California Hikes Wages 25%, Saves US Economy!

Stock-Markets / Wages Sep 26, 2013 - 02:30 PM GMTBy: PhilStockWorld

California is raising the Minimum Wage to $10 an hour!

California is raising the Minimum Wage to $10 an hour!

Unfortunately, not until 2016 but this is exactly what we need to really move the economy forward so first break in the dam, thank goodness. Still, it's a 25% increase over 2 years, not bad and not a bad reason to buy gold and silver (yesterday's play on SLW is a good start) as California, no matter how wacky you think they are, usually leads the nation in necessary reforms and this is one that's been a long time coming.

See "Inflation Nation", where I laid out the bull case for inflation way back in 2008.

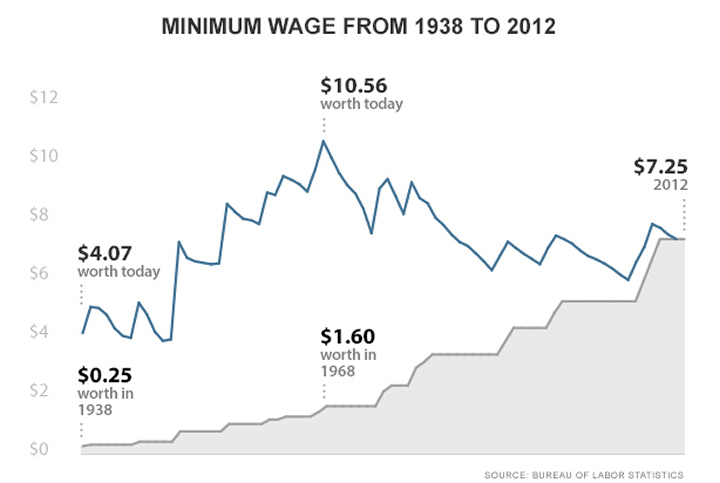

As you can see from the chart, the .25 an hour your Grandfather earned in 1938 really did suck but, by 1968, I remember my 10-year older brothers did quite well for themselves earning $1.60 an hour, which gave them plenty of money to go on dates, buy clothes my parents didn't approve of and get their own muscle cars (my first car was my older brother's '68 Barracuda).

Even I, at 10-years old in 1973, was able to make $20 a week from my paper route and, based on this chart, that was like $132 today and I remember there was a big road sign near my house that told me a new VW Beetle was $1,999 and that, at the time, was my goal to save up for (with whatever I had left from my comic purchases, of course).

$132 is what a modern-day adult makes working 18 hours at minimum wage – and my money was tax-free (or, at least no one asked me for any at the time)! There's something terribly, terribly wrong with that and if you think that the average person in the United States of America has the same opportunities as you did when you started out in life making an inflation-adjusted 30% LESS than you did in your first job – you are deluding yourself.

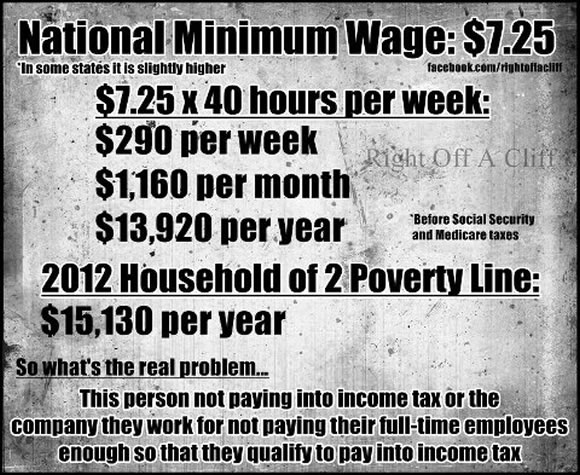

Let's extrapolate that $132 and call it $300 a week and say it should be $450 a week instead ($11.25/hour). What's the difference? Well, $15,600 a year is the poverty line – that's where we keep our minimum wage workers now. Assuming they continue to live at the poverty line (like most of us did as teens – other than the free home from our parents) they could save that extra $150 a week and that's $7,800 a year and $7,800 invested at just 4% (20-year notes) over 20 years adding $7,800 each year (minimum wage with no inflation, no raises) is – $258,650.53.

That's the median price of a house! That means a person, living modestly with a LIVING WAGE (not the crap we pay now) could reasonably be expected, between the ages of 16 and 36, to save up enough money, not just for a mortgage, but for a whole home bought with CASH! Who could possibly be against that?

Well, bankers, for one thing. They would HATE it if everybody went around just buying homes for cash. How do they make money on that? When you buy a house for $250,000 and put $50,000 down, at 5% your mortgage is $1,073.64 per month and, over the course of 30 years, you end up paying $386,511.57 on your $200,000 mortgage – $186,511.57 in interest paid to the bank. And, don't forget, that extra $186,511.57 you pay to the bank is $186,511.57 you can't save for retirement – it's the grift that keeps on taking!!!

Essentially, the system we have now, that deprives people of the ability to save early in life, creates a cycle of Wage Slavery, where we are constantly getting more and more in debt to banks and credit-card companies – not to buy extravagances – but to buy necessities like homes, cars, medical care, etc.

It's no accident that this happens to people – the system is designed that way! Amzazingly though, we not only force our citizens into lives of wage slavery but we also villify them for not being able to make ends make – what a bunch of amoral, sadistic bastards we are – GO CAPITALISM!

You may watch Django Unchained and cluck your tongue at the "evil" plantation owner but what do you think we're doing when we vote for a political and economic system that forces 40% of our citizens to live below the poverty line.

Is there "nothing you can do about it" or is it just easier to pretend that they "did it to themselves" by being lazy or stupid or "not wanting to work hard enough."

Our GDP is stuck in the mud (2.5% growth in the Q2 revised forecast today) because WAGES are stuck in the mud (not profits – wages) because WAGES, not profits, drive the economy. When a company that employs 2M people, like WMT, makes another $5.6Bn (20% of pre-tax income) they hire a dozen accountants to figure out how to hide the money overseas and avoid paying taxes and pretty much none of it goes back into the economy. When you pay the 2M WMT workers $2,800 a year more instead – as calculated above – you begin to CHANGE THEIR LIVES!

That money then flows back through the economy (a lot even goes back to Wal-Mart in the form of more sales) and trickles UP to the businesses that earn it anyway – it just has the added benefit of making a few million people's lives better along the way as WMT's 2M workers have another $233 month to spend or save.

$233 a month saved over 40 years at 5% puts $321,311.40 in a Wal-Mart workers retirement account. That makes them far less likely to be a burden as they get older and again, let's them afford the finer things in life like a home or a college education without signing their lives away and becoming permanently enslaved to the Banksters.

THE BANKERS DO NOT WANT THIS – they will do ANYTHING to stop it because your debt is what they live on. JP Morgan (JPM) has already been fined $5Bn for various forms of financial misconduct and is staring down the barrel of anothe $6Bn and those are JUST THE FINES for the things they got caught doing. These people are not your friends – they are criminals! This money was stolen from the American people and only SOME is finding it's way back:

- Sept. 19, 2013 — $920 million – In settlements with the OCC, the SEC, the Fed and the U.K. Financial Conduct Authority, J.P. Morgan agreed to pay a total of $920 million to settle all claims about its management and oversight of traders involved in the London Whale debacle. The bank also admitted wrongdoing in the matter, a trade that cost the bank more than $6 billion.

- Sept. 19. — $389 million – The bank paid $80 million in fines and refunded $309 million to credit-card customers to settle regulators’ charges that it harmed consumers by allegedly making errors in hundreds of thousands of debt-collection lawsuits and leading more than two million credit-card customers to buy services they didn’t want.

- July 2013 — $410 million – FERC alleged J.P. Morgan Ventures Energy Corp. traders gamed rules that help set the cost of electricity in California and the Midwest with 12 manipulative trading schemes starting in 2010. The DOJ is now investigating the claims. The $410 million included a $285 million fine and the bank agreed to give back $125 million in profits.

- January 2013 — $1.8 billion – In two separate agreements, the bank contributed $1.8 billion to the nationwide bank settlement on allegations the banks improperly carried out foreclosures during the housing crisis, including employing so-called robo-signers. The bank also agreed to contribute $3.7 billion in aid to troubled homeowners and nearly $540 million in refinancing. The first part was reached in a nationwide settlement in February 2012.

- November 2012 — $269.9 million – The bank settled with the SEC over the creation and underwriting of mortgage-backed securities.

- August 2012 — $1.2 billion – The bank disclosed in a filing its share of a broad settlement over interchange allegations against the banks and Visa and Mastercard.

Wow, I use Visa and Mastercard, I have a mortgage, I buy electricity at pumped-up prices, I buy homes at pumped-up prices. Do you think this doesn't affect you? Do you think gas would be $3.60 a gallon if not for the rampant manipulation in the energy markets, would typical suburban homes cost 10x a family's income if they weren't gaming the system?

And why do they do it? TO PUT YOU IN AS MUCH DEBT AS POSSIBLE! TO MAKE YOU THEIR SLAVE! So thank God for Jerry Brown and California – may this be the first step of many on the way to taking back our country from these Godless Banksters!

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.