ECB's Tough Balancing Act, Bubbles vs Deflation

Stock-Markets / Euro-Zone Nov 07, 2013 - 05:55 AM GMTBy: Gary_Dorsch

Today, a small group of central bank chiefs can meet in private and wield unprecedented power over global markets, economies, and wealth distribution. They are held accountable to the ruling politicians that in most cases have no respect for the principle of sound money. Instead, in Europe, the UK, Japan, the US, and elsewhere, central bankers have become intricately linked to monetizing government debts, and financing the expansion of the welfare state. As such, disciplined and independent central banking, a cornerstone to any hope for sound money and credit, has been relegated to the dustbin of history.

Today, a small group of central bank chiefs can meet in private and wield unprecedented power over global markets, economies, and wealth distribution. They are held accountable to the ruling politicians that in most cases have no respect for the principle of sound money. Instead, in Europe, the UK, Japan, the US, and elsewhere, central bankers have become intricately linked to monetizing government debts, and financing the expansion of the welfare state. As such, disciplined and independent central banking, a cornerstone to any hope for sound money and credit, has been relegated to the dustbin of history.

Central banking, - ostensibly designed to combat high levels of inflation and promote economic growth, while overseeing the stability of the banking industry, has instead, morphed into technocratic planning boards that are constantly involved in rigging the value of the financial markets. Their principal modus of operandi is to encourage risk taking in the local stock markets, through massive injections of ultra-cheap liquidity. However, the result isn't better economic conditions, but rather the expansion of massive bubbles in various financial markets. In turn, central bankers have widened the wealth gap between the owners of equities, and the rest of the struggling population whose wages are sliding backwards, and is increasingly seeking out assistance through welfare programs.

Historically, the value of the stock market reflected the dynamics of the local economy, and would influence the social mood of the populace. A stock market that is booming would signal an up-and-coming economy that would be followed by increased business investment and the creation of good paying jobs. Rising share prices boost the fortunes of about 10% of households in the country, and triggers a greater propensity to spend for goods and services - otherwise known as the "trickle down" effect. Therefore, keeping a constant vigil on the behavior of the stock market, - has become the raison d'être of central banks.

In earlier times, stocks traded on the local stock exchange used to track or even anticipate the nation's business cycle. But that reliable role as a leading indicator began to seriously break down after the financial crisis of 2008. Since then, because of the hallucinogenic effects of "quantitative easing" (QE), - stock markets are no longer reflections of the health of the local economies or forecasting mechanisms of the business cycles. Instead, they are just slices of ownership in specific companies that are unreliable gauges of anything but the underlying strength of the companies they represent, their dividend payments and buybacks, and the schizophrenic mind-set of the traders who buy and sell the shares.

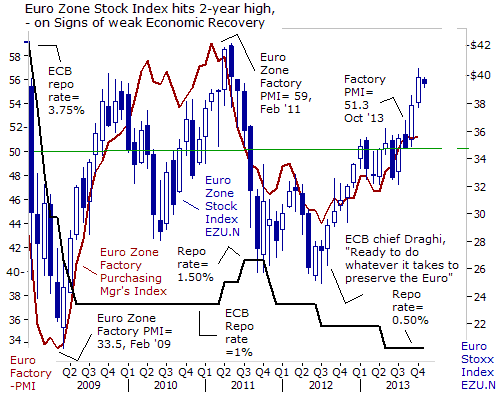

EuroStoxx index Rebounds to 2-year high, - Supported by anecdotal signs of a recovery in the Euro zone factory sector, - the exchange traded fund for the EuroStoxx Index, (NYSE ticker: EZU), has managed to recoup most of its losses from the Bear market of 2011-12. EZU rebounded to $40 per share in October '13, capping a +54% gain from the low of July 2012. Yet fifteen months ago, FX traders were piling up bets on the break-up of the 17-country currency bloc, and EZU had tumbled to as low as $25.50 per share, and nearing its lowest levels since the depth of the 2008 financial crisis.

However, with a few ad-libbed words, Europe's chief central banker, Mario Draghi changed the course of the Euro-zone debt crisis. "The ECB is ready to do whatever it takes to preserve the Euro. And believe me, it will be enough," Draghi warned on a warm summer day in London. That was enough to stabilize the Euro at $1.200 and stop EZU's bear market in its tracks. After six weeks of frenzied backroom bargaining, the ECB said itwouldbuy unlimited amounts of sovereign bonds of troubled debtor countries that sign up for strict austerity measures, - through its Outright Monetary Transactions program (OMT).

For equity traders markets, the OMT was like a nuclear weapon: the mere threat of its use was enough to fuel a 15-month rally that lifted EZU to as high as $40 per share and helped to support the Euro's rally to $1.3800 in late October '13. Draghi declared it a master stroke. "It's really very hard not to state that OMT has been probably the most successful monetary policy measure undertaken in recent time," he said in June '13.

Draghi's verbal intervention coincided with a bottom in the Euro zone's Purchasing Managers' Index (PMI) that gauges the health of the factory sector. The factory PMI bottomed out at the 44.5-level in June '12 and rebounded to the 51.3-level by October '13, signaling that Europe's longest postwar economic recession has ended. New orders for industrial goods have increased for the fourth month in a row, and factory output increased in Spain, Italy and Ireland meaning the bloc's nascent recovery is becoming more broad-based. In this case, traders can point to the chart showing the direction of the EuroStoxx markets and the gauge of the local factory sector moving in synchronization, as would historically be the case.

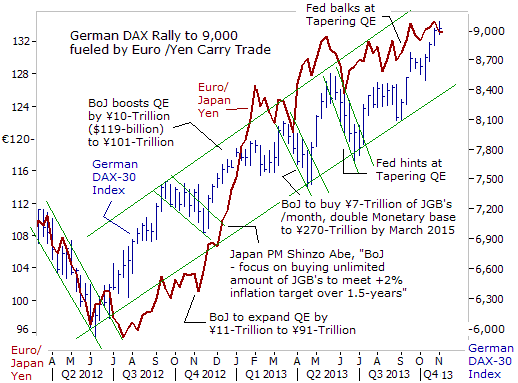

German DAX disconnects from Economy, - Tracks Euro /Yen Carry trade, - Yet the rally in the broad based EuroStoxx index is somewhat deceptive. Most of the EuroStoxx's gains were powered by the steaming locomotive - Germany's DAX-30 index, which has climbed above the 9,000-level, - it's highest in history. The disparities of market performance are wide. Germany's DAX index is hovering +13% above its pre-crisis highs of 2007, and stands out far above the rest of the pack. In stark contrast, France's CAC-40 index is still trading -31% below its 2007 high, Spain's Ibex-35 index is -39% lower and Italy's Mib-40 index is a whopping -57% below its peak levels of six years ago.

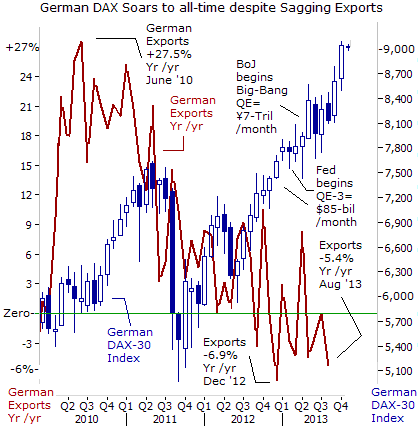

In March '13, a study produced by the Vanguard brokerage firm, concluded that fundamentals, - corporate earnings, profit margins and gross domestic product (GDP) growth, are useless when it comes to forecasting stock market trends. For instance, Germany's blue-chip DAX-30 index is +18% higher since the start of 2013, and is +50% higher since the beginning of June 2012, even though is $3.4-trillion economy expanded at a paltry +0.9% annualized rate. The big disconnect is explained by the fact that German companies listed in the DAX index earn 70% of their revenues from outside the country. That's increasingly the case for the Euro-Stoxx-600 companies - 33%of their sales in 2013 are with emerging markets, - from China, to Turkey, to Brazil, or three times greater than in 1997. Sales from within the Euro-zone fell to 46% of transactions this year, - and down from 51% in 2012 and 71% in 1997.

Germany's DAX-30 index has defied weak economic data, and topped the 9,000-point mark for the first time in its 25-year history. What's not widely recognized is that the DAX rally is primarily fuelled by a torrent of cheap money flowing from the printing press of the Bank of Japan. Alongside the DAX's parabolic surge, the Euro has also rallied from a 10-year low of ¥96 in July '12 to as high as ¥134 in Oct '13. Carry traders are borrowing Japanese yen and swapping into German equity indexes. Currency carry traders are keen to see the DAX index surge to 10,000-points, even though it's unlikely that German DAX profits can keep pace. In other words, Tokyo is inflating a massive bubble on the Frankfurt Stock Exchange.

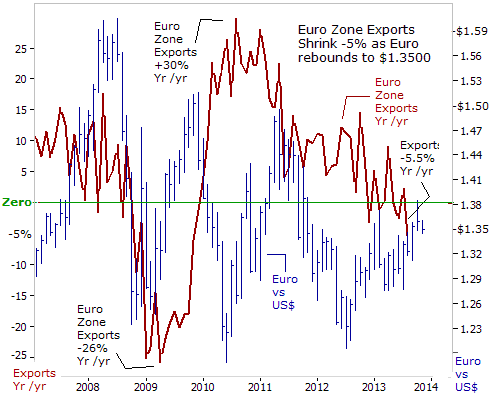

Stronger Euro Threatens Euro-zone Exporters - According to the PMI surveys, - the Euro-zone's factory sector is operating at its best levels for 2-½-years. However, the accuracy of the PMI surveys should be measured with a grain of salt. The PMI gauges are wildly at odds with other macro-economic indicators that suggest the Euro-zone's economy may be headed for a "Lost Decade" similar to Japan's experience. In August, exports from the 17-member Euro-zone were -5.5% lower than a year earlier, and are at risk of shrinking further if the Euro continues to climb against the Chinese yuan, the Japanese yen, the US-dollar, and more exotic emerging currencies. Yet currency traders continue to bid the share prices of the Euro-Stoxx companies higher, despite signs that their overseas sales are shrinking.

On Nov 5th, Brussels warned that it is too early to claim victory in the fight against recession saying there will be a time lag until 2015 before the pickup in economic activity leads to a fall in unemployment. The EU commission trimmed its forecast for the Euro zone's growth rate to +1.1% for next year and said the jobless rate will remain stuck at 12.2%. The legacy of Europe's debt crisis - namely fiscal austerity - would continue to act as a brake on growth. Of the big-4 Euro-zone countries, only Germany is forecast to grow by more than +1% in 2014. Spain is expected to grow +0.5%, Italy by +0.7% and France by +0.9%.

The problem for the Euro-zone economy is - as with its monetary policy, one exchange rate may not suit all. Each individual country has its own threshold of pain - for French exporters, sales begin to dwindle when the Euro trades above $1.22, on average. For Italy, exports are adversely impacted when the Euro is above $1.16. In that case, French and Italian exporters must cut workers' wages, in order to compete with Germany, whose threshold of pain for the Euro exchange rate is estimated at $1.5400 or higher.

Interestingly enough, even with the Euro trading between $1.2800 and $1.3500, German exporters are faring no better than the bloc's average. German exports of goods and services fell to €85.2-billion in August, or -5.4% lower than a year earlier. For the past three years, German exports have been stuck within a range between €80-billion and €99-billion per month. Yet the German DAX-30 index has divorced itself from shrinking year over year figures for its key export markets. Instead, it's soared in a parabolic surge to above the 9,000-level, - thanks to the financial engineering of the Bank of Japan.

In a Bubble, valuations run far away from the fundamentals in the economy, the market or individual stocks. It's driven by momentum, as investors who have profited from the market's gains greedily chase more. Investors who have been on the sidelines decide they must join the party. As long the BoJ's and the Fed's liquidity spigot is wide open, carry traders see very little risk. It's like a giant game of musical chairs, and it's time to dance while the music is playing. Everyone thinks they're smart enough to know when the music is going to stop.

A tsunami of Liquidity can blur the pain of economic stagnation and fuel euphoria in the stock market. But according to a report published by the European Commission, "household incomes in the Euro-zone have declined since the financial crisis began in 2008, and the risk of poverty is constantly growing." Young adults, unemployed women and single mothers are especially at risk of sliding into chronic poverty. According to the EU's report, 24% of Europeans are either at risk of falling into poverty, or are severely materially deprived, and 36% would be unable to cope with unexpected expenses. With sinking tax revenues and rising welfare payments, many countries simply lack the finances to protect households from the fallout of the crisis. Jobless rates are rising in Greece (27.6%) and Spain (26.6%), Italy (12.5%), and France (10.9%).

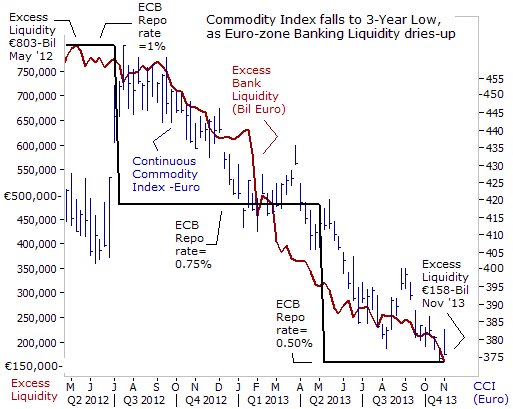

Euro-Zone at Risk of falling into Deflation Trap, - Economists are debating what the sharp drop in the Euro-zone's inflation rate means for the broader economy. The latest data from EuroStat shows the consumer inflation rate more than halved, from +2.6% in September 2012 to +0.7% in Sept 2013, marking the slowest rate of increase since the depths of the global financial crisis. That's far below the ECB's target of +2%. More troubling, consumer prices are now falling in Greece, while Ireland, Portugal, and Spain are all on the cusp of price deflation. Much of the downward spiral in consumer prices can be linked to the slide in the commodity markets. Earlier this week, the Continuous Commodity Index (CCI), a basket of 17-equally weighted commodities, fell to the 375-level, priced in Euros. That's -15% lower compared with a year ago. Likewise, the specter of deflation now haunts the Euro-zone.

Therefore, if the Euro continues to climb above $1.3500 vs the US$ it could deal a double whammy - stifling exports and ushering in deflation. The previous time the Euro traded above $1.3500, in Feb '13, ECB chief Mario Draghi tried to knock it lower through jawboning. "The exchange rate is not a policy target, but it is important for growth and price stability. We want to see if the appreciation is sustained, and if it alters our assessment of the risks to price stability." The comments helped to push the Euro to as low as $1.2800.

However, a major reason for the Euro's buoyancy is the sharp drop of excess liquidity in the Euro-zone's banking system. It's rapidly drying up. Since May '12, it declined from as high as€803-billion to as little as €158-billion this week. Meanwhile, the money supply in Japan has mushroomed to ¥182-Trillion, and the US's high octane MZM money supply hit an all-time high of $12.2-trillion last week, up +12% since the Fed launched QE-3.

The Bank of Japan is injecting $70-billion worth of yen each month into the Tokyo money market, and fueling the Euro /yen carry trade. The Fed is printing $85-billion per month, and exerting upward pressure on the Euro. The ECB has refrained from such radical steps. It bought over €200-billion in government bonds at the height of the Euro crisis in 2010 and 2011, but sterilized the intervention by draining an equal amount of Euros from the banking system to keep the money supply stable. From Dec '11 through Feb '12, - the ECB flooded the Euro-zone banks with €1-trillion of Long-Term Repo Operations (LTRO's). However, the European banks have already repaid 80% of the LTRO injections, - thus reducing the level of excess liquidity - cash beyond what lenders need to cover their day-to-day operations - in the system further, to the current €158-billion.

If the Euro climbs towards $1.400 or higher, and if global commodity prices continue to slide on a sustained basis, it could usher the plague of deflation into the Euro-zone. A particularly troublesome aspect of deflation is that it limits the ability of countries like Ireland, Italy, and Portugal to reduce their public debt burdens. These countries all have public debt ratios of around 125% of GDP and they are still building up their debt piles. As the Japanese experience over the past two decades would attest, deflation can constitute the strongest of headwinds to economic recovery. Not only does it incentivize consumers to delay spending, it also increases the real burden of repaying debts. This would seem to be the last thing that a struggling European economic periphery needs.

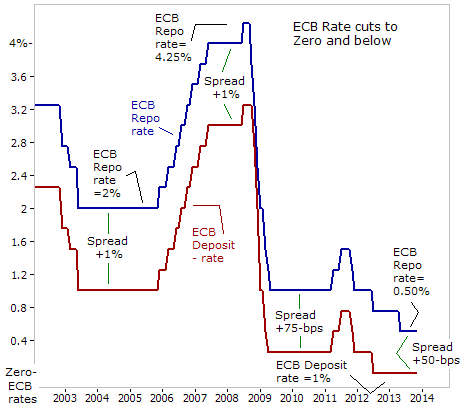

The ECB has few options to counter the deflation threat, - as it'sblocked by treaty from buying European sovereign debt (QE) directly. The ECB could offer to extend more LTRO's to banks or lower the repo lending rate to 0.25%. However, Euro-zone banks are in no mood to borrow and lend. European banks are saddled with €1.2-trillion of Non-performing loans (NPL's) and the amount of toxic loans increased by €100-billion in the past 12 months. Loans in default have increased from $700-billion in 2008, spurred by bad debts in Italy, Greece, Spain and Ireland. British banks are sitting on $224-billion of NPL's, Spanish banks with $227-billion, and Germany banks with $245 billion.

ECB's untested weapon - Negative Deposit Rates? Banks usually park their excess liquidity at the central bank and normally earn interest on this money. However, at the moment, the interest rate on these funds is 0% at the ECB. However, European banks themselves could soon be asked to pay interest to the ECB for the privilege of parking their excess cash at the central bank. On Oct 14th, Malta's central bank head Josef Bonnici said the ECB is prepared to introduce the negative deposit rate. "It has consequences that should be taken into account, but it is possible to go negative and we are prepared to go negative," Bonnici declared, adding that "there are pluses and minuses to this negative rate."

Earlier this year, on June 18th, ECB chief Draghi said, "Another measure that we have looked at with an open mind was to consider the possibility of having a negative rate on our deposit facility. We will continue reflecting on all these measures and we are ready to tackle (them) with all the unintended consequences they may entail."

Negative deposit rates, therefore, may be the ECB's best hope to knock the Euro lower in the immediate future, and stave off the specter of deflation. In theory, negative rates could push banks in Germany, the Netherlands, France and Austria, which have the most cash lodged with Europe's central bank, to reject paying a fee on their deposits in favor of lending toperipheral countries such as Spain, Portugal and Italy, making it cheaper for small and medium-sized businesses to borrow money, thereby spurring economic activity. If banks in the core of the Euro-zone - Germany, the Netherlands, France and Austria,lowered interest rates on retail deposits, customers might choose to spend their money instead of stashing it in the bank, which would also provide an economic boost.

Doing nothing, and kicking the can down the road would risk allowing the BoJ's and the Fed's money printing operations to push-up the value of the Euro to $1.40 or above, which in turn, would risk the return of a triple-dip recession, beset by deflation. Yet if the ECB decides to enforce negative interest rates, it might force European banks into making more bad loans. In any event, traders in the high flying German DAX can always rely on the support of the Euro /yen carry trade for at least another year, to expand the DAX bubble towards 10,000.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Global Money Trends filters important news and information into (1) bullet-point, easy to understand reports, (2) featuring “Inter-Market Technical Analysis,” with lots of charts displaying the dynamic inter-relationships between foreign currencies, commodities, interest rates, and the stock markets from a dozen key countries around the world, (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, posted Monday and Wednesday evenings, with the latest news and analysis on global markets. To order a subscription to Global Money Trends, click on the hyperlink below,

http://www.sirchartsalot.com/newsletters.php

or call 561-391- 8008, to order, Sunday thru Thursday, 9-am to 9-pm EST, and on Friday 9-am to 5-pm.

This article may be re-printed on other internet sites for public viewing, with links to:

http://www.sirchartsalot.com/newsletters.php

Copyright © 2005-2013 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.