America to Become the Next Poland?

Economics / US Economy Sep 30, 2013 - 11:25 AM GMTMichael Lombardi writes:

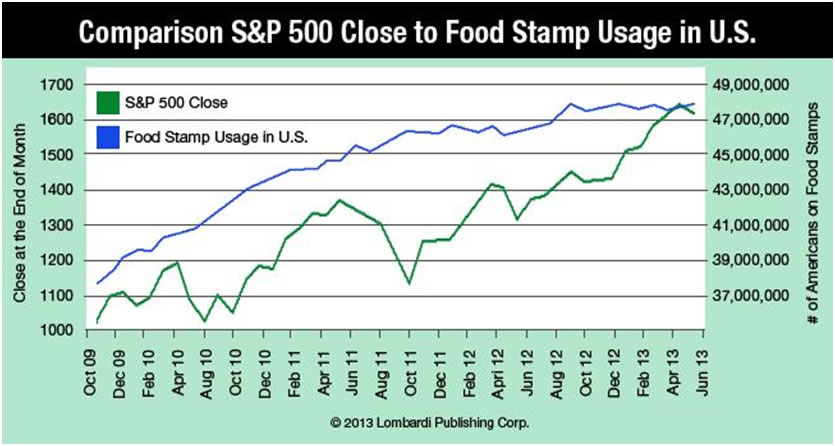

I want to share with my readers a chart that I find very interesting. The chart below (courtesy of our research group) compares the number of Americans on food stamps since the so-called recovery began in the S&P 500.

As you can see for yourself, they are following the same trajectory! Our research shows that since late 2009, for every one-percent increase in food stamps usage in the U.S., the S&P 500 increased two percent!

Yes, food stamps usage has skyrocketed in this country. In October of 2009, there were 37.67 million Americans using some form of food stamps. In June of this year, that number reached 47.76 million people! (Source: United Stated Department of Agriculture web site, last accessed September 26, 2013.) This is an increase of more than 10 million Americans using food stamps in just four years.

During the same time, the S&P 500 has increased from around the 1,000 level to above 1,600—an increase of more than 55%.

This is very troublesome. And it’s a black-and-white example of how the rich (those buying stocks) are getting richer in this country, while the poor (those who can’t afford to buy stocks) are getting poorer.

An average American would think we should not be seeing the poor getting poorer when our government is spending rigorously and our central bank is printing $85.0 billion a month in new money—all in the name of economic growth. After all, doesn’t economic growth mean the standard of living improves for everyone?

The reality is simple: the Fed’s action of aggressively creating trillions of dollars in new paper money is helping the rich to a much larger degree than it is helping the average American Joe.

And in the next few weeks, we’ll hear that Congress has increased the government’s debt ceiling for the 79th time since 1960.

What’s next is the big question: how does the U.S. plan to deal with its national debt, with the mountain of debt growing trillions of dollars bigger and the “money in the system” growing by billions of dollars each month?

This month, the government of Poland confiscated half of the private pension funds in the country to pay for its national debt. (Source: Reuters, September 4, 2013.) Through this technique, the government will be taking bond holdings from the pensions, and leaving them with stocks. Why would a country do that? Well, to borrow even more.

The madness goes on.

Source -http://www.profitconfidential.com/food-stamps/

Michael Lombardi, MBA for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.