Why Facebook Stock is a Dead End Investment

Companies / Internet Nov 01, 2013 - 12:51 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: I've made no bones about my feelings for Facebook Inc (Nasdaq: FB) - that it's overrated, a flash in the pan, and ultimately doomed.

Keith Fitz-Gerald writes: I've made no bones about my feelings for Facebook Inc (Nasdaq: FB) - that it's overrated, a flash in the pan, and ultimately doomed.

Yes, the company just knocked the ball off earnings yesterday. And the stock is up 4.86% as I write this. But I really couldn't care less what happens in the short term. I still can't get behind its long-term potential.

Mobile or not, customers (most notably the younger teenagers who put Facebook on the map) are moving on to other platforms, developed markets are stagnant, and, according to CFO David Ebersman, the company doesn't expect to significantly increase the "quality and relevance" of Newsfeed advertising in Q4.

And then there's the new "dead last" report that just came out.

This is where the rubber meets the proverbial road for me...

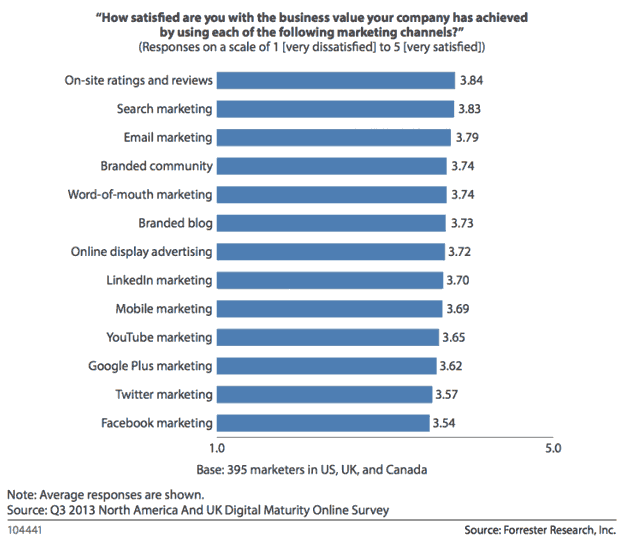

Marketing Executives Think Facebook Is a Dead End

Forrester Research, a respected firm noted for its savvy tech knowledge and commentary, issued a blistering report prior to earnings. "Facebook," the report says, "creates less business value than any other digital marketing opportunity." It also notes, with all the tact of a bull in a china shop, specific advice for marketing execs: "Don't dedicate a paid ad budget for Facebook."

Ouch! Seems the social network ranked dead last when it comes to online marketing effectiveness in a survey answered by 395 executives. There's just no getting around this one.

To be clear, Facebook isn't broken... it received mid-level rankings across the board. What this report suggests is that Facebook is not the do-all-end-all that profit-hungry believers like to believe it is.

Naturally the Technorati aren't happy.

Eyeballs do convert to sales, they insist. Look at Q3 profits, which rose to $0.25 a share on $2.2 billion in revenues that were up 60% year over year they say. Facebook remains on track to "connect the world," to quote CEO Mark Zuckerberg.

They have a point. But for how long? And what's that actually worth to investors?

Those are very different questions...

Personally, I prefer businesses that have broader moats, more predictable cash flows, and customers who actually need their products. Facebook remains nothing more than a discretionary collection of individuals who use it... for the moment. The next best thing is quite literally a click away.

Clearly traders who are nimble and quick have done well. So have the investment bankers and the insiders who made billions.

Investors, on the other hand, continue to have a very different experience.

This Is a Game of "Relative Performance"

You can't just pick winners and losers in today's world. If you are to be successful, you've got to pick the best winners while avoiding the worst losers.

That means honestly assessing business results rather than blindly piling on to potential. "What is," as my Grandmother Mimi (whom you've heard me reference as the voice of reason in past articles) used to say, "matters more than what could be."

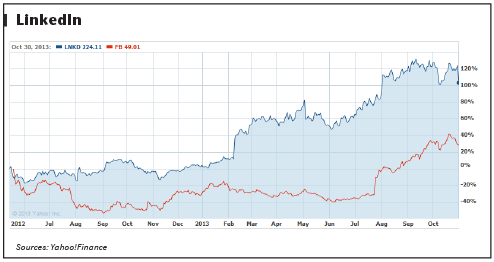

For example, I'd much rather invest in LinkedIn Corp. (NYSE: LNKD) - and its better-than-expected $393 million in revenue - than Facebook. Why? Because LinkedIn is a social media network based on productivity and executive need rather than recreational social data. The business case for owning it is far more cohesive, as have been the results.

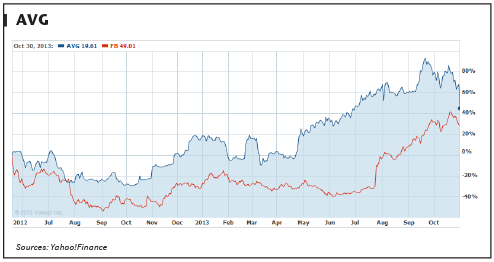

The same is true for antivirus provider AVG Technologies NV (NYSE: AVG), with its "freemium" model and high paid conversion rates. It, too, has bettered Facebook's returns.

What's more, anybody who uses a computer or a smart device actually needs the company's services. Even though the fall from September highs has been brutal, investors are still ahead of the glory hounds who piled into Facebook.

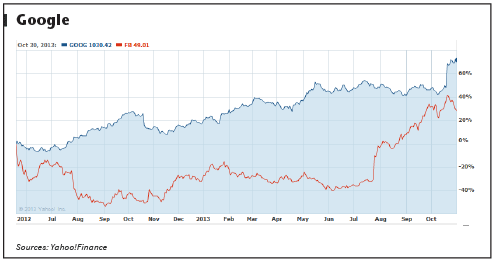

Then there's Google Inc (Nasdaq: GOOG).

The company practically is the Internet these days, and its revenue models are highly developed rather than socially pubescent. Now topping $1,000 a share, the company has offered investors a far more comparatively stable ride that outperforms Facebook's "potential" even on a bad day.

The Bottom Line

The real takeaway here for me when it comes to Facebook is that the senior marketing executives in charge of millions who pay for the company's services scored it lower than other alternatives. Small sample or not, investors would be wise to remember that it is their confidence and cash flow that ultimately translates into Facebook's earnings. End users are just eyeballs.

Call me a Luddite if you want, but social media companies are no different than any other form of business out there. Social media is not a game changer. Instead, it's like breakfast cereal or used cars. Neither has changed much in 100 years - they just taste better and the packaging is cooler.

To this point, author B.J. Mendelson, who wrote Social Media Is Bullshit, pointedly notes that the "only difference is that some unscrupulous experts, marketers, journalists and PR professionals came along, dressed things up a bit and gave the products different names so they can charge you gobs of money to learn about stuff you're already using or don't even need."

I agree - what everybody is excited about is merely the speed and form factor that's changed how we interact. Especially when it comes to Facebook.

The upshot?

You may get very lucky if you own Facebook, but I wouldn't count on it. It's easy to create big numbers off a low base, but looking ahead 3 to 4 quarters, that's going to change as 100% growth slows to 50%, to 40%, and ultimately lower numbers.

Diapers, soap, soup, and semiconductors, on the other hand, will be with us for the long haul.

#remembermyspace?

#howaboutaol?

#Iwouldntbuytwittereither.

Source :http://moneymorning.com/2013/11/01/facebooks-dead-last-chart-reveals-a-troubling-fact/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.