Janet Yellen the U.S. Interest Rates Hawk?

Interest-Rates / US Interest Rates Oct 22, 2013 - 07:10 AM GMTBy: Steve_H_Hanke

Well, it’s official. President Obama has picked Janet Yellen as his nominee to be the next Federal Reserve Chairman. In the months leading up to this announcement, the press unanimously dubbed Yellen the Queen of the Doves, pointing to her reluctance to roll back the Fed’s Quantitative Easing program. As it turns out, however, Yellen is hardly the dove she is made out to be. Indeed, when it comes to money supply, Dr. Yellen seems, well, downright hawkish.

Well, it’s official. President Obama has picked Janet Yellen as his nominee to be the next Federal Reserve Chairman. In the months leading up to this announcement, the press unanimously dubbed Yellen the Queen of the Doves, pointing to her reluctance to roll back the Fed’s Quantitative Easing program. As it turns out, however, Yellen is hardly the dove she is made out to be. Indeed, when it comes to money supply, Dr. Yellen seems, well, downright hawkish.

Traditionally, the dove label has referred to an emphasis on the Fed’s mandate to pursue full employment (even at the expense of slightly higher inflation), while the hawk label has referred to a focus on the Fed’s price stability mandate. In practice, however, the dove-hawk distinction typically comes down to a question of the money supply: to increase, or not to increase?

“The United States, with Yellen’s blessing, has employed a loose state money/tight bank money monetary policy mix.”

First, we must define what measure of the money supply we are talking about. While it is true that the Fed has turned on the money pumps in the wake of the 2008 crisis, the Fed only directly controls what is known as state money, also known as the monetary base, which includes currency in circulation and bank reserves with the Fed. The vast majority of the money supply, properly measured, using a broad metric, is what is known as bank money. This is money produced by the private banking sector via deposit creation, and it includes liquid, money-like assets such as demand deposit and savings deposits.

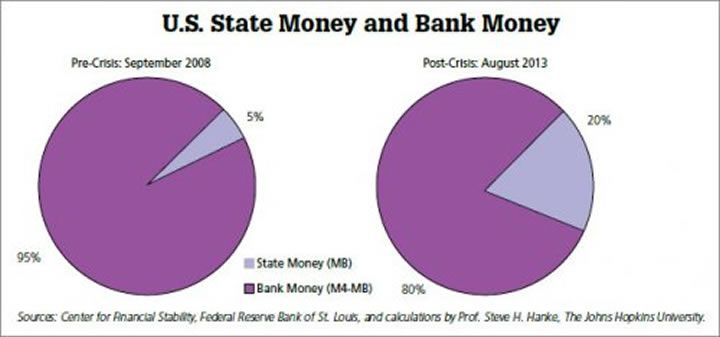

The Fed has indeed been quite loose when it comes to state money, with the state money proportion of the total money supply increasing from 5% of the total before the crisis, to 20%today (see the accompanying chart).

[Hear More: Professor Steve Hanke: The Fed's Stimulus Policies Are Making the Credit Crunch Worse]

Given Yellen’s support for continuing the Fed’s interest rate and easing policies, it would appear that, when it comes to state money, Yellen is indeed a dove. But, where does Yellen stand on the other 80% of the money supply? To answer this question, we must look not to her stance on monetary policy, per se, but rather on financial regulation.

For some time, I have warned that higher bank capital requirements, when imposed in the middle of an economics lump, are wrong-headed because they put a squeeze on the money supply and stifle economic growth. Thus far, the result of efforts to impose these capital requirements has been financial repression — a credit crunch. This has proven to be a deadly cocktail to ingest in the middle of a slump.

In the aftermath of the financial crisis, politicians, regulators, and central bankers around the world (including Yellen)have pointed their accusatory fingers at commercial bankers. They assert that the keys to preventing future crises are tougher regulations and more aggressive supervision, centered around higher capital requirements for banks.

This would be fine if higher capital requirements were being imposed during an economic boom, because capital hikes cause money supply growth to slow, which tends to cool down the economy. But, when capital hikes are imposed during a slump, they become pro-cyclical and actually make things worse. Indeed, the imposition of higher capital requirements in the wake of the financial crisis has caused banks to shrink their loan books and dramatically increased their cash and government securities positions.

Even the International Monetary Fund (IMF) and the Paris based Organization for Economic Co-operation and Development (OECD) quietly acknowledge that this will hamper GDP growth and raise lending rates. But, thus far, they have failed to fully assess the negative impact of raising capital requirements during an economic slump. The problem is that they are not properly focused on the money supply. Indeed, when viewed in terms of money — bank money, to be exact — the picture comes into sharp relief.

For a bank, its assets (cash, loans and securities) must equal its liabilities (capital, bonds and liabilities which the bank owes to its shareholders and customers). In most countries, the bulk of a bank’s liabilities (roughly 90 percent) are deposits. Since deposits can be used to make payments, they are “money.” Accordingly, most bank liabilities are money.

To increase their capital-asset ratios, banks can either boost capital or shrink risk assets. If banks shrink their risk assets, their deposit liabilities will decline. In consequence, money balances will be destroyed.

The other way to increase a bank’s capital-asset ratio is by raising new capital. This, too, destroys money. When an investor purchases newly-issued bank equity, the investor exchanges funds from a bank account for new shares. This reduces deposit liabilities in the banking system and wipes out money.

So, paradoxically, the drive to deleverage banks and to shrink their balance sheets, in the name of making banks safer, destroys money balances. This, in turn, dents company liquidity and asset prices. It also reduces spending relative to where it would have been without higher capital-asset ratios.

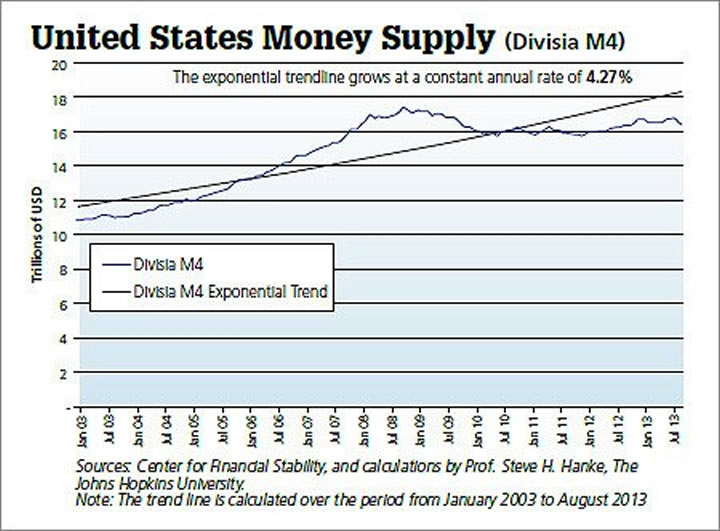

The United States, with Yellen’s blessing, has employed a loose state money/tight bank money monetary policy mix. Yes, for all the talk of QE3 and Fed’s loose monetary policy, the inconvenient truth is that the overall money supply in the U. S., broadly measured, is still, on balance, quite tight — thanks in large part to ill-timed bank capital hikes. With bank money making up 80% of the total U. S. money supply, broadly measured, it should come as no surprise that the U. S. is actually registering a money supply “deficiency” — 10. 1% to be exact (see the accompanying chart).

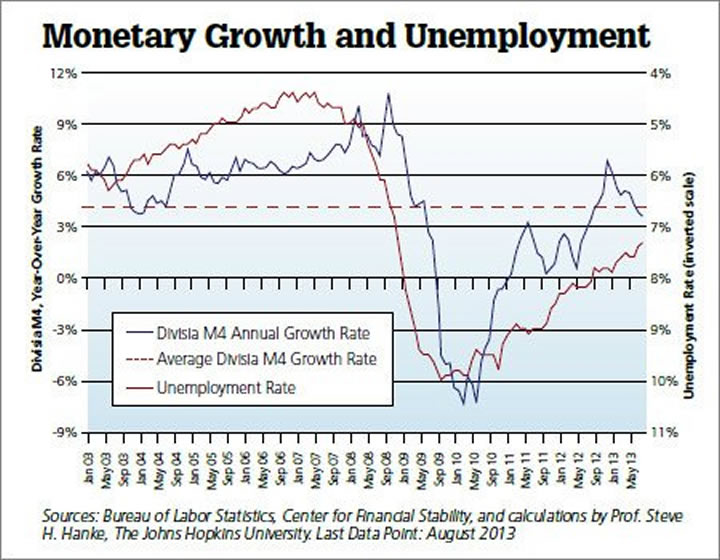

Yes, the shrinkage in bank money has far outstripped the Fed’s efforts to boost state money. In consequence, the current money supply is over $1 trillion less than its pre-crisis level. This is bad news for the real economy, particularly the labor market, as money supply growth and unemployment are tightly linked (see the accompanying chart).

If Yellen were truly a dove, she would have been advocating laxity in bank capital requirements and supervision, not stringency. Alas, despite the massive regulatory burden that has been heaped upon the banking system by the Basel III and Dodd-Frank regulatory regimes, and the repeated capital hikes that have been imposed on banks by domestic and international regulators, Yellen is not satisfied. Indeed, she calls this effort “unfinished business.”

These are clearly not the words of a dove, properly understood. Indeed, on the issue of bank regulation — specifically its effect on bank money — the Queen of the “Doves” has unfortunately sipped the same Kool-Aid being served in the current Chairman’s office.

This article appeared in the November 2013 issue of Globe Asia.

By Steve H. Hanke

www.cato.org/people/hanke.html

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2013 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.