Janet Yellen to the Rescue?

Politics / US Federal Reserve Bank Oct 17, 2013 - 07:59 AM GMTBy: Axel_Merk

While Democrats and Republicans fight with water pistols, the President may be readying a bazooka by nominating Janet Yellen to succeed Ben Bernanke as Fed Chair. You may want to hold on to your wallet; let me explain.

While Democrats and Republicans fight with water pistols, the President may be readying a bazooka by nominating Janet Yellen to succeed Ben Bernanke as Fed Chair. You may want to hold on to your wallet; let me explain.

Water pistols

Our reference to water pistols refers to our assessment that bickering over discretionary spending is distracting from the real issue, entitlement reform. For details as to what we believe will happen if we don't get entitlement reform done, please read our recent Merk Insight "The Most Predictable Economic Crisis".

Bernanke Fed

Central banks in developed countries are generally considered independent, even if their members are appointed by politicians. In the U.S., however, there's an added element: aside from a mandate for price stability, the Federal Reserve is tasked with promoting maximum sustainable employment. This simple concept might have been put in place with the best of intentions - who wouldn't want to have maximum employment? Central banks that have a single focus on price stability, such as the European Central Bank, point out that the best way to foster sustainable growth is by keeping inflation low. The U.S., even with an employment mandate, had pursued the same practice.

That is, until Ben Bernanke appeared to run out of options to lower borrowing costs. Bernanke's frame of reference had been the Great Depression; he had frequently cautioned that the biggest mistake during the Great Depression was to raise interest rates too early. After a credit bust, as central banks push against deflationary market forces, premature tightening might undo the progress to reflate the economy. In today's world, it's not just short term, but also longer-term interest rates that Bernanke has been concerned about - partially because Bernanke has always considered it important to keep mortgage rates low. To achieve his goal, the Bernanke Fed:

- Talked down interest rates;

- Lowered interest rates;

- Purchased Treasury and Mortgage-Backed Securities

- Engaged in Operation Twist

- Introduced an employment target

Introducing an employment target was nothing but an extension of existing policies, as it signals the Fed might keep rates low independent of where inflation might be.

Yellen Fed

With Janet Yellen coming in, the concept of promoting employment is raised to a new level. Long gone is the Great Depression, but what remains may be a conviction that monetary policy should make up for the shortfalls of fiscal policy. That's problematic for a couple of reasons:

-

When the Fed meddles with fiscal policy, Congress will want to meddle with monetary policy. For example, when the Fed buys mortgage-backed securities it allocates money to a specific sector of the economy (favoring the housing market); that's not what the Fed ought to do - it's the role of Congress to channel money through tax and regulatory policy. One can disagree whether even Congress should be picking winners and losers in an economy, but that's a political determination to be made by elected officials.

-

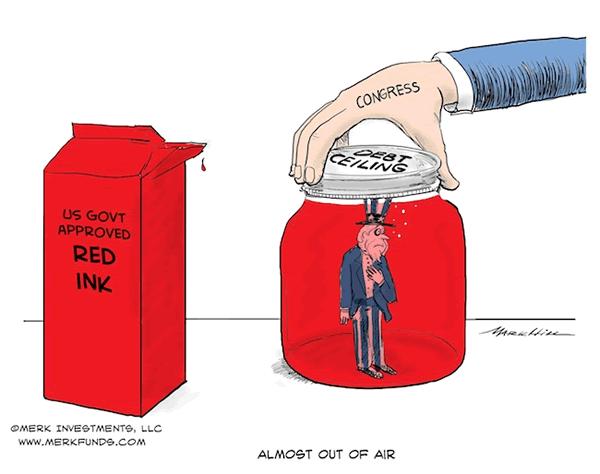

When the Fed keeps rates low to promote employment, there's a fair risk that important cues are removed from the market that would encourage Congress to show fiscal restraint. Congress has always loved to have a printing press in the back yard, but an employment target suggests that this printing press is going to be moved into the kitchen. The Eurozone may be proof that policy makers only make the tough decisions when forced to do so by the bond market; if, however, the Fed works hard to prevent this "dialogue" between the bond market and politicians, the most effective incentive to show fiscal restraint might be gone.

-

Inflation is a clear risk when the Fed emphasizes employment. In our assessment, inflation may well be the goal rather than the risk in the eyes of some policy makers, as inflation lowers the value of outstanding government debt.

Hold on to your wallet

In a democracy, it's all too tempting to introduce ever more entitlements. As obligations mount, however, servicing these obligations might become ever more challenging. It's nothing new that governments tax their citizens. But when deficits are no longer sustainable, governments may be tempted to engage in trickery. Structural reform, that is taking away entitlements, to lower expenditures would be the most prudent path to regain fiscal sustainability. Raising taxes is all too often the preferred alternative; while politically difficult, raising taxes is a strategy that's all too often politically viable. Yet the path of least resistance may well be to inflate the debt away. Central banks ought to be independent to take this option away from policy makers. We have seen in the Eurozone that it can be most painful when the printing press is not at the disposal of politicians.

In our assessment, a central bank pursing an employment target is a central bank that has given up its independence. It's only ironic that outgoing Fed Chair Bernanke recently praised Mexico's central bank for gaining "independence."

Whatever happened to the government being the representative of the people? Interests of the government and its citizens are no longer aligned when a government has too much debt. The government's incentive will be to debase the value of the debt. The U.S. may have an easier time debasing the value of its debt than some other countries, as much U.S. debt is held by foreigners who can't vote in the U.S. Differently said, promoting a weaker dollar is another potential avenue for U.S. policy makers to kick the can down the road. But fear not, whatever policy is coming to a neighborhood near you shall be done in the name of fostering maximum employment.

Please register to join us for an upcoming Webinar as we dive into these dynamics in more detail. Also make sure you subscribe to our newsletter so you know when the next Merk Insight becomes available.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.