Stocks Bull Market Continues

Stock-Markets / Stock Markets 2013 Sep 22, 2013 - 04:27 PM GMTBy: Tony_Caldaro

An expected volatile FOMC/Options expiration week did not disappoint. The market started the week with a gap up opening, held those highs on Tuesday, then spiked when FED chairman Bernanke did not taper QE 3 as was expected. Then the unwinding of that spike unfolded during Thursday and Friday’s expiration. For the week the SPX/DOW were +0.95%, the NDX/NAZ were +1.45%, and the DJ World index was +2.0%. Economic reports for the week ended positive. On the uptick: industrial production, the CPI, existing home sales, the Philly FED, leading indicators, the monetary base and the WLEI. On the downtick: the NY FED, the NAHB, housing starts, building permits, and weekly jobless claims rose. Next week: Q2 GDP (est. +2.5%), PCE prices and more housing reports.

An expected volatile FOMC/Options expiration week did not disappoint. The market started the week with a gap up opening, held those highs on Tuesday, then spiked when FED chairman Bernanke did not taper QE 3 as was expected. Then the unwinding of that spike unfolded during Thursday and Friday’s expiration. For the week the SPX/DOW were +0.95%, the NDX/NAZ were +1.45%, and the DJ World index was +2.0%. Economic reports for the week ended positive. On the uptick: industrial production, the CPI, existing home sales, the Philly FED, leading indicators, the monetary base and the WLEI. On the downtick: the NY FED, the NAHB, housing starts, building permits, and weekly jobless claims rose. Next week: Q2 GDP (est. +2.5%), PCE prices and more housing reports.

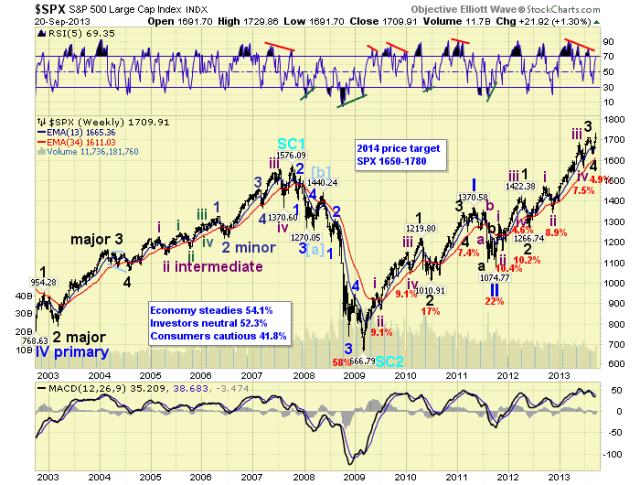

LONG TERM: bull market

With the markets inflection point out of the way, and the much anticipated QE 3 taper a non-event, we can concentrate on the long term count. The recent August correction only declined about half of what was expected. The three previous Major wave corrections, during this bull market, had ranged between 7.4% and 17% in the SPX and 6.7% and 14.9% in the DOW. So we expected something about in the middle, around 10%. At the August low, however, the SPX had only corrected 4.9% while the DOW corrected 5.7%. This correction, being the smallest of the four Major wave corrections, could not be anticipated in advance. Our error, we got it wrong.

While there has been some discussion of a more bullish count long term. We are maintaining our conservative bull market count as we have been reporting now for a few years. This bull market remains Cycle wave [1] and should unfold in five Primary waves. Primary waves I and II ended in 2011. Primary wave III has been underway since then. Primary I divided into five Major waves with a subdividing Major wave 1. Primary wave III has also be dividing into five Major waves, but both Major waves 1 and 3 subdivided. Major waves 1 and 2 of Primary III ended by mid-2012, and Major waves 3 and 4 appear to have just ended in mid-2013. Major wave 5 of Primary III should now be underway. When this uptrend concludes it should end Primary wave III. Then after Primary IV correction, the next uptrend, Primary wave V, should end the bull market. We still expect a bull market top by late-winter to early-spring 2014.

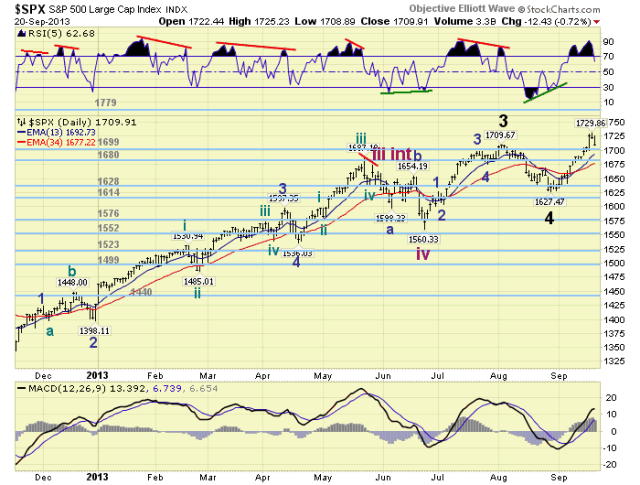

MEDIUM TERM: uptrend

It was a disappointing August downtrend for many traders as the market only declined to the 1628 pivot, found support, and began to rally. However, the downtrend was sufficient to trigger a confirmation in the bellwether DOW which retraced over 80% of its previous uptrend. As a result of this OEW activity we have labeled the recent low as Major wave 4 in both the SPX and DOW. The uptrend, which has been underway since the late August low, is Major wave 5.

Since Major wave 5, of Primary I, was the shortest of those Major waves, and did not subdivide. We are expecting Major wave 5, of Primary III, to be a one trend advance. A subdividing Major 5, however, can not be totally ruled out, since Major waves 1 and 3 have subdivided. But to anticipate something that is uncharacteristic of this bull market is not being objective, nor conservative. When this uptrend concludes the next correction should give us the answer. Typically, after a large five wave advance the market should have a significant correction. Primary wave II declined 22%. That was somewhat extraordinary for a bull market, as many turned long term bearish the exact day it bottomed. Typical corrections during this bull market have been about 10%. Medium term support is at the 1699 and 1680 pivots, with resistance at the 1779 pivot.

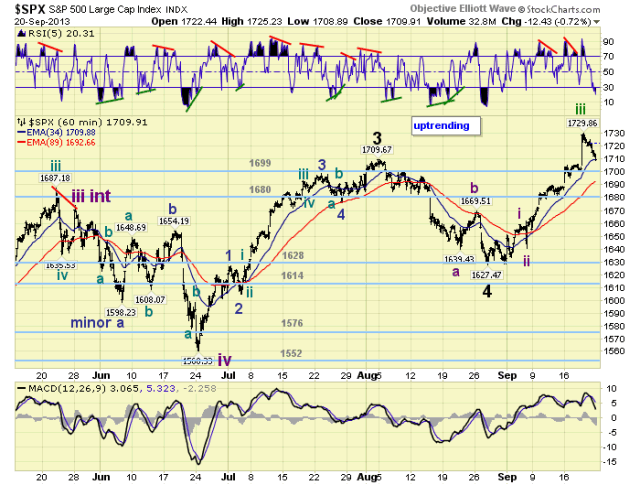

SHORT TERM

Since we are expecting a one trend Major wave 5, we have been labeling its advances in Intermediate waves. Intermediate wave i was a leading diagonal from SPX 1627-1662. Intermediate wave ii was a sharp decline, which often occurs after diagonals, to SPX 1641. Intermediate wave was a simple five wave advance to SPX 1730. Intermediate wave iv should be underway now, as the market has pulled back 21 points from its high. This is the same length as the entire Int. wave ii decline. After this decline concludes the market should rally to new highs to complete Int. wave v, Major wave 5, and Primary III.

Short term support is at the 1699 and 1680 pivots with resistance at the 1779 pivot. Short term momentum ended the week quite oversold. The short term OEW charts remain positive with the reversal level now SPX 1692. Best to your trading!

FOREIGN MARKETS

Asian markets were mostly higher on the week for a gain of 2.1%. All indices uptrending.

European markets were mostly higher on the week for a gain of 1.4%. All uptrending too.

The Commodity equity group were all higher for a gain of 2.1%. All uptrending as well.

The uptrending DJ World index gained 2.0%.

COMMODITIES

Bonds had a good week gaining 1.2%, but have not confirmed an uptrend yet.

Crude sold off this week losing 3.5%, and should be confirming a downtrend soon.

Gold lost only 0.2% on the week, thanks to Wednesday’s rally, but appears to be downtrending.

The USD was also in the red this week -1.2%, and is now downtrending.

NEXT WEEK

Tuesday: Case-Shiller, the FHFA housing index and Consumer confidence. Wednesday: Durable goods orders and New home sales. Thursday: Q2 GDP, weekly Jobless claims and Pending home sales. Friday: Personal income/spending, PCE prices and Consumer sentiment. The FED has only one speech on its agenda: FED governor Stein on Thursday in Germany. Best to your weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2013 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Toby Connor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.