Stock Market Still Looks Bullish – In the Rear-View Mirror

Stock-Markets / Stock Markets 2013 Sep 28, 2013 - 10:51 AM GMTBy: Sy_Harding

In his 1999 warning that the stock market over the next 17 years “will not perform anything like it performed in the past 17 years”, Warren Buffett made several other interesting observations.

In his 1999 warning that the stock market over the next 17 years “will not perform anything like it performed in the past 17 years”, Warren Buffett made several other interesting observations.

He said [in 1999], “Investors in stocks these days are expecting far too much. . . . . . Once a bull market gets under way, and once you reach the point where everybody has made money no matter what system he or she followed, a crowd is attracted into the game that is responding not to interest rates and profits, but simply to the fact that it seems a mistake to be out of stocks. In effect, these people superimpose an I-can't-miss-the-party factor on top of the fundamental factors that drive the market. . . . . . . Investors project out into the future what they’ve been seeing. That's their unshakable habit: looking into the rear-view mirror instead of through the windshield. . . . Staring back at the road just travelled [this was in 1999] most investors have rosy expectations.”

If we do that now, we sure see no problems.

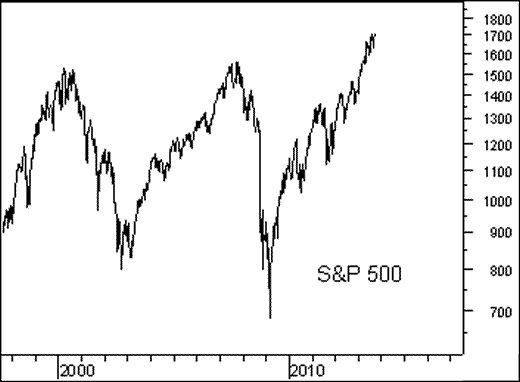

There’s a super impressive bull market stretching back for more than four and a half years. We see there were some bumps in the road that needlessly made investors nervous. The economy slowed in the summer of each of the last four years. But the Fed solved those situations by jumping in with more stimulus each time. There was a debt-ceiling fight in Washington in 2011 that resulted in a 20% plunge by the S&P 500. But that was obviously just a buying opportunity once Congress came out of its funk at the last minute and took care of the problem. In the mirror we can also see that markets in Asia and elsewhere plunged, and the eurozone debt crisis kept popping up. But for the U.S. market, those were clearly just bullish bricks in the wall of worry that stock markets climb. And look at that. Investors who were previously seeing only the 2008 crash and its aftermath in the rear view mirror, and as a result were pulling money out of mutual funds all through the bull market, finally turned the corner, like what they now see in the mirror, and have been pouring money back in at a record pace for almost a year now.

More recently in the rear-view mirror, the Federal Reserve threatened to taper back its QE stimulus. But when markets showed their displeasure, the Fed changed its mind.

So, all is still looking great in the rear-view mirror, rosy in fact.

But Buffett has been right, at least so far, with his 1999 prediction that the next 17 years wouldn’t look anything like the previous 17.

I mean, looking further back in the rear-view mirror than just the last five years – maybe you shouldn’t – prior to the current bull market there have been two severe bear markets since 1999, which until recently have had the market significantly underwater for 13 years, in fact by as much as 50%.

So let’s humor Warren and look through the windshield.

Whoa. Okay, so it takes a little adjustment to look ahead rather than back. Everything is so clear looking back.

Buffett said in 1999 that we should be looking at the direction of interest rates, profits, and valuation levels, not through the rear-view mirror, but through the windshield. Interest rates because “they act on financial valuations the way gravity acts on matter: The higher the rate the greater the downward pull. If government rates rise, the prices of all other investments must adjust downward.” Corporate profits because the value of a company’s stock ultimately rests on its earnings.

Okay, so interest rates that had plunged to near zero over the last five years, are beginning to rise, enough so that it’s apparently spooking the housing market.

And corporate earnings growth has been slowing significantly over the last year or so.

And in the last few weeks, Buffett, Carl Icahn, and Stanley Druckenmiller, three billionaire investing titans, all came out with concerns that the market is getting rich and fully valued.

And what’s that in the road just ahead?

Why, it’s Congress, playing their debt-ceiling game again.

And just beyond them is the Fed, ready, just as soon as Congress gets its road block out of the way, to dial back the stimulus the economy has needed to keep its head above water.

So okay, maybe the view is not so rosy through the windshield.

Maybe it is time for investors to pull their eyes and hopes away from the rear-view mirror, and focus on what lies ahead for a while.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2013 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.