Gold and Emperors With No Clothes - From Nero To Nixon To Obama

Commodities / Gold and Silver 2013 Oct 04, 2013 - 04:54 PM GMTBy: GoldCore

Today’s AM fix was USD 1,316.00, EUR 967.01 and GBP 817.04 per ounce. Yesterday’s AM fix was USD 1,309.00, EUR 961.58 and GBP 806.63 per ounce.

Today’s AM fix was USD 1,316.00, EUR 967.01 and GBP 817.04 per ounce. Yesterday’s AM fix was USD 1,309.00, EUR 961.58 and GBP 806.63 per ounce.

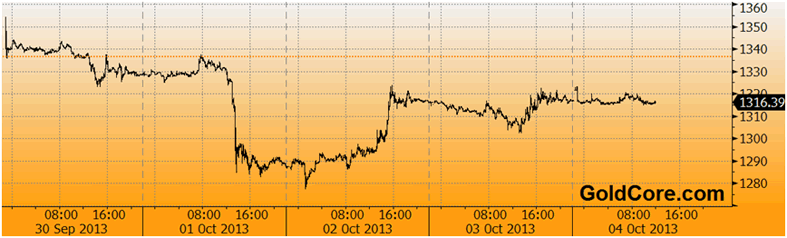

Gold inched up $1.40 or 0.11% yesterday, closing at $1,317.40/oz. Silver remained unchanged closing at $21.70. Platinum climbed $10.10 or .74% to $1,372.40/oz, while palladium climbed $3.47 or 0.5% to $700.47/oz.

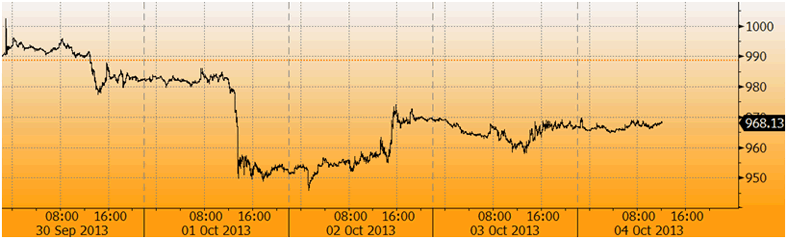

Gold traded up marginally in London as investors digested the U.S. government shutdown and the debt ceiling deadline.

Andy Smith, Independent Analyst at LBMA Rome, 2013

Gold is being supported by the U.S. government shutdown and potential October 17th default that threatens to hurt fragile U.S. and global economic growth, increasing bullion's safe haven appeal.

Some buyers are allocating to gold prior to the deadline in order to hedge potential market turmoil.Gold's 1.2% loss for the week so far is largely due to a single massive Comex futures sell order on Tuesday that quickly sent the price below $1,300 an ounce, but it quickly recovered as the budget impasse in Washington dragged on.

The COMEX paper speculators hold sway for now but physical supply and demand, the psychology of the investment public, and gold buyers internationally will dominate again soon.

With Chinese markets closed for the National Day holiday through Monday and no major U.S. data expected due to the shutdown, gold was vulnerable to another sell off last night, but it did not; rather it kept in a tight range during Asian hours and in early European trading.

Many federal agencies have stopped collecting and publishing data after Congress failed to agree on a spending bill. Federal Reserve officials said this week that the lack of data was making it difficult to read the economy and the Fed might have to keep monetary policy easy for longer to help offset the harm caused by the political fighting in Washington.

Gold in USD, 5 Day - (Bloomberg)

The shutdown of the U.S. government appears likely to drag on for another week and possibly longer.

There are growing fears in financial markets about the more significant mid-October deadline to raise the U.S. debt ceiling.

The very bad state of the debt-ceiling negotiations is leading to a re-evaluation of U.S default risk. While still unlikely, it is not now completely impossible given the degree of political tension, bickering and fighting amongst U.S. politicians.

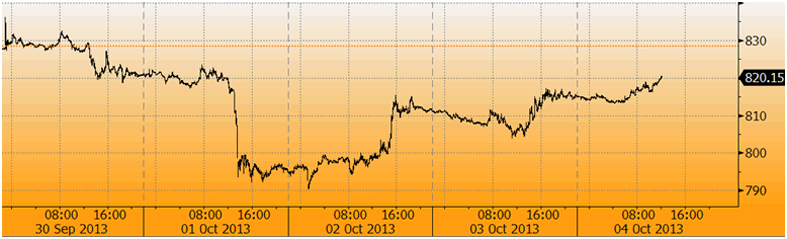

Platinum gained more than 1% to $1,379.24% due to a strike at Anglo American Platinum's South African operations. The miner said it was losing an average of 3,100 ounces of production a day.

Platinum gains may also be due to the fact that South Africa cut water supply to platinum mines in the North West province to half their usual quota, Business Day reported.

Mines operated by Anglo American Platinum Ltd., Impala Platinum Holdings Ltd. and Lonmin Plc in the Rustenburg area produce 73% of global platinum output, the Johannesburg-based newspaper said.

The North West province has been declared drought-stricken under the Disaster Management Act.

A spokesman for Impala said the government had asked mines to cut back water consumption by only 10%, according to Business Day.

Macquarie says in a report today that the Amplats strike affects about 20% of world platinum output. Global platinum mine production is about 15,000 oz a day while Amplats is losing 3,100 ounces of platinum production a day due to the strike.

LBMA 2013, the gold industry’s flagship annual international conference was held in Rome this year and was a great success with a near record attendance with over 800 delegates and 316 organisations. This included precious metal refineries, government mints, banks, central banks, pension funds, regulators, exchanges, bullion dealers, financial media and other industry participants.

We live tweeted speeches including some photos of excellent slides from the event and they can be seen on Twitter at @GoldCore and @MarkTOByrne and at hashtag #LBMA.

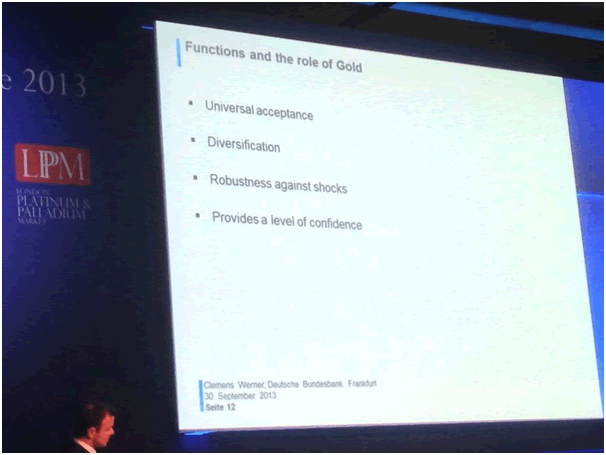

The key conclusions of the two and a half day event were that central banks continue to view gold as an important diversification and that while gold may weaken in the short term, the medium and long term gold fundamentalsare very sound.

Bundesbank’s View of Gold - LBMA Conference

There was a consensus that gold would go higher in the medium and long term and prices over $2,000/oz were cited as a strong possibility. Central banks and many participants emphasised that gold's importance was as a store of value and vital diversification in a foreign exchange, savings and investment portfolio.

The final session on Tuesday host by Brian Lucey of Trinity College Dublin was one of the most enjoyable and informative of the sessions. In it, Jeremy East of Standard Chartered Bank, Philip Klapwijk of Precious Metals Insights, Marwan Shakarchi of MKS and Andy Smith, an independent analyst gave their perspectives.

Gold in GBP, 5 Day - (Bloomberg)

Marwan Shakarchi of MKS said that he was bearish in the short term as he thinks that the Fed may start tapering soon. After this, the bull market will recommence.

The world is in a mess and governments are in a mess. China is still an emerging market and China will consume easily double to about 2000 tonnes in 2 to 3 years time - up from 1,000 tonnes today.

So, physical market demand will come back. In the long term, it is the people in the souk and the man and woman in the street in Asia that will decide the price. So, in the long term, price will be much higher.

Silver will follow gold higher and may outperform but it is more volatile.

Silver coin buyers are buying silver and putting it in the vault and they will not sell until silver rises to over $200/oz or $300/oz.

Jeremy East of Standard Chartered Bank is bearish in the short term. However, he said that people would continue to buy gold. He sees a relocation in the market with demand and influence on price moving from the West to the East.

China is slowly becoming the price setter. Asian markets are largely physical markets and people buy it for investment and as a store of value unlike the West where speculation remains more common.

China would continue its demand going into the next year. India will start soon. So, prices would rebound after seeing a correction in the short term. Fundamentals are more supportive to platinum and palladium than gold today.

Philip Klapwijk, Precious Metals Insights said that gold has further room to fall, before it stabilises. There was a large surplus of 2151 tonnes in 2012 and net demand from private sector has slumped, which is roughly estimated at 650 tonnes. Physical demand has increased although a bit.

He believes that $1,000 – 1,100/oz could be a level that gold falls to.

Perhaps most importantly, Klapwijk who has often been bearish on gold in recent years said that in the long run physical buyers of gold will be seen as wise.

Analyst Andy Smith was very bullish and he gave the most interesting, thought provoking and entertaining of the presentations. There were one or two “death by powerpoint” presentations and his presentation was in marked contract and he thus won the ‘Best Speaker’ category at the LBMA 2013.

Detriot Today

In his words, “there are ruins all around us” as he juxtaposed images of ancient Rome and today’s Detroit.

Ancient Rome

Defaulting recently on $600 million of debt due for repayment, Smith noted that Detroit only has “half the debt per head of the US national average."

He said that the US Federal Reserve's vote last week not to "taper" its current $85 billion of government purchases each month was very gold bullish. Referring to the US purchases of its own debt he said, "can you imagine what would happen if the Fed sold what it's bought?"

As the Fed's Treasury bond holdings come due, said Smith, "It will be called one arm of government forgiving another. But it will in fact be one giant step close to Weimar [hyperinflation]." Some key points of his presentation were:

- The hyperinflation of Weimar Germany in the 1920’s is coming

- Gold will be the only saviour - from a financial perspective

- Gold is a psychological market

- Retail gold investors are far more intelligent than is assumed

- Inflation is neither a necessary nor sufficient condition to push gold prices much, much higher.

- All that is necessary is a change in people’s psychology regarding the value of paper money

- India is a role model for the west when it comes to household savings into gold. That is the only social security system which will protect people in the coming years.

- The Indians are wise as they are right not to trust governments or banks to protect their wealth

- Silver will not be as valuable as gold in a hyperinflationary environment

- Government is clever enough to call wealth confiscation other names - say redistribution, welfare etc.

- Asset confiscation or ‘outright theft’ by desperate governments - including deposits and pensions is coming

Gold in Euros, 5 Day - (Bloomberg)

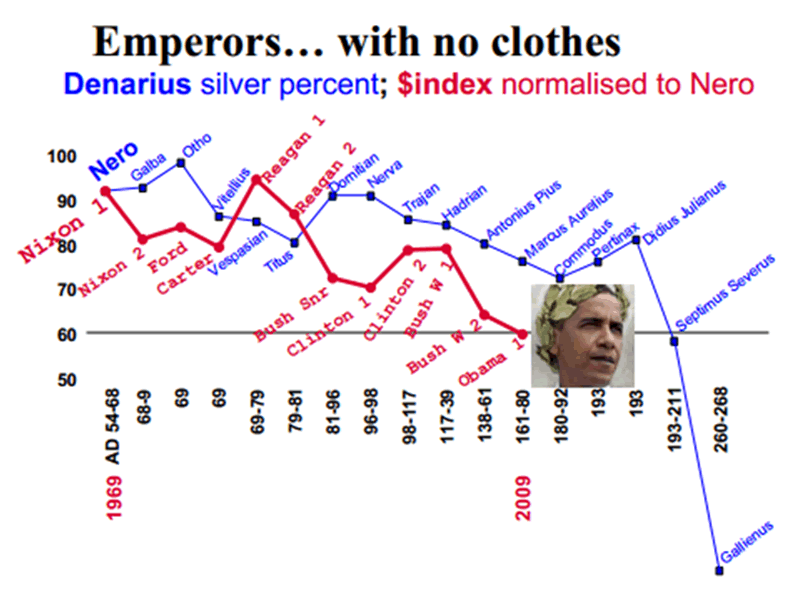

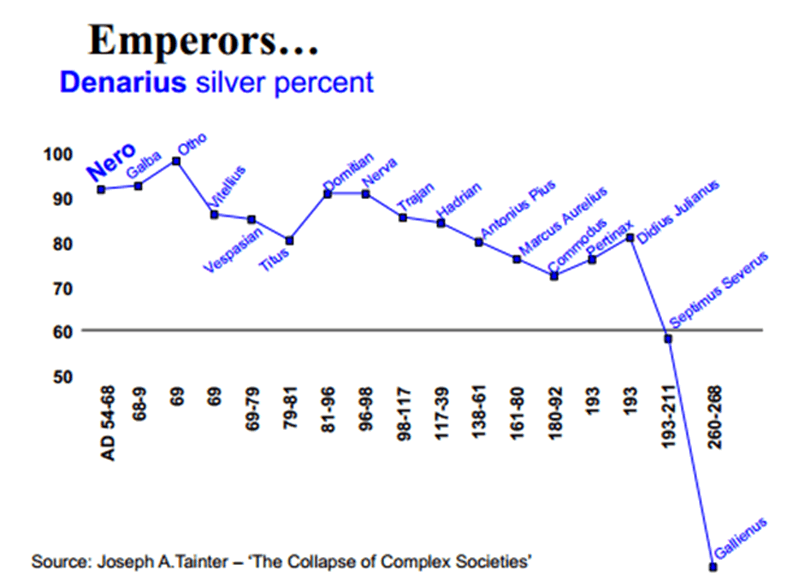

One of the biggest laughs of the conference came when Smith presented the slide, ‘Emperor … With No Clothes’ which compared how the value of the Roman denarius, silver coin and the U.S. paper dollar have fared during periods of currency debasement.

The chart (see above) shows the silver denarius since Nero and the dollar since Nixon and looked at the level of debasement during the reign of each Roman Emperor and the term of each Presidency.

President Obama, the current incumbent, is shown in Roman Emperor style with the laurel wreath, a crown, which signified the Emperor’s divinity, on his head.

Interestingly, the chart shows that President Obama’s presidency has not been the worst in terms of currency debasement with President Reagan and President Bush II being much more detrimental to the U.S. currency.

In fairness to Obama too, the debasement of the U.S. currency is due to the U.S going off the Gold Standard in 1933 and the Gold Exchange Standard under Nixon in 1971 and the ultra loose monetary policies of recent years.

Currency devaluations and debasement are set to continue in the coming years.

Owning physical gold, silver, platinum and palladium - either in one’s possession or secure allocated storage will protect people, companies and institutions in the coming years.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.