Google Super Stock Takes Market To New Highs

Stock-Markets / Financial Markets 2013 Oct 18, 2013 - 06:12 PM GMTBy: PhilStockWorld

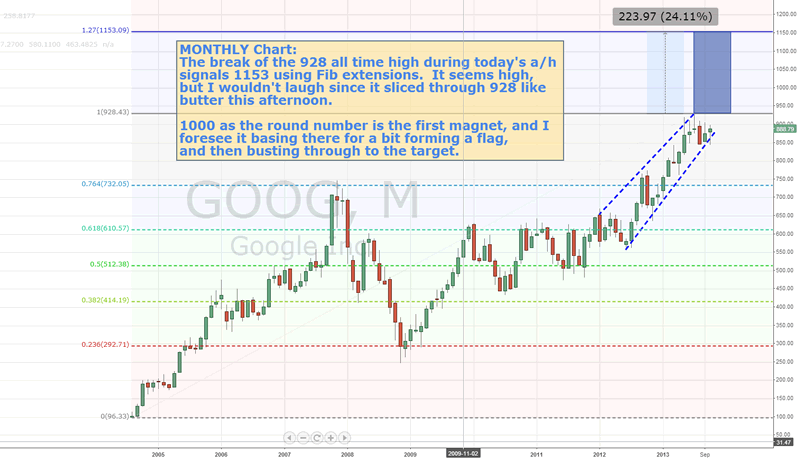

Right behind mighty PCLN, GOOG is closing in on the $1,000 per share club after earning $2.97Bn or $10.74 per $970 share. What? Oh sure, yes, $10.74 is just 1/90th of $970 BUT, keep in mind there are 4 (four) big quarter and 4 x $10.74 is $42.96 and GOOG was expected to earn $43.50 this year anyway and though they were SUPPOSED to make $10.34 so, of course a .40 beat means the stock should pop $10%, right?

While $970 (a p/e of 22.5) may SEEM high for a company who's revenues only grew 12% (well behind the industry average 20%) where else are you going to stuff $29Bn of Uncle Ben's funny money overnight? That's right, within minutes of the stock market closing, GOOG jumped 10% and added $29Bn of market cap in a matter of minutes. I know $29Bn may not seem like a lot to us anymore but it is 29,000 Million dollars. (Chart by Ycharts.)

On average, GOOG trades less than 2M shares a day x $800 = $1.6Bn so, from a cash-flow perspective, in order to sustain that price Google will need all 2M of those trades to be buys (all inflows) for 18 consecutive days to put enough cash into the market to justify that jump. Luckily, that's not how the market works and usually it takes just 1/10th of the money coming in to "justify" a bump in price but, still, that's a lot of inflow needed to support this bump.

Still, we have to give props to the move and, technically, they are busting out and a technical market is what we're in, so we're not going to get short on GOOG but we will keep tight stops on our 2015 $800 calls, which we paid a virtual $115.07 for in our Long-Term Portfolio and shame on us if we don't take what's likely to be a double off the table if it starts to fade on us. See last night's Member Chat for our thoughts on how to play that position, as well as ISRG and CMG – all very exciting today.

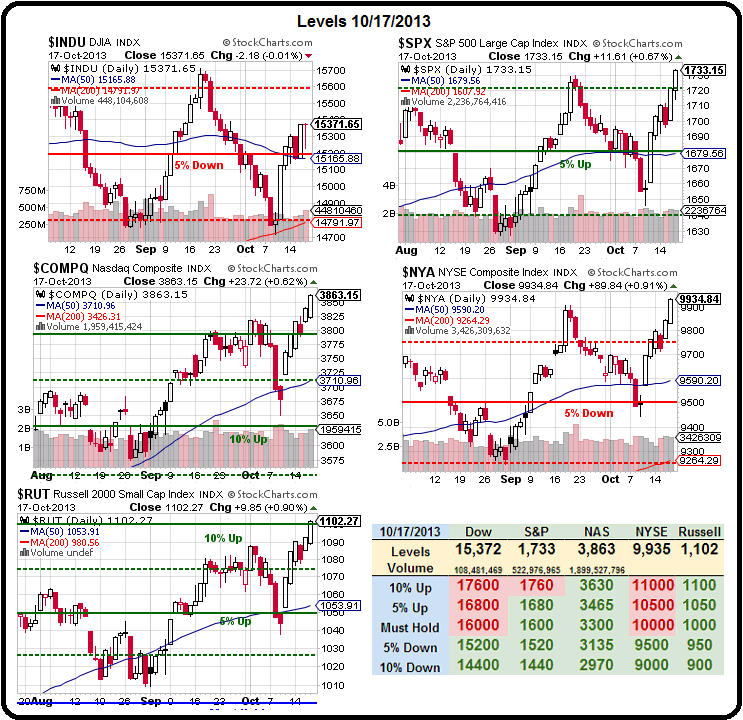

In the broader markets, everything's coming up roses and it's Friday, so let's just enjoy the ride and see what happens next week. We did not get the pullback we expected on option expiration day (today) so we'll have some rolling to do for next month in our Short-Term Portfolio and, of course, next week we get 150 earnings reports from the S&P and THEN things get interesting.

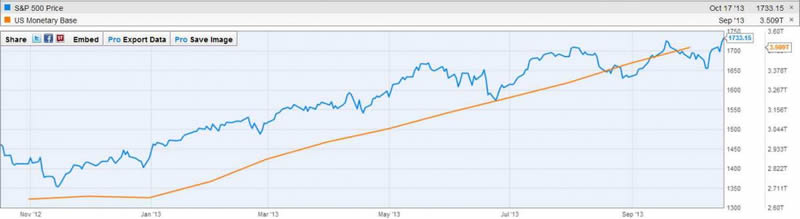

Of course the weak Dollar (79.6) is some help as it's down from 82.5 in early Sept and that's 5% lower for the Dollar and we've had a 100-point rally in the S&P and that's 6.3% so 1.3% of this rally is REAL!!! Isn't that special?

78.60 was the 2012 low on the Dollar (also Sept) and we bounced back to 81.50 in November and that sent the S&P tumbling from 1,474 to 1,343 but what's 10% between friends on a 3.8% move up in the Dollar? As long as the Dollar keeps collapsing – the bulls have nothing to worry about. This is Abenomics, American Style!

Check out this chart of the US money supply vs. the S&P. That's a pretty good correlation, right? So no reason not to go higher as long as the Fed keeps printing money. The supply of money went from $2.65Tn (monetary base) to $3.5Tn THIS YEAR! That's 24% MORE FREE MONEY than there was last year and the S&P has gone from 1,450 to 1,733 and that's "only" 19.5%. The money isn't going away so the S&P needs to move higher to accommodate all that extra cash and, as I said at the top – where else but GOOG can you stuff a quick $29Bn?

Or, as I said to our Members last night:

That's what TNA is for – it's 3x in the opposite direction. TZA's are meant to protect long positions – never to be your only position. If you look at our monthly summaries – we have HUNDREDS of bullish long positions and we protect them in our Short-Term portfolio by playing short-term bearish – just in case the market turns down – it should give us some additional cash to play with. If the market keeps going up and up and up, then our long-term positions do well and the losses in the STP are the cost of insurance.

We are NOT long-term bearish on the market – inflation is likely to make that impossible. There are certain stocks we think will fail and we like to short certain indexes at certain inflection points but, long-term, we are still bullish, not bearish.

How can you be bearish when ANOTHER $85Bn will be pumped into the economy this month, and another next Month, and another in December? All those $85Bns have to find a home somewhere and IBM didn't make the Blue Chips look sexy so it's off to the Momentum Stocks like SBUX, TSLA, PCLN, etc. and big-cap techs like GOOG, AAPL, FB etc. and that's how we build a new bubble. God help us all if the Fed ever does withdraw this liquidity! Or, as Art Cashin puts it:

I do worry a little bit that we're beginning to hear things that are reminiscent of the 1999-2000 period—the number of hits, the number of eyeballs.

I think if we hold to the old tried-and-true—how many dollars are coming in—then we might be better served. But people are extrapolating, in some way, in a manner similar to the way they did in 1999-2000.

We're beginning to see a case of old tech/new tech—and the key topic this earnings season is how deeply you are involved in cloud technology and/or can you make money on the mobile side. For an old fogy like me, the trend of extrapolating future earnings based on users and viewers gets the warning flags flying.

We still like gold, which began the year at $1,650 and is now $1,320, that's DOWN 20% while the Dollar is diluted by 24%. While there are other factors, like Global Unrest that contributed to the rise in gold – at some point it is a value play and gold itself may not be doing much but I'm loving ABX at $18.50, HMY at $3.28, NAK at $1.49 and SLW at $23.25 as long-term hedges against inflation.

As to the broader market: We're skeptical of this week's pop and we're probably going to short something into the weekend and, if we see a good play, we may even dare to short GOOG as a day-trade – we'll see how things go because long-term, we're certainly bullish until the Fed stops easing but, short-term, we're still looking for a pullback off this triple top.

Have a great weekend,

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.