India Housing Market Bubble Bursts; Panic Selling Coming Next

Housing-Market / India Sep 14, 2013 - 11:08 AM GMTBy: Mike_Shedlock

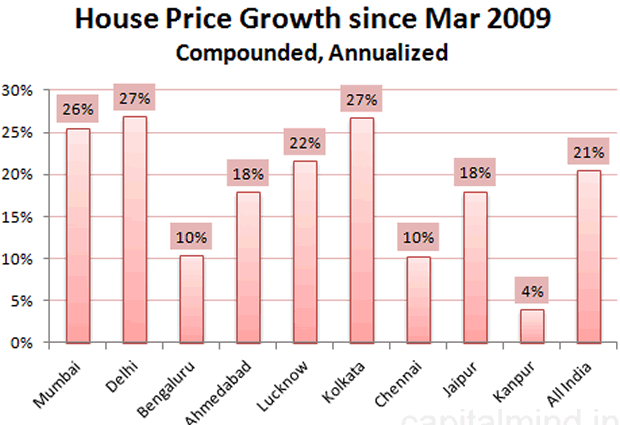

On August 1, in India Housing Bubble Still Expanding I posted a series of charts by Deepak Shenoy, an economic blogger at Capital Mind in India.

Those charts showed the bubble in India was alive and growing. Here is one of the charts and a small bit of commentary ....

As of March 2013, Prices have more than doubled since 2009. The All-India Index is at 211, from 100 in March 2009.

The bubble is intact.

But is the bubble bursting? QoQ growth is the second lowest since the data has been recorded - an all India QoQ growth level of 2.1% (versus 6.4% last quarter).

Credit will be constrained from July onwards, so it is quite likely that price growth is hit. Already, rental prices have flattened or reduced, and commercial rents and prices are down (speaking of the June quarter, from anecdotal information). A credit crunch could well cause developer defaults, and then prices will truly fall. For now, the bubble is well and truly visible.

The Bubble Bursts

On Wednesday, the Wall Street Journal reported A Housing Slump in India

The Orbit Grand, a block-size complex designed to have at least 26 floors of elegant apartments, an extensive array of ground-floor stores and abundant parking for the chauffeured cars of residents and shoppers, was supposed to be a diadem of India's real estate market.

So...Now it is turning into a symbol of the slumping fortunes of property developers and owners in a once-promising emerging economy. Construction of the Orbit Grand has almost completely stalled at the 10th floor, the tower crane at the site seldom moves and the builder has defaulted on its loan.

"There's no real work going on right now. There's just a minimum number of workers coming in to do small things," said Alam Sheikh, an electrician who is one of just 14 builders left at the site.

The volume of real estate transactions has slumped in India as developers have refused to offer discounts for fear of starting a market rout.

"If they drop prices, investors will panic and it will be a self-fulfilling prophecy," causing further declines in prices, said Siddharth Yog, a co-founder and managing partner of the Xander Group, a large international real estate investment firm started in 2005. That was the year India began allowing foreign institutional investors into its real estate market.

But with sellers refusing to cut prices, many potential buyers are losing interest.

Work stops, builders default, condo complexes stall in mid-air, transaction volumes plunge, buyers lose interest, and sellers (for now) refuse to cut prices out of fear of causing panic.

Have we seen this picture before? Yes indeed.

It was supposed to be "different in India", just like it was supposed to be different in Las Vegas, Miami, Phoenix, San Diego, etc., etc.

India Economy in Serious Trouble

In September all hell broke loose. Here are some links.

- India in Serious Trouble (and Gold at the Heart of It)

- India Manufacturing PMI Contracts for First Time Since March 2009

- Exploring the Impossible: India Seeks to Expand Trade in Rupees; India Stock Market Sinks; Rupee Decline Continues

Those links were from early September.

On August 18, I noted Official Denials Run Rampant in India; "No Question" of Economic Crisis; Rupee Plunges to Record Low; Gold Coin Imports Banned

Panic Coming Up

Builders refuse to offer discounts for fear of starting a market rout, causing investors to panic in a self-fulfilling prophecy.

Yet, it's far too late to stop panic.

Moreover, the faster and steeper the panic, the better. Prices need to plunge to reasonable levels, and attempts to halt that process are counterproductive.

Meanwhile, I will see if I can get a housing update from Deepak. The next few months may look interesting. Bear in mind, history suggests that transaction volumes will completely dry up, before the real plunge in price occurs. That may take another month or two of no demand from buyers.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2013 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.