Republican Baby Budget Battle Breaks the Stock Market

Stock-Markets / Stock Markets 2013 Sep 30, 2013 - 02:32 PM GMTBy: PhilStockWorld

Told you so!

Told you so!

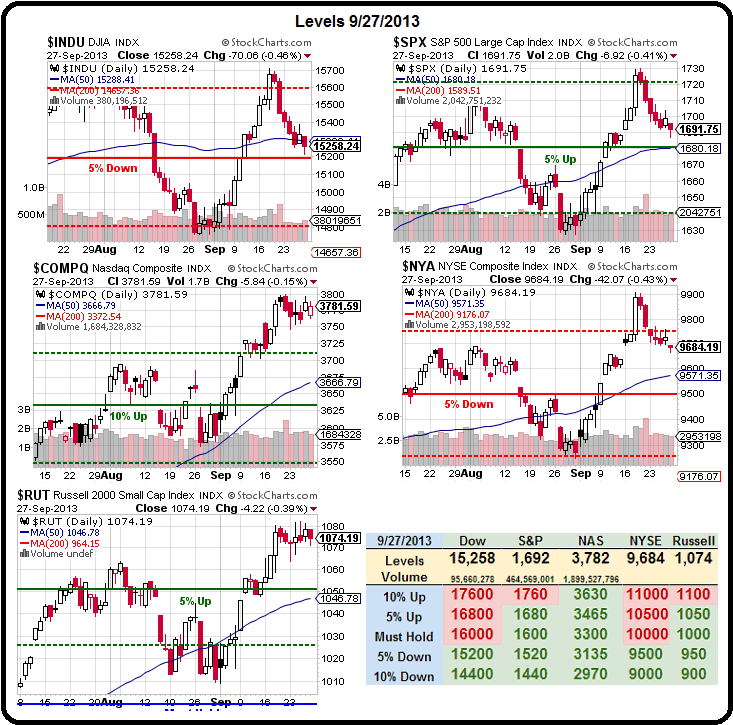

As we expected, the Futures are off about 1% this morning and down about 3.5% on the Dow, S&P and NYSE since Thursday, the 19th, when we told you to ignore the Fed rally and the painted charts and focus on the FUNDAMENTAL ISSUES that were going to drive the market lower. I also had some opinion about what to do with the new oil contract, saying right in the morning post (where even the free readers could see it):

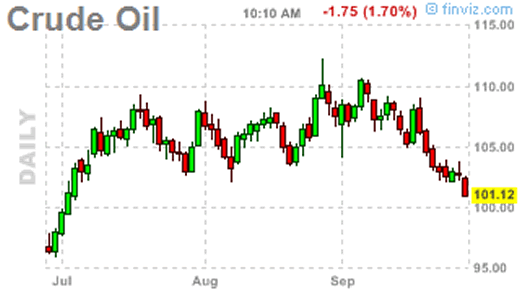

Oil shot back up to $108 on the new October contracts (/CLX3) and we shorted them in Member Chat this moring and already caught a very nice $500 per contract ride down to $107.50. Tomorrow is the last day the October contract trades (/CLV3) and there are still 79,243,000 fake barrels on contract and, if they were actually delivered to Cushing, OK next month, the US would have a 15-20M barrel PER WEEK build in inventories and prices would plunge.

That, of course, will not happen. What will happen is that the 79,243 fake open orders for October will be rolled into the already 331,304 fake open contracts for November to make it look like we have this MASSIVE demand for oil when, in fact, less than 20M barrels will actually be delivered in October, November and December in order to make it LOOK like we have a scarcity of oil in this country.

It's a con, plain and simple. It is the criminal manipulation of the energy markets in order to overcharge you for oil, and petroleum products – screwing you and your family out of thousands of Dollars each year but please – don't write your Congressmen – just continue to be a good little drone and pay the criminals. That's the American way…

That last part was, of course, sarcastic as I'm always encouraging our readers to write to Congress and our Members sometimes do and we get some interesting responses. Do we make a difference? I don't know but I do know those /CLX3 contracts fell below $102 this morning and that's a gain of $6,000 per contract and, had you shorted all 331,304 contracts 11 days ago – you'd be $1,987,824,000 richer this morning. Not bad for free advice, right? If you don't get our Daily Newsletter – I'd start here!

Of course, most people just short a few contracts but still, making $18,000 or $30,000 or $60,000 in 11 days is pretty good, right? We also shorted USO and went long on SCO (the ultra-short oil fund) for those who can only play stocks or options and even the stock made 5% on USO and 10% on SCO while the options on them have almost doubled up already (the good side of leverage!).

I wouldn't be wasting your time telling you this if conditions weren't right for more fun. Cheesy as it is, I have to say "I told you so" so you'll know I might know what I'm talking about next time I go rambling on about the oil scam and how we can take advantage of the market manipulation to make even more money as we head into the end of the year but, for now, $101.50 (this morning) is a good place to take the money and run while we wait for the day's intrigue to resolve itself.

137657 600 GOP Suicide cartoonsThat same day, aside from finding a long play on TTWO that's working well and a short play on TSLA we're still waiting for – I made an offhand comment to StJeanLuc at 1:13 in Member Chat regarding Boehner's idiotic speech that day, which was: "Boehner/StJ – I don't see how he backs off this cliff now," accompanied with this and several other political cartoons indicating my ever-so-slightly Liberal disdain for the GOP.

The next morning, also totally for free in the Morning Post (and Emailed to you pre-market at 8:30 am in our daily PSW Report to our Members) I had several ideas to short the market as we maxed out our overbought levels on the NYSE McClellan Oscilator (90), saying: "This stuff isn't complicated folks, it's just physics." Our FREE trade ideas were:

- IWM short at $107, now $106 – up 1%

- Russell Futures (/TF) short at 1,070, now 1,063 – up $750 per contract

- TZA Oct $22/25 bull call spreads at .96, now $1 – up 4%

- FAS Oct $80 calls short at $1.55, now 0.30 – up 80%

In Member chat we added the SPY Oct $171 puts at $2.05 as a Portfolio Hedge and those are already at $3.09 – up 50% in 10 days on a 3% move down in the S&P – now THAT'S how you use LEVERAGE to your advantage!

When you are able to make 50% on a 3% move in an index on your insurance plays, you only have to commit a very small amount (5% or less) to offset losses. As I often say to members, hedging your portfolio with trades like this can be better than cashing out because you don't have the friction cost of getting in and out of positions and, if you are using our "7 Steps to 40% Annual Returns" system, then leaving your positions open means you are MAKING money on your short premium sales and that pays for your insurance.

As noted in that video and as noted last week in Member Chat – one of our "7 Steps" is realizing that, sometimes, it's a good idea not to play the game and, other than our short positions that seemed kind of obvious – this seemed to be one of those times when CASH was truly KIng. Aside from the Republican idiocy in Congress today is the last day of what may be a prop job into the end of the 3rd quarter anyway, we've got a heavy data week capped off by Non-Farm Payrolls on Friday.

Already this morning we got some bad news out of China as September PMI came in barely above the line at 50.2 and that's down a point from the "flash" PMI estimate of 51.2 that gave them a boost earlier in the month as they are, in fact, flat to Augusts 50.1. There are still a lot of structural headwinds ahead, says HSBC's Frederic Neumann. "This is as good as it gets for the time being. It reflects the stimulus over the summer but don't expect too sharp an acceleration from here." Nomura's Zhiwei Zhan believes that the marginal improvement in August indicates that China's economic recovery is unsustainable, and he expects growth to peak in Q3 and then resume slowing. We chose not to renew our China play but, back in August, we liked them in our 8/21 Member Chat, as we looked over the Fed Meeting Minutes and I said:

So far, we're not even near weak bounces so we can't really read these tea leaves yet but, I think Asia will love it and Europe will be up so how about adding 10 FXI Sept $34 calls to the STP at $1.70 and 10 EWJ Sept $10 calls at $1.20 to cover a rally in Japan and China.

Those FXI calls expired on the 20th at $4.43, up 160% and the EWJs expired at $1.90 for a smaller 58% gain. We took the money and ran on earlier spikes, however as we knew the data from China was – let's just say – less than reliable…

Not that our own economic data is reliable. Our last NFP report had revisions to previous reports that were more than 1/3 of the current amount – that borderlines on being completely useless from a data point of view. However, our job is not to measure how useful the data is, our job is simply to predict the market reaction to useless data so we can make some money from the idiocy of others.

Other big news this week will be Auto Sales tomorrow along with PMI, ISM and Construction Spending. Bernanke speaks on Wednesday afternoon (assuming the Government is open) and we have various jobs reports throughout the week, leadding up to the big one. PMIs come in from Europe and Asia as well and EU jobs numbers and retail sales – lots of interesting things to mull over as we wait for those Q3 earnings reports to start coming in.

Cash is king but, so far, we've had great opportunities to put it to use (see Friday's post) and, whether the Governement shuts down or stays open (which would be worse?), I think we'll find something to play!

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.