Government Shutdown, Debt Ceiling and Other Bullish Factors for Gold

Commodities / Gold and Silver 2013 Oct 04, 2013 - 10:34 AM GMTBy: Jason_Hamlin

The partial government shutdown that began this week is not going to have a quick resolution. Both sides of the political aisle seem to be entrenched and unwilling to negotiate. It is political theater to be sure, but there are real world consequences and investment opportunities at hand.

The partial government shutdown that began this week is not going to have a quick resolution. Both sides of the political aisle seem to be entrenched and unwilling to negotiate. It is political theater to be sure, but there are real world consequences and investment opportunities at hand.

The cost of the government shutdown is estimated at roughly $300 million per day, based on the lost wages of some 800,000 government workers. While the initial reaction of investors was to send stock prices higher, the odds of a major shock to the economy or full-blown correction increase with each day the government remains shutdown.

Q4 GDP is expected to be negatively impacted and all of this comes as the market was already on shaky footing. Employment numbers have been weak recently and the FED’s unexpected decision to continue their $85 billion per month QE program failed to light a fire under equities. It has been reported that the BLS may not be able to report employment data this week, but the initial ADP jobs report came in below forecast.

The government shutdown will likely increase the annual budget deficit. The loss of tax revenue from the masses of furloughed workers, coupled with the cost for agencies to implement the shutdown, will likely put upside risk on the budget deficit this year.

The Impact on Gold

In a counter-intuitive move, gold and silver prices have declined in the two weeks following the FED’s decision not to taper. Most analysts agreed that significant FED tapering was baked into the sharply lower prices for precious metals, yet the news of no tapering failed to generate a rebound.

Adding to the bizarre price movements lately, stocks advanced 1% and gold prices declined sharply the day after the government shutdown was announced. Investors somehow interpreted the news as bullish for stocks or perhaps it was simply sell the rumor, buy the news.

Short-term price movements aside, the budget battle and debt ceiling debate are highlighting the fiscal weakness of the U.S. government. Even the President has warned Wall Street of the potential of a first-ever U.S. default on its debt. I don’t think they will allow it to happen, but public discussion of the possibility is enough to raise concern. Yet, the truth is that the government defaulted on the debt long ago, via de-linking the dollar from gold and debasing the currency. They might be able to pay back the nominal amounts owed, but it will be with significantly less valuable money.

When we consider the potential of a downgrade and the chances of an increased budget deficit this year, one would assume the impact would be bearish for the U.S. dollar and bullish for precious metals. Yet, both gold and silver have dropped to their lowest levels since July this week.

Many suspect that the banks are using leveraged paper trading to push down the gold price and re-inforce faith in their fiat funny money. Whatever the reason for the decline over the past few weeks, I think current conditions present an excellent buying opportunity in precious metals. The following charts paint the bullish case…

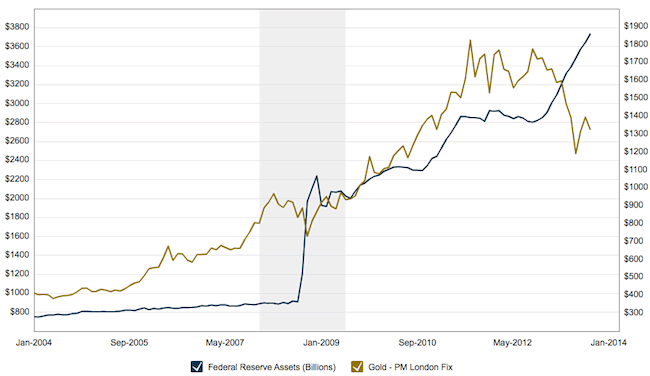

The first chart (courtesy of macrotrends.net) shows the gold price versus the FED’s balance sheet. The two are usually highly correlated, but you will notice the recent divergence that has developed. The balance sheet of the Federal Reserve has continued to explode higher fueled by the $85 billion/month in QE, yet the gold price has declined. Look for the gap between these two lines to close as gold climbs back towards previous highs in the coming months.

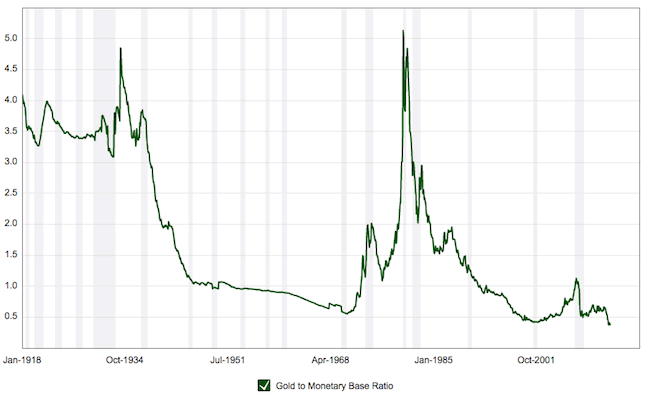

The second chart shows the ratio of the gold price to the monetary base. The two huge spikes toward 5 mark the tops of the last two major bull markets in gold. Notice how this ratio has barely climbed above 1 during the current bull market, suggesting that gold has much higher to climb in order to account for all of the money that has been printed since the financial crisis.

While I advocate holding physical metals in your possession first and foremost, mining stocks are likely to offer significantly better returns during the next wave higher. This is because gold and silver miners, relative to their underlying assets, remain at the most undervalued levels since this bull market began. As precious metals climb back towards their all-time highs, look for leveraged gains from quality mining stocks, many of which need to triple or quadruple in price to return to their previous highs.

The chart below shows the ratio of the HUI gold mining stocks index to the price of gold. As you can see, mining stocks are the most undervalued they have been since the start of the 12-year bull market. Part of this can be explain by rising input costs compressing profit margins. But most of the best-in-breed miners have been reducing costs as of late, while increasing production. Once prices begin moving higher, their profitability will rebound and the leveraged gains will be powerful. This highlights the growing importance of being very careful and selective about which mining stocks you buy.

When the realization sinks in that continued QE at $1 trillion per year, the potential of a default on U.S. government debt or ratings downgrade, increased deficits and desperate measures to pay the bills are all bullish indicators for gold, prices should revalue much higher.

Of course, there are plenty of pundits forecasting that gold will drop below $1,000 in the coming months. I agree that such a move is possible, but I maintain it is highly unlikely. The correction in precious metals has run its course, both in terms of duration and severity. It has already been the longest and most severe correction since the start of this bull market. This doesn’t mean that more downside is impossible, but suggests it would be wildly out of sync with previous corrections.

In addition, prices have dropped to the cost of production which has forced many companies to shutter mines that are unprofitable below $1,300. If prices drop to $1,000 or less, miners around the globe will shut down activities, severely restricting supplies. If the gold supply declines and demand remains fairly steady, prices will quickly move back above the cost of production. The bottom line is that commodities rarely drop below their cost of production and never do so for an extended period of time.

The bull market in precious metals is far from over. Prices have yet to reach their inflation-adjusted highs, participation remains historically low, we have yet to see an exponential move higher or blow-off top as always occurs at the end of bull markets.

Any move towards $1,000 for gold will be incredibly short-lived in my estimation and will lead to massive amounts of physical buying, skyrocketing premiums and a short squeeze that accelerates the gains. There will be a growing divide between COMEX pricing and free market pricing, with shortages and difficulty finding the metals anywhere near spot prices.

Given all of the fundamental factors at play, the buying opportunity in precious metals is not likely to last much longer. Western governments continue to sink deeper in debt, the potential of a default or downgrade on U.S. debt in the near term has increased, the government shutdown looks likely to last longer than expected and tensions in the Middle East continue to simmer. Furthermore, the world is experiencing a growing distrust of Western governments, their banking masters and the fiat paper that they peddle. The Internet and alternative media are ushering in an information revolution as the establishment media loses credibility and viewers.

Gold and silver prices are not yet accounting for all of the money printing and new debt that has been created since the financial crisis. This type of delay between monetary inflation and price inflation typically lasts 5 years, suggesting that we may begin to feel the impacts in early 2014. This is also the strongest seasonal period for precious metals when the largest gains are realized.

I believe that the downside risk at this point is relatively minimal compared to the upside potential for precious metals. It is incredibly difficult to buy an asset when sentiment is overwhelmingly negative, but this is precisely how successful investors generate their biggest gains. Whether prices blast higher right away or we get more downside first, I believe you will look back on this time period as the last great buying opportunity of the current bull market in precious metals.

If you would like to see which mining stocks we believe will generate the greatest gains during the next move higher for gold and silver, click here to sign up for the premium membership.

You will receive the monthly contrarian newsletter and email trade alerts every time that I am buying or selling a stock. I never accept compensation to promote a stock and usually hold the same positions in my personal portfolio. Best of all, you can try out the newsletter and premium membership for just $39. If you find it worthwhile after the first month, you can switch to a yearly membership at just $25/month. Click here to watch a short intro video or click on the newsletter to get started right away.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $25/month by clicking here.

Copyright © 2013 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.