Healthcare Revolution - The Road to a New Medical Order

Politics / Healthcare Sector Oct 06, 2013 - 01:47 PM GMTBy: John_Mauldin

There is no doubt that the single most contentious topic I can bring up in a small group discussion or speech is the Affordable Care Act, otherwise known as Obamacare. You can feel the tension rise, as everyone has an opinion they want to express – most of them based essentially on preconceived philosophical positions, nearly all of which can be can seen through their own eyes as reasonable and consistent with civilized behavior. And the facts that can be trotted out to support their positions, pro and con, could fill up a document almost as long as the original 2,300+ page bill. I have avoided writing about the Affordable Care Act (ACA) for a variety of reasons but primarily because it is so difficult for us to get our heads around the economic implications.

There is no doubt that the single most contentious topic I can bring up in a small group discussion or speech is the Affordable Care Act, otherwise known as Obamacare. You can feel the tension rise, as everyone has an opinion they want to express – most of them based essentially on preconceived philosophical positions, nearly all of which can be can seen through their own eyes as reasonable and consistent with civilized behavior. And the facts that can be trotted out to support their positions, pro and con, could fill up a document almost as long as the original 2,300+ page bill. I have avoided writing about the Affordable Care Act (ACA) for a variety of reasons but primarily because it is so difficult for us to get our heads around the economic implications.

Today I will try, though some of my readers may conclude that I have failed, to avoid coming to political conclusions about the ACA. Instead, I will aim to dwell simply on the economic ramifications of the implementation of the bill as it exists today. We are changing the plumbing on 17.9% of the US GDP in profound ways. Many, if not most, of the changes are absolutely necessary.

This letter has grown out of a rather lengthy, ongoing conversation I have had with my very close friend and personal doctor, Mike Roizen, about his perceptions of changes that his institution, the Cleveland Clinic, and others like it have to make concerning the delivery of medicine in the near future, and the Clinic's expectations regarding the income they will receive for providing their services. The Cleveland Clinic is one of the largest and most respected hospital groups in the world (heck, Obama and Romney even cited it in their first debate as an institution providing great care very efficiently – the only institution so cited). The Clinic has 43,000 employees and a healthcare budget of over $6 billion. Looking at the future budget considerations of the Cleveland Clinic and similar institutions outlined below, there is both reason to be both optimistic and reason to be deeply concerned about the changes that are coming to US society in the immediate future.

I asked Mike if he would be willing to provide me with some notes concerning the future of healthcare in our nation and the Clinic's own future. He kindly obliged, and I have edited and expanded upon what he wrote and shared with me in our conversations. This following should not be read as a policy statement or an official analysis from the Cleveland Clinic itself; instead, it is an essay that grew out of an exchange between two friends, a doctor and an economist, trying to make sense of how things will change.

For those not familiar with Mike, he is quite the medical celebrity. He is an anesthesiologist and an internist, an award-winning author, and the chief wellness officer of the Cleveland Clinic. He has completed a tour of duty in the US Public Health Service and has written more than 170 peer-reviewed papers and 100 medical chapters, filed 14 US patents, started 12 companies, served on Food and Drug Administration (FDA) advisory committees as a committee member or as a consultant to them for 16 years, and chaired an FDA advisory committee. He also co-invented a drug that is now FDA-approved.

He first became famous for developing the RealAge concept and has authored or coauthored five number-one New York Times best sellers, including RealAge and three titles in the YOU series, with Dr. Mehmet Oz. Possibly, he is best-known for being Oprah’s doctor. He has been praised for encouraginge Americans to exercise, eat healthier, manage stress, and live healthier lives. He has been an outspoken critic of politicians who use healthcare funds for other purposes, and particularly of states’ taking tobacco settlement money and using it wrongly for projects in no way related to tobacco prevention programs. Besides advocating for a healthier lifestyle today, Dr. Roizen has controversially speculated that by 2023 one of the 14 areas of aging research might see a breakthrough that will allow us to live until 160 with the same quality of life we enjoyed at age 45.

Mike wants to be sure you know that we are talking here about what may happens to hospital systems similar in size to the Cleveland Clinic. The views he expressed in preparation for this letter are his and his alone and are not necessarily reflective of anyone else's at the Cleveland Clinic.

This letter is somewhat longer than usual, but I was simply not willing to break it up into two letters. It was written to be read as one essay, and this topic is too important and timely to serve up by halves. I think you will find the conclusion thought-provoking, as we come at this issue from a bit of a different angle than you normally encounter. Mike and I welcome your comments and will read them and perhaps do a follow-up letter with our responses.

The Road to a New Medical Order

We want to make something very clear right at the beginning. The US healthcare system as it stands is dysfunctional and can no longer continue as it currently operates. With or without Obamacare, profound change is required to deal with the dysfunctionality, and that change will happen, one way or another. Obamacare is simply one method for “encouraging” that necessary change.

The US currently spends 17.9% of its total GDP on health services (http://data.worldbank.org/indicator/SH.XPD.TOTL.ZS). This figure is projected to rise in the near future by about another 1% due to the population’s aging and a further 3% due to the growing incidence of chronic illnesses. Anticipated increases would raise the nation’s healthcare costs to an unsustainable 22% of GDP, crowding out spending for other goods and services.

By contrast, the Netherlands spends 12% of its GDP on healthcare; Switzerland, Germany, France, and Canada about 11%; New Zealand 10%; Sweden 9.4%; and the United Kingdom 9.3%. As we travel through these countries, there is frequently a clear, if anecdotal, perception that people are healthier than in the US.

And the data backs up that perception. The US spends more money on healthcare because we are in fact far less healthy on average than the rest of the developed world. This difference is in large part due to poor lifestyle choices, but the good news is there are programs that have clearly and conclusively demonstrated that this difference is reversible. Changing behavior, while it will be difficult, can result in significant cost savings. In fact, changing behavior may allow us to spend more on education, social programs, and even defense.

The potential for positive change is rather spectacularly illustrated by work done by Dr. Jeff Brenner in Camden, New Jersey. Jeff was recently awarded one of this year's MacArthur Foundation grants, informally known as the “genius grants.” He is the founder and executive director of the Camden Coalition of Healthcare Providers (CCHP), an organization that seeks to improve the quality of care delivered to vulnerable populations in Camden.

Basically, he found that 1% of the patients in Camden were responsible for 30% of hospitalization costs. Sometimes called super utilizers, high utilizers, or frequent fliers, these patients have complex medical conditions and often lack social services such as transportation or knowledge about how to use the health system most effectively. By some estimates, 5 percent of these patients account for more than 60 percent of all healthcare costs. This is a system that is so dysfunctional that it does not even work for those who are getting the care! CCHP has been able to lower costs in a prototype program by proactively working with these high utilizers prior to an emergency event. There are scores of such opportunities throughout the healthcare system to reduce costs and improve services, so we write not of a bleak healthcare future, just a profoundly changing one.

We Are Changing the Health Care Plumbing

Perhaps the best way to illustrate the problem is by means of a rough analogy. Let’s imagine an older, 50-story office building in a big city. New office buildings have grown up all around it, and the business tenants are beginning to vacate. Because of the lower rents available to individuals, people have started renting space and converting it into apartments. But as is typical in office buildings, there are very few bathrooms and no showers to speak of, so residents rework the plumbing to provide bathroom and kitchen supply water and drains for their living spaces. On a small scale it works. One floor after another soon converts, until the building is now an apartment complex.

But at some point the plumbing becomes a huge problem. Not everybody can get enough water at the same time; sewage backs up on some floors at inconvenient moments; and if someone flushes a toilet, someone else gets scalded by hot water in the shower. Depending solely on where you live in the building, you may have access to much better service, while others get none. Because of the plumbing problems resulting from poor infrastructure, many of the apartments no longer receive adequate water or get it only on an emergency basis and at great expense and trouble.

The cost of maintaining the system becomes significant, so the residents get together and decide that the building must have a completely new plumbing system. No one wants to keep the old plumbing, but everyone has a different idea about how to go about creating a new system and what it should accomplish and how much it should cost and who will pay for it. Do you do one floor at a time? All the kitchen sinks at once? And can there be different sinks, or must one type fit all? Do you separate the water for the toilets from the potable water?

In a very contentious vote, the occupants of the building narrowly decide on a plan that requires all of the plumbing in the building to be changed simultaneously. Walls will be knocked out, and new pipes and equipment will be installed. The new system is going to be a marvel of technology and efficiency, but the process has the potential to be very messy, as the all-too-human occupants will be going about their day-to-day business in the midst of the construction. They will need fresh water and sewage disposal even as the plumbing is being reworked.

The United States, by analogy, is changing the plumbing of its healthcare system. In describing the plumbing changes, we will focus primarily in this letter on the financial aspects, and specifically on money flows from patients to providers and from providers to their staffs. How do we go about paying the doctors and nurses and covering other hospital costs? As it turns out, a more efficient system will mean that each apartment (hospital) will actually get less water (money) and will have to organize itself to deal with that.

Again, the fundamental changes that are necessary in the US healthcare system are going to happen with or without Obamacare. The system is simply dysfunctional. ACA is just accelerating the process. With a few noncontroversial (we hope) exceptions, we are not going to be making suggestions about what to do to improve the healthcare system or the new healthcare law. The following is simply an analysis of the economic and business challenges that will occur as a result of the Affordable Care Act as it is currently understood. This is the business reality that hospitals all over America face, not just the Cleveland Clinic.

First, we want to acknowledge one real caveat. As you read the requirements that are going to be forced on the Cleveland Clinic, it might be very easy to assume that many hospitals are not going to be able to make the necessary changes, given the history and difficulty of making major changes in the medical care system. The challenges, as you will see, are quite daunting. However, there is an alternative view to despair.

I was reminded by Jack Rivkin at a dinner in New York of a similar problem in our nation’s recent history. As we approached the opening of the new millennium, there was great concern about the so-called Y2K problem. Computers were simply not designed to deal with the changeover of the date, and many legacy systems had to have massive upgrades. Given the observable historical fact 50% of major software updates are not completed on time (and that this had been the case for 40 years), it was not unreasonable to be concerned as to whether every provider of important services would in fact be ready for the year 2000.

January 1 came, and we held our breath, and sure enough, not much happened. It was business as usual. It was just as my good friend (and former Libertarian presidential candidate) Harry Brown told me in a 1999 conversation in New Orleans: “John, it won’t be a problem. Each company will solve their own problem, and they will get it done on time, given the cost of failure. That’s what a free market system does.”

Hospitals and doctors are going to be required to make significant adjustments to their operating budgets and methodologies for delivering medicine. If they ignore the problem, they’re going to be dealt a rude awakening. But just as with Y2K, this is a problem that we can see coming. It is not a Black Swan. Perhaps most, if not all, healthcare organizations are making plans in the same way that the Cleveland Clinic is. We can only hope.

We agree that a successful outcome is probable over time. Our concern is that the transition may be messy and economically disruptive for a limited time. We offer the following analysis as information to be considered rather than as a prescription for a solution for healthcare delivery.

First, we will give you a brief summary of the problem.

Over the next five years we will go from volume-based reimbursement in medicine (based on the number of procedures or patients a provider sees) to a value-based system (being paid the same amount per patient no matter how well or sick she is, so the goal will be to motivate people to stay healthy). This change will result in lower hospital income even as we treat more patients. We will need to redesign the flow of patients to accommodate a different set of insurance reimbursement rates, and there will likely be a three-tiered care system much different from today’s current system.

Whether this transformation plays out in the way we outline below or in a very different way will depend on the interaction of several opposing forces: (1) labor shortages for skilled positions and the need to retain skilled employees, (2) pressures on corporations to lower costs despite the need to keep skilled employees, (3) an excess of chronic disease and a lack of triggers to motivate employees to live healthier lives, and (4) the push to a predominantly one-payer insurance exchange (Medicaid-like reimbursement) program.

Thus, what is certain is that more people will be cared for and at a lower cost. What is not certain is the degree to which employer-based insurance will change in light of a shortage of highly skilled employees and a large increase in the number of less-skilled employees in the general workforce of the United States. If you are an engineering firm and you are having trouble finding trained and skilled workers, and your competition offers health insurance, then to be competitive you also need to do so. Businesses that use less-skilled labor will likely not offer full health coverage. As we see with each passing week, more and more firms are moving their employees onto the new healthcare exchanges and providing a subsidy for individuals to purchase their own coverage, controlling costs that way.

There will probably also be a shortage of skilled medical providers. These shifts will occur irrespective of Obamacare but will be greatly influenced by it.

Specifically, there are five major cost-pressure factors that will affect Cleveland Clinic and other hospital organizations:

· The overall cost of medical care and the increased incidence of chronic disease

· Cost transparency and reference pricing

· Increased government role in paying for care

· Increased coverage (Forty million more people will be covered nationally, at reimbursement rates below the cost of providing that care.)

· Limited highly skilled medical workforce

Let's take these in turn.

1. The overall cost of medical care and the increased incidence of chronic disease: In 1960, the US spent 5.2% of GDP on medical care. By 1970, medical care claimed 7.2% of GDP, and its slice of the pie continued to widen, to 12% in 1990, and to around 17.5-18.5% now. While improved technology, specialized treatments, and the overall increased medical care required by our aging population have contributed to these increased costs, so has the increase in chronic disease, with, for example, the incidence of hypertension growing from 3% to 10% of our population over the last half century, type 2 diabetes from 2% to 10%, and obesity from 10% to 28%. This prevalence of chronic disease and the spending it requires makes the USA less competitive with respect to jobs and decreases our ability to fund social, educational, and even defense programs. Over the next six years, the projected increase in chronic disease stands to boost medical costs another 3% of GDP (if cost per process remains constant), and the aging of the population is likely to account for an additional increase of 1% of GDP. This trend, if allowed to continue, would clearly crowd out other spending options and weaken the rest of the economy.

2. Cost transparency and reference pricing: A hospital system like the Cleveland Clinic currently bills about $18 billion for medical services and collect around $6 billion. (We do not know the exact numbers for the Clinic.) It costs such a system around $5.5 billion to provide all the services, and thus they are able to invest $500 million in plant, equipment maintenance, and new equipment at the Clinic. An institution like the Clinic gets this revenue by collecting from Medicare about $0.23 on the dollar billed, from Medicaid about $0.18 on the dollar billed, and about $0.38 on the dollar billed for the aggregate of commercially insured patients. We are sure this seems bizarre to someone from outside the US, and actually it does to us, too, but it is the way the system has evolved.

As medical costs become more transparently evident and reference pricing (see below) becomes more popular, commercial insurance providers will continue to demand prices closer to those paid by Medicare. (In Florida, for example, a branch of the clinic already collects at Medicare-level rates for commercially insured patients).

The present three-tiered U.S. medical insurance system is composed of concierge care (typically a flat fee for super-quick access to a medical professional and/or someone to help you navigate the healthcare system) for 1.5% of the population, a Medicaid system that 5 to 15% of the population uses, a Medicare system that 40% of the population depends on now, and a commercial system that 35 to 42% of the population uses. (About 15% are now uninsured.)

In order to plan and develop a budget, you could logically forecast that by 2015 the number of Americans utilizing concierge care will decrease from 1.5% to 1% (as Cadillac plans are taxed), the public using Medicaid or insurance priced to pay at Medicaid rates will increase from 5-15% to 23%, Medicare use will remain about 40%, and lower-cost commercial plans will cover 35% of people, down from 42%, and reimburse the Clinic at just $0.32 on the dollar (vs. the $0.38 they now receive). You can find different forecasts, but for our purposes, given that this is a guess about the unknowable future (see more below), this is about as educated an estimate as we are likely to find.

We can forecast that by 2018, perhaps 5% of Americans will be able to choose (that is, to afford) concierge care, 75% will likely be utilizing insurance exchanges that represent a public Medicaid-Medicare model, and 20% will be commercially insured by corporations, reimbursable at $0.26 on the dollar (vs. the present $0.38). It is likely that traditional insurance will be used as an employee retention/recruiting tool, but even traditional insurance will become far more cost-conscious. The move to insurance exchanges is an economic one for business and governments.

The drivers and contra-drivers for the percentages of each dollar billed will remain access to care and whether a business can afford to and wants to retain its super-key employees. In a 100% low-cost hospital push necessitated by Medicare and insurance-exchange reimbursement, we cannot forecast with certainty what will happen with fewer doctors and nurses. Businesses, for their part, will struggle to retain limited-skill employees and to ensure that employees have good access to medical care.

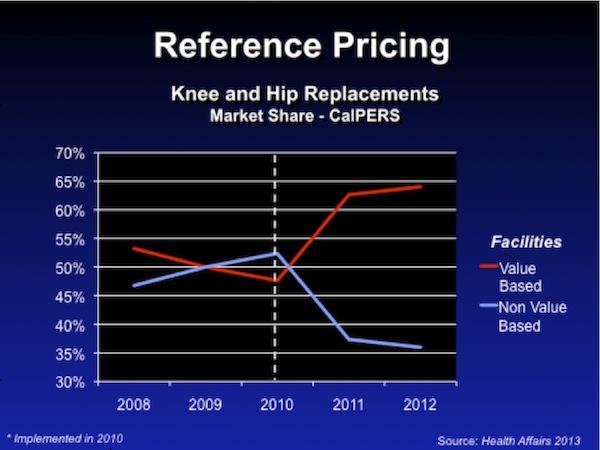

An article in Health Affairs indicates that in California the CALPERS system, the largest state-run health insurance provider, has gone to reference pricing in some areas – CALPERS gives employees $30,000 for a total hip or total knee replacement and lists the hospitals that charge less than that. Virtually all academic medical centers (those that provide care for the sickest, and those that train our future doctors, nurses, pharmacists, dieticians, etc.) fall into the high-cost group, and their share of the CALPERS patient population that has hip or knee replacements has gone from 54% to 35%, while the share for low-cost hospitals has climbed from 46% to 65%. (Only one high-priced group hospital in California converted to a low-cost group hospital in the past three years.)

3. An increased government role in paying for care: The third major cost-pressure factor that will affect hospitals is that the government, which in 1990 paid for 20% of patients through Medicare and 10% through Medicaid, is now paying for about 60% of their patients. As this percentage grows, the government's take-it-or-leave-it prices (at $0.23 on the billed dollar for Medicare and $0.18 for Medicaid, depending on the state) mean that they will all have to find a way to reduce their costs to $0.23 on the dollar billed, a 30% reduction from the average of $0.33 they now collect, just to break even – that is, without any money to reinvest in plant, equipment, or new procedures. This means that hospital systems like the Cleveland Clinic have to find a way to reduce their costs by approximately $1.6 billion over the next four years as these expected changes occur.

4. Increased coverage: 40 million more people will be covered nationally, at a reimbursement rate below our cost. The Health Care Reform Act will extend coverage to 40 million more people. As a result, all hospitals will likely see more people, mostly pediatric patients or those who did not have insurance in the past, and will be reimbursed, for the most part, at a level below the current rates. This increase in patients will not allow most hospitals to cover even the current variable costs of their services. This is the same issue that will be facing the hospitals in your neighborhood.

5. Limited highly skilled medical workforce: The increase in the number of patients hospitals serve and a reduced reimbursement per patient will mean that hospitals need to re-engineer care in ways that impact personnel.

The prediction is these hospitals will be paid approximately 5% fewer total dollars next year and 25–35% fewer dollars in 2018, while treating a growing number of patients. Since more than 60% of their costs (in many institutes the figure is more than 80%) are for personnel, we either have to find ways to do things more efficiently, that is with fewer personnel to do the same amount of work (for example, as the Center for Integrative Medicine has done with the shared medical appointments for acupuncture or with the shared TrimLife Program); or to do things in new ways (to re-engineer care), as in the Lifestyle Medicine Program; or to do things with less-expensive personnel, for example, by substituting a medical assistant for a physician or nurse in some processes where a physician assistant is equally capable of doing those things.

An example of these savings is a potential program for dealing with low back pain. Low back pain is one of the two most common problems seen in most medical centers and at the Cleveland Clinic. For the first three to six weeks after the onset of low back pain, being cared for by medical personnel with limited training will generate the same result as being cared for by an extremely skilled surgeon – that is, conservative therapy, involving at most non-steroidal anti-inflammatory drugs, works in most cases to help patients get better. No imaging or other procedures are needed. Further, it should be noted that no opiates will be prescribed for the first three to six weeks while the patient implements a treatment program of non-steroidals and exercise.

Thus, instead of having the patient seen by any one of five different physicians – a family practictioner, internist, pain management specialist, spine specialist in medicine, or spine specialist in orthopedic or neurosurgery surgery – those patients will now all go to a physical/occupational therapist who will teach them how to do exercises progressively and if possible put a system on their smartphone that will alert them every four hours to do the exercises.

The patient will indicate in that smartphone app that she did the exercises, and the physical therapist or practice office will respond in some automated fashion to the patient's responses. Eventually, people who do not get better using that conservative therapy will receive imaging studies, but 40 to 60% of the currently ordered imaging studies will be eliminated. Further, instead of a system the size of the Cleveland Clinic having 14 spine surgeons and 8 anesthesiologists and 22 operating room nurses to meet those needs, it will end up with several fewer spine surgeons, anesthesiologists, and OR nurses for the same volume of patients. Such a system will transform services, so that not everything is available everywhere. This approach will result in lower personnel costs and a lower cost to treat low back pain – but will the public be accepting of such changes? Anecdotally, as we ask our audiences how receptive they will be of such a process, the universal answer seems to be “not very.” If that is your answer, you may need to pay for concierge insurance.

There is another option in reforming the system, and that is to reduce the incidence of chronic disease. Since 70% of our healthcare costs are occasioned by the abuse of alcohol and other substances (especially tobacco!), physical inactivity, poor food choices and overly generous portion sizes, and unmanaged stress, we could avoid a substantial fraction of these costs if people had better incentives to make lifestyle changes and were able to change their behavior.

There are many potential triggers to get this done in Obamacare, and some corporations are using these triggers on their own. For example, the Cleveland Clinic has gone from a 9% yearly increase in costs to actually decreasing per person costs of Medical care for their own employees this year by reducing the incidence of new chronic disease in their caregivers from +10% a year to -2% per year. This innovation and change did not happen overnight but took years to develop. As an example of such transformations, the 43,000 Cleveland Clinic employees have lost over 400,000 pounds by using a variety of programs.

The problem for the immediate future is that it is unknown whether this transformation in healthful human behavior will occur quickly enough, or whether most corporations and the government understand the process of motivating people to make lasting changes well enough, so that wellness programs can supplant the alternative model of changing the insurance system.

But make no mistake, there are a substantial number of corporations that will use wellness programs to drive down medical costs and thereby have an advantage in retaining employees with key skill sets (the very employees who will be in short supply). These companies will be able to recruit better employees because they have figured out how to use wellness programs to drive down healthcare costs and increase employee satisfaction and engagement.

Implications for Provider Organizations

The Cleveland Clinic is now financially strong and believes it is able to innovate and move more nimbly than most of its peer organizations. Hospitals and other healthcare providers everywhere are faced with the same challenge and opportunity. This could be their time to thrive if they respond to the challenge.

But it is no small challenge. The Cleveland Clinic will have to reduce overall costs 5-10% (average 8%) per year for the next four years. That is no small feat. They have been taking roughly 2.5% per year out of their cost for supplies, and this supply-cost reduction bucket is largely exhausted. They will now have to re-engineer and reorganize what they do, since personnel is their largest cost.

What will happen overall to medicine? Healthcare providers will have to reduce the cost per procedure and/or the cost per person delivering the procedure, or reduce costs by reorganizing and recrafting how care is given, with the same number of people doing the same or greater amounts of work (as in the low back pain example above).

But we have been able to be efficient and then be more efficient for years in a variety of industries. Healthcare should not be an exception to American ingenuity, as the story about the Camden, New Jersey, doctor above illustrated. There is every reason to believe that we can meet this challenge.

Going back to the comment by my friend Jack Rivkin that this is just like Y2K, I would agree – except for one huge caveat. Y2K was a very known problem. In one sense it was quite straightforward. See that software is broken: fix software.

The Cleveland Clinic and other hospitals around the country are recognizing that their revenue is going to go down, and they are planning responsibly. That is the known part of the problem. The concern here is the unknown part.

How many young people will sign up on insurance exchanges the very first day they are open for business? How many of them will wait until they have an emergency, walk into the hospital and sign up, get free service for 90 days, and then neglect to pay their insurance premiums? While the insurance company is responsible for the first 30 days of billing, the hospital is responsible for the next 60 days. Hospitals currently have to write off a great deal of emergency medical care. Will the future percentage be roughly the same? Less? More? We don’t know.

Think everyone who does not currently have insurance will be covered? Think again. The New York Times writes:

A sweeping national effort to extend health coverage to millions of Americans [later estimated to be 8 million] will leave out two-thirds of the poor blacks and single mothers and more than half of the low-wage workers who do not have insurance, the very kinds of people that the program was intended to help, according to an analysis of census data by The New York Times.

This failure of coverage is primarily due to the variations between states, as government coverage begins at different income levels in different states (26 states having rejected the expansion of Medicaid funded by Obamacare). The very people who cannot afford insurance today are likely to sign up for an exchange only when it is absolutely necessary. Their costs will not be covered by the government.

Hospitals will have fewer employees (the Clinic is accomplishing this through early retirements and care transformation this year) and/or lower-cost employees (employees practicing close to the limits of their licenses), since if they suffer the expected 25-35% reduction in real income and simultaneously treat more patients without redesigning their systems, each employee would need to be paid 40% less. Whatever way the Clinic and other hospitals go, the net result will be a lower-cost system. This reduction is clearly needed and will benefit society. But the transition may be very difficult.

While there will be a growing long-term need for more healthcare workers, during the transition period it is quite possible that significant numbers of health workers will find themselves unemployed. And while they may be able to find new jobs, the may also receive lower pay.

If you reduce the revenues of 18% of the economy by 6 to 8% every year for 4 years, you are forcing a reduction of about 1.4% of GDP over the entire economy. Admittedly, this money will eventually be freed up to go elsewhere, but it is the short term that is the concern. In an economy that is growing at not quite 2%, what would be the effects of such a reduction in employment and revenue? The cost reduction has to come from some portion of the economy. Fewer bandages? Cheaper medicines? One organization's cost reduction is another organization’s lost sales.

Further, it is fairly evident that the US has too many hospitals and that one of the outcomes of cost savings and reorganization is that some hospitals will simply have to shut down and/or consolidate. What happens to those workers while they are looking for jobs? Will this reorganization happen slowly, or will cash-flow concerns become readily apparent in the third quarter of 2014, forcing drastic reductions in hospital staff and/or pay? There is simply no way to know until we get there. Reducing the redundancy in the system may be good for the overall system, but it is quite difficult for the individual participants who are part of the reduction.

All sorts of models can be built to make projections, but there are just too many variables that are functions of human behavior. All such models are significantly dependent on assumptions, and when we are talking healthcare, all too often those assumptions are made on the basis of a political bias. One can create models that predict the end of the world scenario, and with a different set of assumptions it is possible to predict a future of no worries.

As they confront healthcare changes and costs, companies will have to balance their need to retain highly skilled employees, whose availability may be limited in a declining workforce population, with their need to strategically deploy the skills of lower-cost employees who are not in short supply. How the transition in healthcare will affect companies that provide health insurance to their workers will depend on that balance. Success in motivating employees, through various initiatives both in and outside the workplace, to adopt healthier lifestyles and thus prevent chronic disease will also be very important.

While Obamacare incorporates many potential triggers that would accelerate incentives for wellness, it is not clear how quickly these will be deployed. It is also not clear how great an effect the technology revolution will have on increasing the currently limited supply of skilled employees or, conversely, making them less needed. The implementation of technology is uncertain not just in medical care.

Clearly, in medicine, the new smartphone applications that will teach patients how to manage their own diseases will play a major role, but how great a role they will play in the shift from highly skilled provider visits to relatively less-skilled provider visits? How fast that shift will occur will be determined by how well relevant technological advances are accepted. For example, will all taxis in New York City really turn into Google Cars with nobody driving them? Will you get into one the first year they are available? If you are given a smartphone application instead of a visit with the doctor, how happy will you be, even if your outcome is better (with lower risk of adverse effects) and your radiation exposure is less? Just asking.

On the business front, competitive cost pressures will affect the resources that companies can devote to healthcare. The simple budgetary fix of putting your employees on a healthcare exchange has proven to be extremely tempting to many corporations – Walgreens, Trader Joe's, etc. And given that businesses have responded to Obamacare by increasing the number of part-time workers in order to avoid a few thousand dollars per employee in health insurance, how likely is it that they will respond to the other budgetary incentives available?

It is likely that the overall dollar inputs to medical care will decrease, while more patients will be accessing the system. There will be more first-line and second-line providers, fewer nurses, and fewer doctors in the future for the average person. As the dollars spent per patient falls, innovation at the individual patient level, education, and research will be threatened; and in the system as a whole we will either have less money per provider or fewer providers.

To put that in perspective, these are not small changes, as a system like the Cleveland Clinic will go from a system that now creates revenues of $6 billion a year to a system that is reimbursed around $4.4 billion for the same services; and other institutions are probably somewhere in that range of revenue reduction.

While the Clinic can predict that their income and costs will change and that the $1.4 billion reduction is the most minimal shift they believe will occur over five years, they cannot predict the real extent of the transformation. That will be dictated by the balance between the number of companies opting for lower-cost insurance programs because they have excess employees available versus the number of companies that will need to continue to attract employees that have skills in short supply, so that they will need to pay premiums for them, including health insurance.

We think that a three-tier system will evolve, consisting of (1) concierge care, (2) Medicaid-Medicare-model insurance exchanges, and (3) a system like Great Britain's of private insurance for the employees of a minority of corporations; and it is possible there will be much pain in getting from the current state of affairs to what our healthcare system will become by 2020 or 2024. This momentous shift has the potential to heighten perceptions of an income divide in our country, and we expect these healthcare economic issues to be quite contentious in the coming years.

When I am asked what keeps me up at night about our economy, my ready answer for the past few months has been the unknown transition costs associated with the ACA. I hope Jack Rivkin is right and that the transition to Obamacare proves to be just another Y2K. I truly believe that healthcare will be significantly better in 10 years, largely due to advances in technology, but also as we streamline our healthcare delivery. So I’m a long-term optimist, though I have to confess that, in the short term, which would be through the last half of 2014, I am quite concerned that dislocating 1 to 2% of the economy could be enough to push us into recession. I have nothing factual to base that on – no inverted yield curve, no evident bubble getting ready to burst – so I will stop far short of a prediction. Let’s just say that these issues need to be right up front on our radar screens. And it wouldn't hurt to keep our fingers crossed.

I must also note that after a few years there will be a massive tax increase on the middle class as all the costs of Obamacare kick in. Yes, you get healthcare in return, but this still rearranges consumer spending patterns. Again, you can create models that will yield any results you find politically and philosophically appealing, but in a few years the truth will out. When Obamacare was being first proposed, I and others criticized it as a giant incentive for businesses to move staff from full-time to part-time work. We were told that we did not understand how business worked and that it would not make any major difference. It does not give me any pleasure to note that we were right. That does not mean that those of us who are concerned about the unintended incentives embedded in the ACA are necessarily right about the future. One correct observation does not qualify you as an infallible prophet.

I really have tried to keep my personal political concerns out of this letter. I also understand the need that people lacking insurance have for healthcare in a country where healthcare is outrageously expensive. Within the last few years my oldest son, Henry, has developed type 1 diabetes; my middle son, Chad, has suffered a lung collapse while at work; my daughter Melissa has had thyroid cancer (with no insurance!); and our family has seen multiple childbirths with their related costs, all too many visits to emergency rooms, and so on.

Healthcare is easily the most contentious issue of our time and will become even more so as entitlement costs spiral out of control. There are no easy answers, and all too many of our political leaders in both parties are seemingly unwilling to confront the issue, paying only lip service to the need for change. Procrastination makes for terrible future policy decisions.

On a totally coincidental note, my team at Mauldin Economics has almost completed a new video webinar called Science Saves the Future. It will air on October 16, and you can sign up here to watch it for free.

The editor of our new Transformational Technologies Alert, Patrick Cox, and I will cohost this webinar. We'll interview our friend George Gilder, along with other major biotechnology experts, to shed light on the transformation that is about to overtake our world. If our healthcare transition keeps me up at night, the biotechnology transformation that is arriving on our doorstep gets me up and going in the morning. This new service from Mauldin Economics has me totally psyched up. We have been planning this for a very long time, and now that the launch is here I feel like a proud father. While the creation of this prodigious infant happened through the very hard work of our whole team of associates, I at least had a small part at the beginning, and I get to be responsible for its care and feeding as it grows up.

Will You Still Need Me, Will You Still Feed Me, When I’m 64?

I finish this letter in Tucson, Arizona, where I am speaking this weekend at the Casey Summit. The highlight of the weekend will be dinner tomorrow night with my friend Ron Paul, who as a doctor has his own personal take on healthcare. Conference organizers have also invited several experts on healthcare to discuss the issue. I plan to attend all those sessions.

I was only 18 when the Beatles recorded “When I’m Sixty-Four” on the album Sgt. Pepper’s Lonely Hearts Club Band. As I’m close to the same age as Paul McCartney, who originally wrote the song when he was 16, I wonder if he was as clueless then as I was about what it would be like to actually be 64. A bit of Beatles trivia: the track was actually sped up a bit faster to raise the key a semitone to D-flat, because McCartney thought it would make him sound younger and was closer to the sound he wanted to have.

I’ve been getting calls and texts from family and lots of emails from friends wishing me a happy birthday. It’s a little bit of an odd feeling to think about being 64, because I still think of myself as no older than 30-something. But there have been a lot of memories packed in over the decades, so I guess it must be true. And if Mike Roizen is right, I may get to pack another hundred years of memories in alongside what’s already there. It’s been a fun ride so far, if a tad strange here and there.

My partners David Galland and Olivier Garrett will be throwing a smallish birthday party for me tonight. A number of friends have come for the evening, including my dentist, Dr. Gary Sanchez from Albuquerque. I’m going to attempt to play golf tomorrow morning with him – or at least something approximating golf.

The Barefoot Ranch, New York, and Code Red

I fly back Sunday night to a full schedule on Monday. Anatole Kaletsky is flying into town, and we will have dinner Monday night before we head off the next day to the Barefoot Ranch near Athens, Texas, to join Kyle Bass and his friends at the Barefoot Economic Summit. My partner Jon Sundt of Altegris Investments will be with us for two days of feasting on macroeconomics, investments, and Texas hospitality and food. It’s a pretty free-flowing discussion, and I always learn a lot when I’m with Kyle. And I’m sure Jon and I will take the opportunity to scout out a few more funds for our platform. It’s that kind of an event.

Later in the month I will return to New York, where we will launch my new book, Code Red, co-authored with Jonathan Tepper (who also co-authored Endgame). The book is about the runaway effects of post-Great Recession central bank policies and the very serious currency war that was kicked off in a big way by Japan this year and is likely to dominate the global economic landscape the rest of this decade.

And finally, let me offer you one last link. It was sent this by a friend who is aware of my eclectic musical tastes. This is from last December at the Kennedy Center Honors Ceremony in Washington, DC, when the rock band Led Zeppelin was honored. Of all groups, they asked Heart to play what I think is their finest song, "Stairway to Heaven." Their rendition moved Robert Plant to tears. It was one of the most powerful versions of the song I’ve ever heard, and I admit that there might have been a little moisture in the vicinity of my own eyes. Take a few minutes, turn up the volume, and enjoy.

http://blogs.vancouversun.com/2012/12/27/heart-plays-led-zeppelins-stairway-to-heaven-makes-robert-plant-cry-video/

Have a great week, and I look forward to celebrating many more birthdays with you.

Your 64 is the new 34 analyst

John Mauldin

subscribers@MauldinEconomics.com

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2013 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.