Monday Stock Market Meltdown – Again

Stock-Markets / Stock Markets 2013 Oct 14, 2013 - 02:15 PM GMTBy: PhilStockWorld

Does this seem familiar to you?

Does this seem familiar to you?

This is how we began last Monday's post as the House failed to pass a debt deal and the markets begain to panic after having popped 100 points on Friday in anticipation of a revolution. Those who forget the past yadda, yadda, yadda - I suppose.

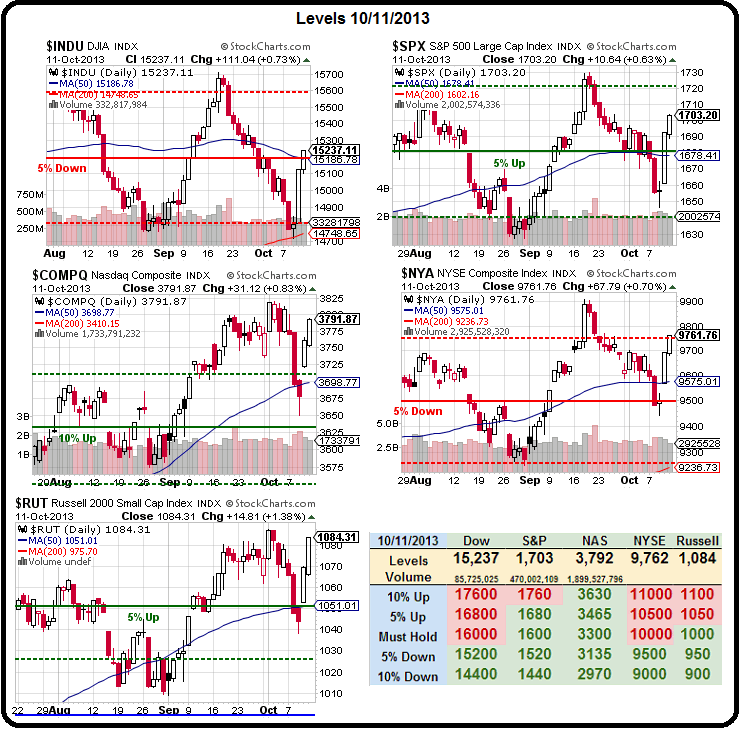

We started last week at 15,100 on the Dow on Monday, fell to 14,700 on Wednesday, rallied back over 15,100 on Thursday and now back to 15,100 at the open this morning (Futures down about 100 points). Isn't this silly?

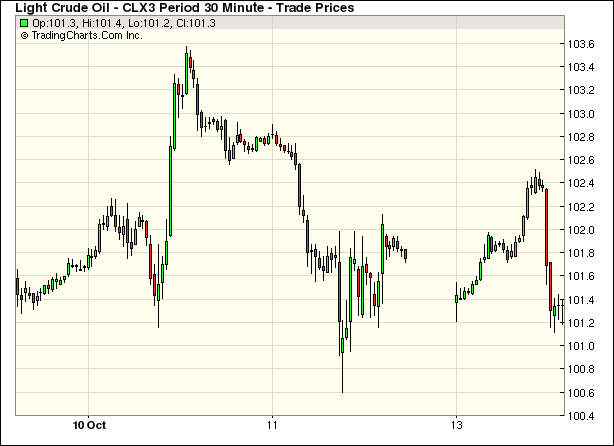

We could have yadda-yadda'd all of last week and wouldn't have missed much – except some fabulous gains in oil, of course, as we got all the way back to $100.50. This morning we caught a nice ride from $102.50 back to $101.25 for a $1,025 per contract gain from our entry in early morning Member Chat but, at this point, I certainly hope you don't need me to tell you what lines we're shorting oil at!

We're actually hoping oil goes up now, as we cashed in our USO/SCO positions and we'd like to add more back. Also, like last Thursday – how much more fun is it when we get a nice BS pop to ride back down? Like any good roller coaster – you have to sit and wait for the car to get to the top of the tracks again before you get that exhilarating "WHEEEEEE!!!" we enjoy so much (and you do not need a degree in rocket science to see that it's a good idea to go LONG at $102.50 until it breaks back under and we can flip back short).

The same goes for our indexes as well. As you can see from our Big Chart, we got almost a full retrace on the Russell and that led us to get aggressive in our Member Chat on Friday and pick up 40 TZA (ultra-short Russell mentioned in Friday morning's post) Oct $23 calls for our Short-Term Portfolio at an average of .625. Those can put up some extremely nice gains if the markets pull back again as those calls were $2.30 on Wednesday – but we'll be happy enough with "just" a double.

Speaking of doubles, we had 4 of them so far from our September Trade Review – and we're only up to the 5th! Aside from a good retrospective of the steps that lead us up to the current market melt-down, there's a lot of usesful general commentary, including a great chart on what it really takes to become a trading "expert".

I've said all I need to say about Republican idiocy and the debt crisis last Monday. The crisis continues and, if anything, the GOP has gotten worse, not better so I'm going to refrain from comment here and you can re-read that if you want. I will point out that all the "progress" we're seeing today is based on cooperative-seeming Senators, which have little to do with the House – where the real crisis of leadership is unfolding.

Today is a semi-holiday and the trading should be light so we're not going to pay much attention to today's action – Monday's are usually "watch" days so no real change of schedule for us. It's a good day to reflect on the fact that, on his return from the New World, Columbus bought 500 slaves with him but 200 died in transit, so he tossed them into the sea to lighten the load.

We have 535 Congresspeople in Washington – if only we had a man like Columbus around today to toss a couple of hundred of them out the door!

Happy Columbus Day,

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.