Euro's October Seasonals and Gold Shutdown

Currencies / Euro Oct 03, 2013 - 06:44 PM GMTBy: Ashraf_Laidi

Euro rallies across the board on breaking political and monetary news as:

-

Italian PM Letta wins a confidence vote in the Senate following Berlusconi's U-turn to support the incumbent government after 25 dissidents from his party gave Letta's government the numbers he needed for maintaining majority.

ECB president Draghi resorted to the usual adjectives of monetary dynamics remaining "subdued" and inflation expectations "well anchored", without adding any particularly dovish remarks, which would have dragged down the forming euro.

Greece announced its 2014 budget with a debt deficit of less than 3% of GDP.

February 7th & Now

Unlike in the February 7 press conference when the euro hovered near 2-year highs and Draghi talked down the strong euro, there was no need to do the same at today's conference. In Feb 7th, EURUSD was up 12% from the July 2012 lows compared to only 6% today from the July 2013. Moreover, ECB excess liquidity was at € 497 million compared € 221 million today, reflecting stark improvement in credit and growth conditions.

Improved confidence over last February is also highlighted via the fact that peripheral spreads versus German 10-year yields are at least 50 bps lower than in early February.

Today, the euro is the 2nd highest performing currency year-to-date behind the Danish krone out of the major 11 traded currencies, beating the pound, Aussie and the Kiwi. Over the last six months, it is the 2nd best performer, behind the British pound.

Euro's October Sun

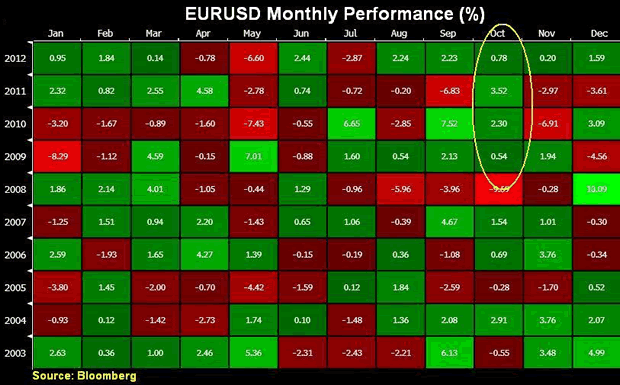

Last but not least, the euro is the only major currency to have risen against the US dollar in every October since October 2009. And in over the last 10 years, EURUSD fell only three times in October; 2003, 2005 and 2008.

Gold Shutdown

All the predictions about a government shutdown being positive for gold have not materialized. Gold sank to 2-month lows despite the implications of the government shutdown on Federal Reserve policy. If the Fed maintains its $85 bln in monthly purchases into the end of the year due to prolonged uncertainty on the federal fiscal front, then the metal is expected to benefit from persistent liquidity. But if the daily economic loss of $200 -$300 million results from the government shutdown, then the impact on retail sales going into the holiday season (Thanksgiving and Christmas) may sustain a fresh drag on inflation, especially if the shutdown lasts two weeks - until the October 17 deadline of the debt ceiling. Such a prolonged drag on inflation will not be pretty for gold.

For tradable ideas on FX, gold, silver, oil & equity indices get your free 1-week trial to our Premium Intermarket Insights here

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2013 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.