Jan. 1, 2014.

Note: Regardless of whether or not you support Obamacare, there are ways investors can use the law to their advantage...

Among the ones that have already gone into effect are a surtax on investment income - individuals making more than $200,000 (or couples grossing over $250,000) must pay a new 3.8% tax on income from investments, an increased threshold for medical deductions, and a 10% tax on tanning services.

Tax changes on deck include a "high-cost health plan tax" in 2018, and an "insurer tax" in 2014.

Here are three provisions that could prove to be the most "taxing" on your wallet:

Individual Mandate. The individual mandate is currently slated to apply Jan. 1, 2014. In the first year, nearly every legal U.S. resident must obtain health coverage, or face a tax penalty. The penalty is $95, or 1% of annual income - whichever is higher. Then, over time, the amount raises. In 2016, the penalty will reach $695, or 2.5% of annual income.

Employer Mandate. Originally scheduled to apply Jan. 1, 2014, but now delayed by one year, the employer mandate requires large employers to offer health insurance plans that meet the minimum essential coverage (MEC) requirement to employees working thirty or more hours per week. If you work for a company subject to the MEC requirement, you will definitely be seeing some changes to your coverage as employers attempt to prepare for this mandate. MEC requires that the plan pay at least 60% of the allowed cost of medical services. Additionally, the employee's portion of the insurance premium of self-only coverage cannot exceed 9.5% of the employee's household income.

High-Cost Health Plan Tax. Also referred to as the "Cadillac" tax, this excise tax targets employer-provided health plans that provide workers with the most generous "Cadillac" coverage that also have low deductibles and little cost sharing for employees. Fans of the tax argue that such benefit-rich coverage insulates employees from the high cost of care and encourages overuse of the care. But consumers with chronic illnesses or otherwise poor health who have been relying on Cadillac plans to cover high annual medical bills will be severely harmed by this tax change, which is slated to apply on Jan. 1, 2018.

Here's is the full list of the whopping 47 Obamacare tax provisions:

The IRS has posted to its website a page devoted to explaining all the Obamacare-related taxes.

While some of the explanations are helpful - listing precise increases, when they will be assessed, and the affected parties - most leave taxpayers more confused than when they got there.

For example: "On Dec. 5, 2012, the IRS and the Department of the Treasury issued final regulations on the new 2.3-percent medical device excise tax that manufacturers and importers will pay on their sales of certain medical devices starting in 2013. On Dec. 5, 2012, the IRS and the Department of the Treasury also issued Notice 2012-77, which provides interim guidance on certain issues related to the medical device excise tax."

Certain medical devices? Certain issues?

Here's what is clear: You are going to see higher taxes to pay for Obamacare.

Fight Tax Pain with Obamacare Profits

In the meantime, regardless of how Obamacare taxes will affect your wallet, our country's new healthcare can make you money.

That's because Obamacare's provisions channel millions of dollars into certain companies - it's a reshuffling of the cards. In fact, Money Morning Chief Investment Strategist Keith Fitz-Gerald calls it "one of the single biggest wealth creation opportunities to hit the markets in decades."

"Some stocks will skyrocket when Obamacare goes into effect on Jan. 1, 2014, and there's no reason why you can't buy them now and ride them to the top," Fitz-Gerald said in his just-released free report.

To find out more on how to profit from Obamacare, you can get started here.

Source :http://moneymorning.com/2013/11/05/more-obamacare-taxes-will-hit-your-wallet-january-1/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.