Gold Weakens Ahead of Central Bank Meeting

Commodities / Gold & Silver Apr 09, 2008 - 11:47 AM GMTBy: Mark_OByrne

Gold is down some 1% in early trading in London this morning. Gold was down $11.10 to $914.00 per ounce in trading in New York yesterday and silver was down 41 cents to $17.68 per ounce. The London AM Gold Fix at 1030 GMT this morning was at $906.75, £460.40 and €576.56 (from $921.00, £465.95 €584.65 yesterday).

Gold is down some 1% in early trading in London this morning. Gold was down $11.10 to $914.00 per ounce in trading in New York yesterday and silver was down 41 cents to $17.68 per ounce. The London AM Gold Fix at 1030 GMT this morning was at $906.75, £460.40 and €576.56 (from $921.00, £465.95 €584.65 yesterday).

Further profit taking seems the most likely reason for gold's weakness this morning with traders looking to the forthcoming central bank meetings which may affect precious metal, currency markets and the wider markets. Interest rate decisions by both the Bank of England and the ECB on Thursday will be closely watched (BofE expected to cut and ECB expected keep on hold). The Bank of Japan left its interest rate target unchanged at 0.5 per cent today, as expected, in a unanimous vote but warned that economic conditions were deteriorating.

With oil remaining near record highs ($108.70) and the dollar range bound (in a range between EUR 1.55 and EUR 1.59) gold seems well supported by bargain hunters in the high $800's and low $900's.

The IMF's latest assessment of the costs of the credit crisis have been raised to nearly $1,000 billion or $1 trillion and this should give pause for thought to those who ludicrously suggest that the worst is over. Ominously the IMF points out how the costs go way beyond subprime and other mortgage related securities and warn of losses and write downs on prime mortgages, commercial real estate, leveraged loans and consumer finance. Not only banks will suffer the losses but also insurance companies, pension funds, hedge funds and other investors.

| 09-Apr-08 | Last | 1 Month | YTD | 1 Year | 5 Year | ||

| Gold $ | 906.67 | -6.79% |

8.80% |

34.86% |

177.77% |

||

| Silver | 17.53 | -12.99% |

18.70% |

27.67% |

292.21% |

||

| Oil | 108.43 | 2.96% |

9.33% |

75.48% |

275.84% |

||

| FTSE | 5,986 | 5.02% |

-6.97% |

-6.42% |

55.02% |

||

| Nikkei | 13,112 | 2.57% |

-14.34% |

-26.10% |

62.72% |

||

| S&P 500 | 1,366 | 5.58% |

-7.00% |

-5.47% |

57.68% |

||

| ISEQ | 6,279 | 1.93% |

-9.44% |

-33.33% |

54.59% |

||

| EUR/USD | 1.5736 | 2.48% |

7.89% |

17.84% |

46.11% |

||

| © 2008 GoldandSilverInvestments.com | |||||||

Initially more sanguine commentators had said that the losses would be of the order of some $50 billion. They were wrong and will continue to be proved wrong and the losses will ultimately be measured in the trillions and not billions as this is the worst financial crisis since the 1930's Great Depression and may lead to a long and protracted recession in many western economies.

This possibility was warned of in the FOMC's minutes yesterday in which some officials warned that a prolonged and severe economic downturn even as inflation pushed higher could not be ruled out. Especially given the further restriction of credit availability and ongoing decline in the housing market. The FOMC is clearly concerned regarding the emergence of stagflation. Ex Fed Chairman Alan Greenspan said overnight that “we are in the throes of a recession”. This will lead to continuing safe haven demand for gold and demand for gold in order to hedge against inflation, stagflation and significant systemic risk.

Gold's non-correlation with the major asset classes means that it is becoming and will increasingly become an essential diversification in all investment portfolios internationally.

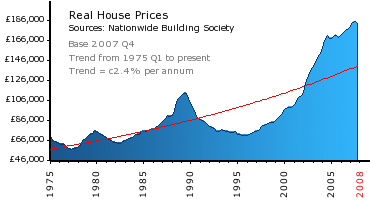

The euro saw yet another fresh lifetime high versus sterling in early morning trade with the UK currency pressured by data supporting the view that the Bank of England could cut interest rates by as much as 0.50% tomorrow after the dreadful house price data yesterday.

In the same way that UK house prices nearly trebled in value from 1996 to 2007 so gold will more than likely at least treble in value in sterling terms to well over £900 in the coming years. It is interesting to note that the last time we had similar conditions to today – stagflation in western economies – gold rallied very sharply in sterling and all international currencies. Gold rose from below £20 per ounce in 1971 to £300 per ounce in 1980 or a rise of 1,500% of 15 fold. Were gold to replicate it's performance of the 1970's again gold would soar to multiples of the multi year low in sterling below £200 per ounce in 1999 (when Gordon Brown very shortsightedly and imprudently sold much of Britain's gold reserves). Gold would thus at least reach its inflation adjusted high of over £800 per ounce.

Support and Resistance

Support is at $885, $900 and $910. A close below $800 could see us retest the recent lows at $885. Resistance is at $930 and $950.

Further consolidation appears necessary but this again looks like the pause in the bull market that refreshes and creates a strong foundation for the next step up in the gold price which will likely take us to $1,200 per ounce.

Silver

Silver is trading at $17.55/17.60 at 1100 GMT.

PGMs

Platinum is trading at $1980/1990 (1100 GMT).

Palladium is trading at $449/455 per ounce (1100 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.