Rehypothecation of Collateral

Stock-Markets / Financial Markets 2013 Oct 09, 2013 - 10:47 AM GMTBy: BATR

Before you get a headache or a pain in your side, rehypothecation is not as difficult to understand as spelling the word. Definition of 'Rehypothecation':

Before you get a headache or a pain in your side, rehypothecation is not as difficult to understand as spelling the word. Definition of 'Rehypothecation':

“The practice by banks and brokers of using, for their own purposes, assets that have been posted as collateral by their clients. Clients who permit rehypothecation of their collateral may be compensated either through a lower cost of borrowing or a rebate on fees.

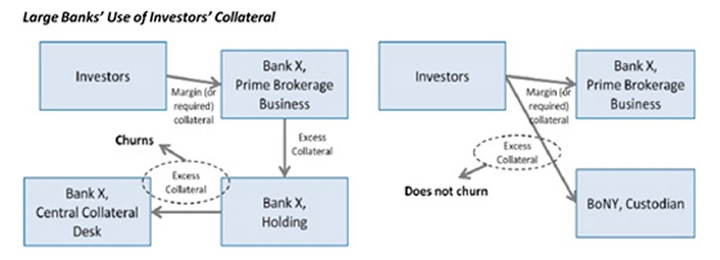

In a typical example of rehypothecation, securities that have been posted with a prime brokerage as collateral by a hedge fund are used by the brokerage to back its own transactions and trades. While rehypothecation was a common practice until 2007, hedge funds became much more wary about it in the wake of the Lehman Brothers collapse and subsequent credit crunch in 2008-09.

In the United States, rehypothecation of collateral by broker-dealers is limited to 140% of the loan amount to a client, under Rule 15c3-3 of the SEC.”

Well, now that it is clear, isn’t it? Still need a better explanation, watch the video Rehypothecation.

Look at the practice as a giant musical chairs orchestra, conducting a continuous symphony. As long as the tune plays, the multi pledged collateral is safe from foreclosure.

Consider that the entire fiat paper financial system is based upon a promise to pay. The original capital plus the interest juice is incorporated within the pledge from the borrower to the lender. However, in the real world only the super privileged and connected negotiate market rate or below, loans without collateral. For the rest of the garden-variety beggars that need to go hat in hand to scrounge money, they had better be willing to put up security for the note obligation.

Of course, unsecured credit card usury rates are the exception to manageable interest rates.

In the realm of high finance the rules for swinging deals takes on surreal implications when leveraging, gearing and syndication pooling share the risk by pledging security instruments to gain loan approval.

The complications are that such guarantees often do not hold unencumbered rights to the underlying security. Obtaining insurance coverage to warrant the value of the collateral is one way to satisfy the lender. Add to this expose the practice of re-insurance when the original underwriter books out their portions of the default risk to another more daring insurer.

While the security industry rules limit the percentage of rehypothecation, do not forget this is the same fraternity that invented the practices of derivatives and swaps.

Do you really believe that any set of rules will prevent the security brotherhood from comingling customer funds? Maybe putting Jon Corzine, the MF Global Holdings guru in charge of regulation enforcement would bring clarity to a complex system of double-dealing.

Sure, such an expert on circumventing the law would be the optimum sheriff to round up the rehypothecation bandits. Well, just understand the significance that the lawyers and barristers acknowledge, in the WGMR report.

"Cash is fully fungible, making it difficult to segregate from other assets, lawyers point out. Full title to the cash is given to the dealer, and all the customer has is a contractual claim for repayment of an equal amount of cash, meaning it would effectively rank as an unsecured creditor in the event of a default. In contrast, securities posted as collateral under a security interest arrangement can be segregated and traceable."

Oh golly, the smoking gun verbalized by the officers of the court . . .

The depositor relinquishes their ownership of funds to the security dealer. When the music is over, turn out the lights. Maybe the message from the Jim Morrison’s song is a warning to investors and borrowers alike. Just close the door on the opaque scheme to overestimate the underlying value of collateral security.

When the only recourse to recoup your losses rests upon an unsecure creditor status in a bankruptcy, the capital formation of the economic system ceases to function. Conversely, before the borrower rejoices that the financial institution takes a mortal hit to their balance sheet, the collapse of liquidity brings hardship to the entire economy.

Common sense in banking is gone. Indemnity protection in securities is worthless. If left to the financial elites to rescue the paper monitory structure, the gnomes of default will just rehypothecate the entire system by claiming the same ownership, of all-collateral as the financial dealers take full title to your cash.

This is how you have become the unsecured creditor of your own assets. When You Wish Upon A Star, Anything your heart desires – REHYPOTHECATION - Will come to you.

Source : http://www.batr.org/negotium/100913.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2013 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.