UK Interest Rates to be Cut to 5% Today on Fears of Housing Recession

Interest-Rates / US Interest Rates Apr 10, 2008 - 12:29 AM GMTBy: Nadeem_Walayat

The Bank of England is expected to cut UK interest rates to 5% at today's MPC meeting following a slump in UK house prices that saw a 2.5% fall in March (Halifax:SA). Interest rates were last cut in February 08 which was inline with the Market Oracle forecast as of August 07 and Sept 07 for UK interest rates to fall to 5% by September 2008, this was revised lower to 4.75% in January 2008 , following the US Panic rate cut of 0.75% on 22nd Jan 08 to 3.5%, and subsequent cuts which has taken the US Fed Funds rate down to 2.25%.

The Bank of England is expected to cut UK interest rates to 5% at today's MPC meeting following a slump in UK house prices that saw a 2.5% fall in March (Halifax:SA). Interest rates were last cut in February 08 which was inline with the Market Oracle forecast as of August 07 and Sept 07 for UK interest rates to fall to 5% by September 2008, this was revised lower to 4.75% in January 2008 , following the US Panic rate cut of 0.75% on 22nd Jan 08 to 3.5%, and subsequent cuts which has taken the US Fed Funds rate down to 2.25%.

Despite the recent up tick in inflation (CPI 2.5%), the overall trend remains down and inline with the Market Oracle forecast as of November 2007 as illustrated by the above graph which shows peaks in the inflation rates having occurred during early 2007. However recent consensus forecasts (Bloomberg) are for UK inflation as measured by the CPI to rise to 3.1% this year on the back of rising energy and food costs. I do not agree with this view, and expect the rise in the CPI to prove temporary.

Credit Crisis Continues

One of the prime drivers for today's cut in UK Interest rates will be in an attempt to ease the systemic instability in the credit markets which has again seen a sharp rise in the inter bank rate towards levels which case distress to UK financial institutions as illustrated by the spread between the 3 month LIBOR rate and the UK Base Interest rate. This results in a vicious cycle of banks withdrawing credit from borrowers as each Credit Crunch Tsunami Wave hits the banking system.

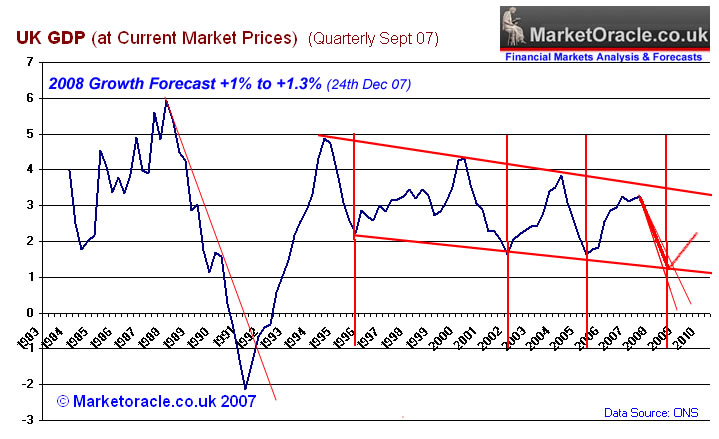

UK Economic Growth

The slowdown in economic activity suggests there will be further cuts in UK interest rates on the back of weak economic data in the coming months. The most probable date for the next rate cut is in June 2008, which will likely coincide with the next Tsunami Wave to hit the UK banks. The IMF revised its forecast for the UK economy down to 1.6% for 2008, against current UK treasury forecasts of 2% GDP growth. These still remain substantially above the Market Oracle forecast for UK GDP growth for 2008 of 1.1 to 1.3% as of December 2007, with increasingly looks optimistic as the risks of a recession by early 2010 grow. Therefore the expectation is for both the IMF and Treasury to make further downward revisions for the prospects for UK growth in the coming months.

UK Housing Bear Market

The UK housing market in March completed the 8th month of its bear market that is forecast to fall by 15% by August 2009. House price inflation is expected to go negative on an annualised basis in April and will be followed by alarming headlines during May 2008.

British Pound

The British Pound has fallen sharply against the Euro, declining by some 15% as the spread between the UK Base rate and the ECB interest rates narrows. There remains little signs of the ECB cutting interest rates during the first half of the year, therefore the Pound is expected to continue to fall against the Euro and the US Dollar after recently trading as high as £/$ 2.11, and now targeting a decline towards £/$1.90 (10% drop from high).

Market Oracle Track Record of Calling Monthly Interest Rate Decisions

Month |

Market Oracle Forecast |

Actual MPC Decision |

Outcome |

Apr 08 |

0.25% Cut |

Pending |

Pending |

No Change |

No Change |

||

0.25% Cut |

0.25% Cut |

||

No Pre-call |

No Change |

- |

|

0.25% Cut |

0.25% Cut |

||

No Change |

No Change |

||

No Change |

No Change |

||

No Pre-call |

No Change |

- |

|

No Change |

No Change |

||

0.25% Increase |

0.25% Increase |

||

No Change |

No Change |

||

0.25% Increase |

0.25% Increase |

||

Apr 07 |

No Pre-call |

No Change |

- |

Mar 07 |

No Pre-call |

No Change |

- |

0.25% Increase |

No Change |

||

0.25% Increase |

0.25% Increase |

||

No Pre-call |

No Change |

- |

|

0.25% Increase |

0.25% Increase |

||

Overall Rate Forecast Accuracy |

92% |

||

By Nadeem Walayat

Copyright © 2005-08 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 120 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.