Stocks Bull Market Continues, But Watch Out For the Short Term

Stock-Markets / Stock Markets 2013 Oct 26, 2013 - 10:46 AM GMTBy: Sy_Harding

The market’s bias remains to the upside. It could even be that the debt-ceiling fiasco in Washington helped to buy the bull market more time.

Economic reports are beginning to show the government shutdown was a negative for the economy, but had less effect than was feared. Yet it had enough effect to make it unlikely the Fed will begin tapering back its stimulus until at least next March.

Fed tapering is not the only market risk that has come off the table for the next few months, as the market enters its favorable winter season when it makes most of its gains.

It’s becoming fairly clear that the debt-ceiling crisis is not likely to be a big deal when it returns in February. Both sides have much more incentive to reach an agreement prior to the deadline, after the wrath brought down on their heads from their failure to do so the first time.

Other risks from outside the market, like the eurozone debt crisis, have also faded into the background at least for a while.

The slowing trend of corporate earnings in the third quarter is a worry, as are warnings from major corporations of slowing sales.

But that has been a worry each quarter so far this year, a worry that so far has faded away each time once the quarter’s earnings reporting period ended. And the third quarter reporting period is drawing to a close.

So fundamental economic and background news is supportive of yet another positive winter season for stocks.

However, investors looking to increase exposure should do so carefully until the short-term technical situation created by the additional spike-up shakes out.

There are three short-term technical problems.

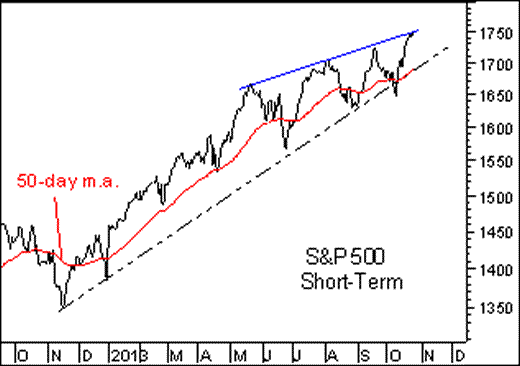

The S&P 500, as well as the NYSE Composite, Nasdaq, and Russell 2000, are again at the overhead trendline resistance that halted their last three short-term rallies. They are overbought above their short-term 50-day moving averages to a degree that also suggests a short-term top is at hand. And investor sentiment as measured by the weekly poll of its members by the American Association of Individual Investors (AAII) jumped to 49.2% bullish and only 17.6% bearish this week, entering the warning zone of too much optimism, perhaps due for a pullback to reality.

Since the intermediate-term trend is still to the upside, and we are in the market’s traditional favorable seasonal period, such a pullback is likely to be of the short-term variety and present another buying opportunity. Only a significant break below the trendline support would be a cause to revisit that expectation.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2013 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.