Stock Market Sideways Consolidation Camouflages Danger Ahead

Stock-Markets / Stock Markets 2013 Sep 27, 2013 - 06:51 AM GMT Today’s action was basically a sideways consolidation, buying time but little else as overhead resistance and low volume grind down the attempts at a rally. Sideways consolidations are generally signs of a continuation of the existing trend.

Today’s action was basically a sideways consolidation, buying time but little else as overhead resistance and low volume grind down the attempts at a rally. Sideways consolidations are generally signs of a continuation of the existing trend.

Several commentators have wondered why the current bottom has held so long. Others have pointed out the obvious Head & Shoulders formation with a minimum target of 1653.90. No one has recognized the Broadening Wedge which has a much more significant meaning.

That is why I maintain that target first and foremost. If past experience is correct, Minor Wave 3 may decline near or to that target price. That still leaves Minor Wave 5 in Intermediate wave (1) or (A).

It may be worthwhile to read this article published by The Telegraph. Furthermore, it may also be helpful to read this “unofficial” position paper put out by some analysts at the Bank for International Settlements (BIS).

We see the same condition in the VIX. There seems to be some “stickiness” around the 50-day moving average which blurs its efficacy, but the upper trendline of the Falling Wedge has firmly held its support on two occasions.

Something is brewing that we have yet to learn, but the warnings posted by the BIS may be a big hint. The earnings warnings on Deutsche Bank, Jeffries and Citi should give us pause.

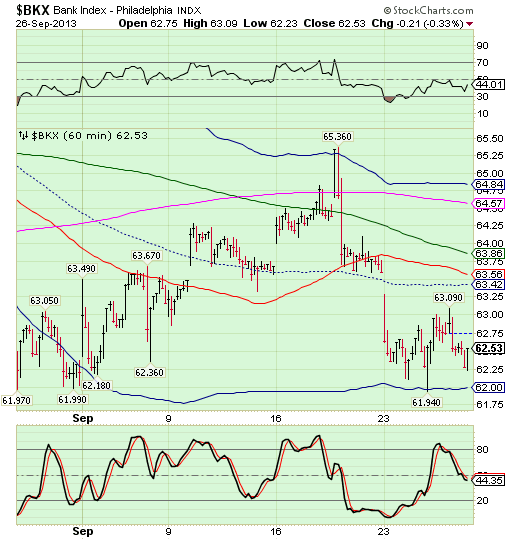

BKX certainly was an underperformer today.

The coup de grace is the TNX, which broke above its Declining Wedge. There will be no relief for the banks (or pension funds and insurance companies, for that matter) from the bond market. TNX appears to be ready to begin the largest wave yet as it goes into a rally that has the potential of rising through Thanksgiving! The first installment appears to be a rally to October 9, which may be Minute Wave [i] of Minor Wave 3. Hopefully, you get the picture.

This move has the potential of being utterly chaotic and devastating. I hope that you have made adequate plans for what may come later this year.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.