Falling Gold Stocks Sector Set to Outperform Stock Market

Commodities / Gold and Silver Stocks 2013 Nov 06, 2013 - 11:23 AM GMT Sasha Cekerevac writes: When it comes to the recent batch of corporate earnings releases, some investors might be cheering. But if you look a bit closer at the results, you will notice the underlying fundamentals aren’t as strong as they first appear.

Sasha Cekerevac writes: When it comes to the recent batch of corporate earnings releases, some investors might be cheering. But if you look a bit closer at the results, you will notice the underlying fundamentals aren’t as strong as they first appear.

One thing to remember: in the equities market, it’s all about expectations. A company might report corporate earnings of $100 million, but if analysts in the equities market were expecting $150 million, the results would actually be disappointing.

The reason for this is that the equities market is a discounting mechanism for future corporate earnings. Analysts and investors estimate what the next 12–24 months might bring in terms of corporate earnings and accordingly adjust their valuations for various stocks in the equities market.

What’s interesting to note in this corporate earnings season so far is that the spread between actual and estimated corporate earnings is declining. This means companies are having difficulty exceeding expectations.

So far, 244 of the S&P 500 companies have reported corporate earnings, and while 75% have beaten corporate earnings estimates, on average, they have only exceeded these expectations by 0.8%. The four-year average is 6.5%. (Source: FactSet, October 25, 2013.)

And if you listen to executives at various companies within the equities market, you will notice another common theme: companies are having difficulty finding and generating revenue growth.

Of the S&P 500 firms in the equities market that have reported corporate earnings so far, only 52% have exceeded revenue estimates—far below the four-year average of 59%.

This is why they are issuing dividends and buying back shares; they can’t figure out a better way to invest the firm’s money (which is really yours as a shareholder) and drive revenue.

Simply put, much of the initial push up in corporate earnings that drove the equities market was due to cost-cutting and a significant amount of share buybacks.

But cost-cutting can only go so far; we all know that. And while there is nothing wrong with share buybacks, especially when stocks are selling at a discount, with the current level of the equities market, companies are actually paying a premium for their shares at this point, which will not be beneficial to shareholders in the long run.

Doesn’t really sound like a bullish scenario over the next year, does it?

Over the long term, investing in the equities market is all about re-allocation of your portfolio; that means buying stocks in sectors when expectations are low and selling stocks in sectors when expectations have gotten too high.

With the equities market at all-time highs, many sectors are now pricing in very high expectations for corporate earnings growth over the next year. I think this leaves little room to the upside, but potentially large risks to the downside.

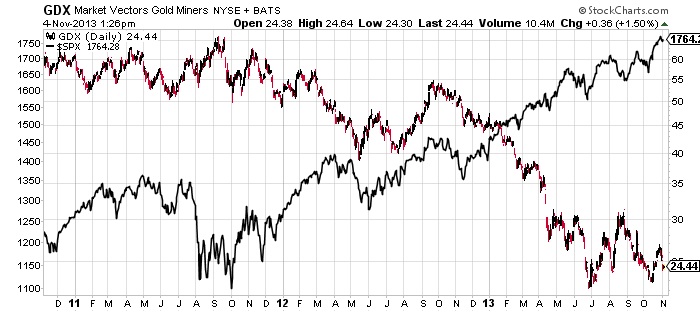

Chart courtesy of www.StockCharts.com

This chart shows the equities market represented by the S&P 500 (black line) versus the Market Vectors Gold Miners (NYSEArca/GDX) exchange-traded fund (ETF).

As you can see, they have moved in opposite directions over the past couple years. While the broad equities market has soared to new highs, mining stocks are near their lows.

It’s pretty obvious that expectations are significantly higher for the overall equities market versus mining stocks. But this is where I believe a long-term investor can take advantage of such a divergence in expectations.

It is true that mining stocks in general have suffered from the drop in commodity prices, which have hit their corporate earnings. As a result, mining stocks are now pricing in very low expectation levels. This means that any marginal improvement in corporate earnings would dramatically shift investors’ outlook for the future and result in higher stock price levels for this sector.

For the long-term investor, you don’t want to be part of the herd. You want to buy when others are selling, and sell when others are buying. For me, as a long-term investor, I think mining stocks look attractive.

This article Declining Sector Set to Outperform Stock Market was originally published at Investment Contrarians

By Sasha Cekerevac, BA

www.investmentcontrarians.com

Investment Contrarians is our daily financial e-letter dedicated to helping investors make money by going against the “herd mentality.”

About Author: Sasha Cekerevac, BA Economics with Finance specialization, is a Senior Editor at Lombardi Financial. He worked for CIBC World Markets for several years before moving to a top hedge fund, with assets under management of over $1.0 billion. He has comprehensive knowledge of institutional money flow; how the big funds analyze and execute their trades in the market. With a thorough understanding of both fundamental and technical subjects, Sasha offers a roadmap into how the markets really function and what to look for as an investor. His newsletters provide an experienced perspective on what the big funds are planning and how you can profit from it. He is the editor of several of Lombardi’s popular financial newsletters, including Payload Stocks and Pump & Dump Alert. See Sasha Cekerevac Article Archives

Copyright © 2013 Investment Contrarians - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Investment Contrarians Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.