The Only Legal Way to Escape US Taxes Besides Death and Renunciation

Politics / Taxes Sep 18, 2013 - 06:37 PM GMTBy: Casey_Research

By Nick Giambruno, Editor, International Man

By Nick Giambruno, Editor, International Man

When I hear about strategies that purport to legally allow US citizens to avoid having to pay income taxes, the first thing that usually comes to mind is that it is some sort of dodgy cockamamie scheme.

This is because the US government is no slouch when it comes to shaking down its citizens for every penny it can get away with. The mind-boggling spending on welfare and warfare policies necessitates this. It would be dangerously foolish in the extreme to think you could slip one past them.

There really was no sure way to legally escape the suffocating grip of US taxes besides death and renouncing your US citizenship… until recently.

Every other country in the world (besides the US and Eritrea) practices a system of residence-based taxation. This means that citizens are not liable for paying income taxes to their home country if they become a legal resident of another country and earn their income there.

Take, for example, an American expat and a Canadian expat who both live and earn income in Singapore. The Canadian would only be responsible for paying the much lower Singapore income taxes, while the American would be responsible for paying Singapore income taxes AND American income taxes (though the IRS does allow for around $100k of foreign earned income to be excluded from income taxes if certain conditions are met).

This is because the US taxes its citizens by virtue of their citizenship (citizenship-based taxation), regardless of where they live and earn their money. Even leaving the US permanently does not absolve you from paying US income taxes. Though Eritrea also practices citizenship-based taxation, it is an impoverished African country and has no ability to effectively enforce it. That's the key difference. The US government can effectively enforce its citizenship-based taxation policies thanks to its massive economic, political, and military weight and the fact that it does not recognize any limit to its jurisdiction (consider FATCA and Edward Snowden).

American expats are therefore in the uniquely unfavorable position of having arguably the worst tax policies and a government that can effectively enforce them. For many, it is a tight and suffocating tax leash. It is no wonder, then, that a record number of Americans gave up their citizenship last quarter to escape these onerous requirements. (You can find more about citizenship-based taxation versus residence-based taxation in this article.)

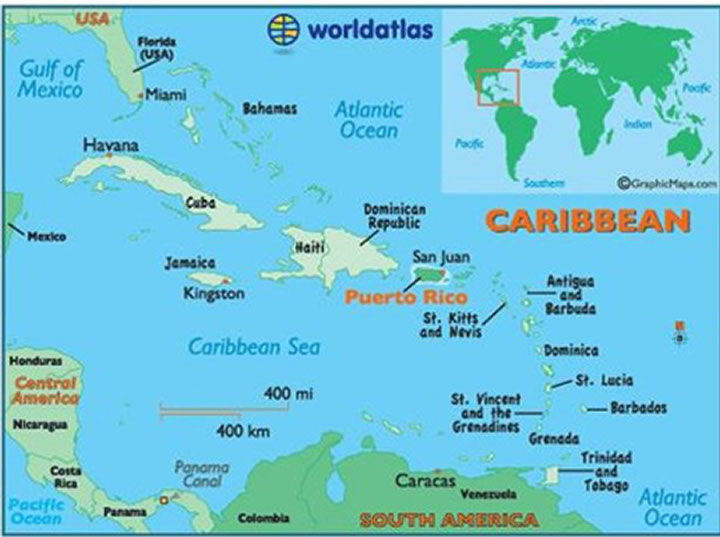

There is, however, another way besides death and renunciation to legally escape US income taxes, thanks to the Caribbean island of Puerto Rico.

Puerto Rico is an unincorporated territory (commonwealth) of the US, and this allows it to have a special tax arrangement. Namely, legal residents of Puerto Rico who earn their income in Puerto Rico do not pay US federal income taxes (though they still have to file a federal tax return).

All Puerto Ricans are already US citizens, and since it is a commonwealth of the US, Americans are generally free to stay on the island without restriction and do not even need a passport to travel there.

In order to obtain legal residency status in Puerto Rico and the associated tax benefits, one would have to be physically present on the island for at least 183 days a year.

While US citizens who become legal Puerto Rican residents do not have to pay US federal income taxes on income earned on the island, they still have to pay local Puerto Rican taxes. This only amounts to 4% in certain cases, a pittance in comparison to combined US federal, state, and sometimes city income taxes.

This low 4% rate only applies if the services are performed in Puerto Rico for clients outside of Puerto Rico—otherwise a local income tax of as much as 33% is applicable. For example, an investment manager based in Puerto Rico who performs services for US-based clients would be eligible for the lower income tax rate. Consult a tax expert to discuss individual cases and circumstances.

In addition, Puerto Rico recently slashed its taxes on dividends and interest to ZERO, and capital gains taxes to as low as zero (maximum of 10%).This is part of a recent program over the past year or so in which Puerto Rico has been promoting itself as a tax-friendly jurisdiction open to Americans, in order to compete with its better-known Caribbean neighbors like the Cayman Islands.

Taken together, Puerto Rico is an attractive destination for American companies and individuals who have portable incomes, such as software developers, writers, Internet businesses, and especially those dealing with investments, like hedge funds, in which the majority of the earnings are derived from investment income like dividends, interest, or capital gains.

Spending half the year in Puerto Rico, with its beautiful white sand beaches, Caribbean climate, and close proximity to the US is not a bad proposition.

In short, thanks to a system of citizenship-based taxation, becoming a legal resident of Puerto Rico is the only way for Americans to keep their US citizenship and legally avoid US federal income taxes.

There have been at least 40 Americans who have taken advantage of this special arrangement with Puerto Rico and moved there during the past year. Earlier this year billionaire hedge fund manager John Paulson was said to have been exploring this option. Check out the short clip below from Bloomberg about an American who has moved to Puerto Rico for exactly these reasons.

Of course, the US government could always pressure Puerto Rico to change its policies, but people in the know view that as unlikely.

For now, Puerto Rico and its special tax situation definitely deserve consideration for Americans.

Puerto Rico may be the best internationalization option for Americans at present, but its conditions may be unworkable for many. Fortunately, many other options exist for internationalizing at least part of your wealth—and your life, should you want to leave your home country and live elsewhere. And honestly, with the global economy in the state it's in, just about everyone would benefit from internationalizing… it isn't just for Americans.

But how to get started? What are the best ways to move wealth offshore, and what are the best destinations for it? Should you internationalize in the same countries that you move your wealth to? All these questions, and many more, can be answered in one convenient, trustworthy resource.

This resource has its roots deeply intertwined with the original "International Man"—legendary contrarian and speculator Doug Casey himself. So you can be confident that every detail has been thoroughly vetted, to not just maintain your wealth and lifestyle… but in many cases, to improve them. Get all the details and get started on your path to internationalization right now.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.