Did Greenspan Have to Cut the Fed Funds Interest Rate as Much?

Interest-Rates / US Interest Rates Apr 08, 2008 - 03:41 PM GMTBy: Paul_L_Kasriel

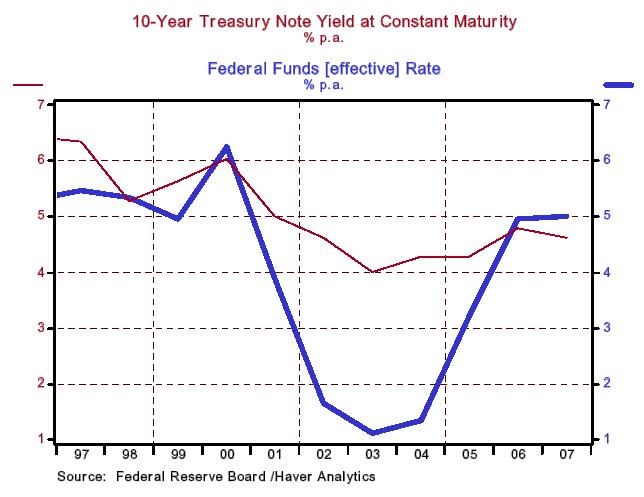

In today's Financial Times , Greenspan is generously given yet another chance to defend his legacy. Greenspan's argument that it was not his doing that set off the U.S. housing bubble reminds me of my two perfect children. When they appeared to err, it was never their fault. Greenspan's main defense lies on the fact that long-term interest rates were falling in the early 2000s due to global factors beyond his control. To start with, let's give him this one. But even if the decline in long rates were beyond his control, did he have to cut the fed funds rate - an interest rate he did control - as much as he did and hold it at the low level as long as he did (see Chart 1)?

In today's Financial Times , Greenspan is generously given yet another chance to defend his legacy. Greenspan's argument that it was not his doing that set off the U.S. housing bubble reminds me of my two perfect children. When they appeared to err, it was never their fault. Greenspan's main defense lies on the fact that long-term interest rates were falling in the early 2000s due to global factors beyond his control. To start with, let's give him this one. But even if the decline in long rates were beyond his control, did he have to cut the fed funds rate - an interest rate he did control - as much as he did and hold it at the low level as long as he did (see Chart 1)?

Chart 1

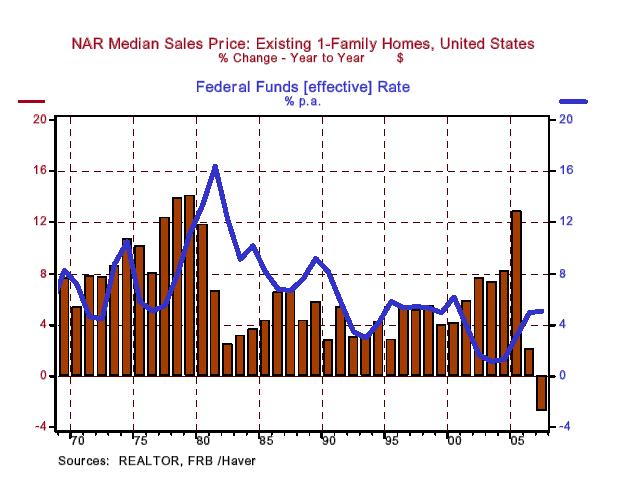

Starting in 2001, Greenspan held the fed funds rate below the year-over-year percent change in the median price of an existing single-family home, holding it below house-price appreciation through 2005 (see Chart 2). That is, the real fed funds rate in terms of house-price appreciation was negative from 2001 through 2005, establishing a record low real fed funds rate of minus 9.6% in 2005. Not since the late 1970s had the Fed allowed the fed funds rate to consistently trade below the rate of house-price appreciation.

Chart 2

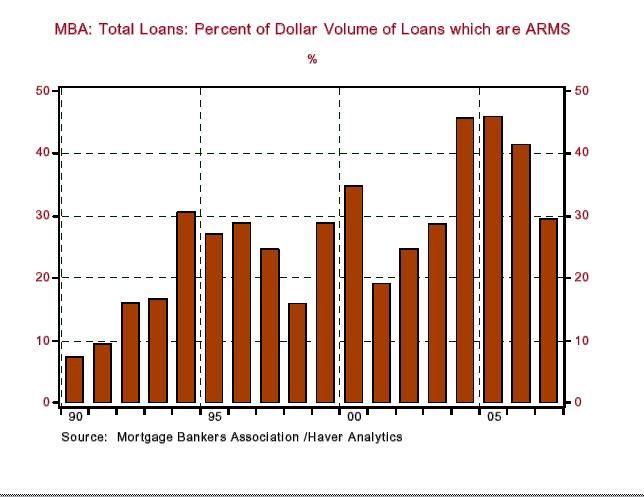

Mortgage borrowers are not restricted to 15- or 30-year fixed rate loans. If shorter maturity rates are attractive, they can opt for those adjustable rate loans Greenspan was actually touting back in 2004. Chart 3 shows that mortgage borrowers did increasing opt for adjustable rate mortgages in the last housing cycle, in part (see Chart 3), presumably, because Greenspan held down short-term interest rates.

Chart 3

Back to Greenspan's lack of control of long-term interest rates. Although bond yields do march to a different drummer than does the fed funds rate, they still "hear" and are affected by the Fed's drum beat. That is, if the Fed sends a strong signal to the markets that it intends to slash the level of the federal funds rate and hold it at a low level for an extended period of time, these fed funds rate expectations will be factored into the level of bond yields - not one hundred percent, but not zero percent, either. So, Greenspan's argument that he had no control over bond yields is not entirely accurate.

So, as a free market economist, I can only lament that one of the byproduct's of Greenspan's artificially-low interest rate policy will be to discredit the functioning of free markets and bring on more regulation. Thanks, Alan. Ayn Rand must be spinning in her grave.

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.