Record 20% of Americans Struggle to Afford Food and Basic Necessities, Who's to Blame?

Politics / Social Issues Sep 13, 2013 - 08:07 AM GMTBy: Mike_Shedlock

The latest Gallup survey shows Near-Record Number of Americans Struggle to Afford Food.

The latest Gallup survey shows Near-Record Number of Americans Struggle to Afford Food.

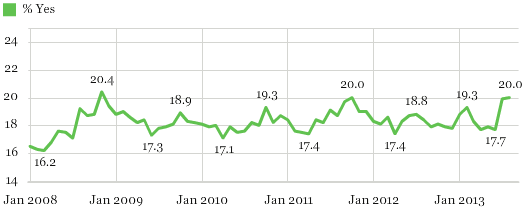

More Americans are struggling to afford food -- nearly as many as did during the recent recession. The 20.0% who reported in August that they have, at times, lacked enough money to buy the food that they or their families needed during the past year, is up from 17.7% in June, and is the highest percentage recorded since October 2011. The percentage who struggle to afford food now is close to the peak of 20.4% measured in November 2008, as the global economic crisis unfolded.

Question: Have there been times in the past 12 months that you did not have enough money to buy food that you or your family needed?

This is only the third time in 68 successive months of Gallup and Healthways' tracking, which began in January 2008, that at least 20% of Americans said they struggled to afford food in the past year.

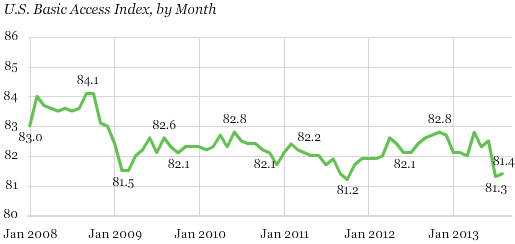

Americans' Access to Basic Needs Hovers Near Record-Low

Americans remain as likely to have access to basic necessities in general now as they were in October 2011, when it was at its lowest point. The Basic Access Index, which includes 13 questions about topics including Americans' ability to afford food, housing, and healthcare, was 81.4 in August, on par with the all-time low of 81.2 recorded in October 2011.

Who Does Gallup Blame?

Citing the Wall Street Journal, Gallup blames stagnant wages.

According to an August 2013 Wall Street Journal analysis of Labor Department data, "the average hourly pay for a nongovernment, non-supervisory worker, adjusted for price increases, declined to $8.77 [in July 2013] from $8.85 at the end of the recession in June 2009." Depressed wages are likely negatively affecting the economic recovery by reducing consumer spending, but another serious and costly implication may be that fewer Americans are able to consistently afford food and meet other basic needs.

Gallup also blames Republicans.

Federal government programs also play a role in addressing this issue. As food stamp (SNAP) enrollment increases, Republicans in Congress are proposing substantial cuts and reforms to the program, while Democrats are resisting such reductions. Regardless, food stamp benefits are set to be reduced in November after a provision of the 2009 fiscal stimulus program expires. Therefore, it is possible that even more Americans may struggle to afford food in the immediate future.

Who is Really to Blame?

- The Fed

- Fractional Reserve Lending (Central banks in general for sloshing money around).

- Lack of a Gold Standard

- Congress (for throwing money at numerous programs)

- War-mongers

Raising the minimum wage does not fix the problem. And wasting money waging wars we cannot afford is counterproductive.

The two primary reasons they are: fractional reserve lending and the Fed (central banks in general). Combined, the Fed, FRL, and lack of a gold standard enable Congress and the war-mongers to waste money.

Fantasyland Price Stability

The Fed and the ECB praise themselves as "defenders against inflation". One look at health-care or education costs is enough to prove they are in Fantasyland.

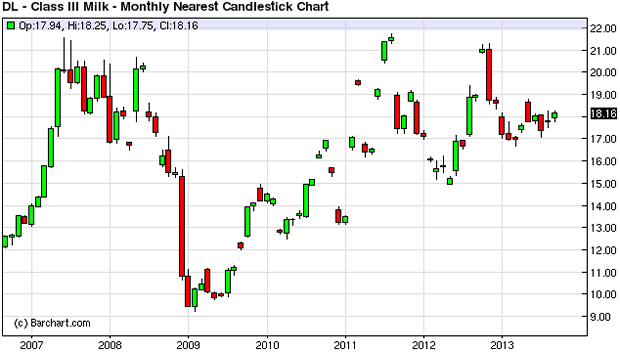

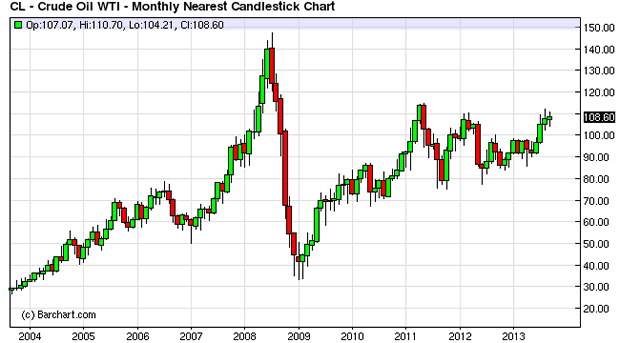

Here are some charts to consider.

Milk

Crude

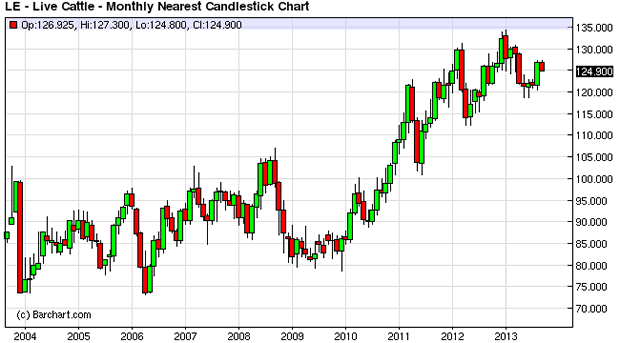

Cattle

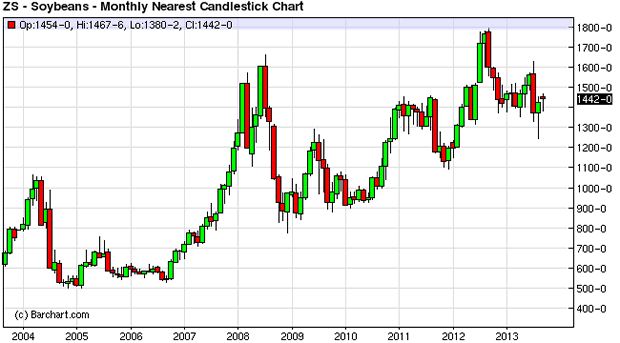

Soybeans

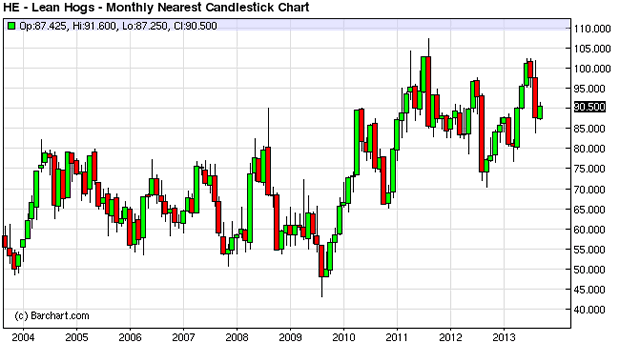

Lean Hogs

Price Stability? Where?

Does any of that remotely look like "price stability"? Of course it doesn't.

And it's no wonder people are struggling. But throwing more money at aid programs is not the answer. Huge wage growth, especially the seriously misguided strike effort at McDonald's for $15 wages is not the answer either.

Symptoms of the Problem

- Decline in real wages

- People struggling to buy food and basic necessities

The decline in real wages is a symptom of the problem. So is the struggle to buy food and other necessities.

You do not cure problems by throwing more money at symptoms, especially when throwing money around is the essentially the problem in the first place.

The problem and the solution can never be the same, no matter how loud the socialists and the Keynesian clowns scream for more wealth distribution schemes and minimum wage hikes.

Who Benefits From Printing Money?

Printing money never solved anything but it sure does make life great for those with first access to it. Who is that? The already wealthy, the banks, and government bodies via taxation.

For further discussion, please see ...

Top 1% Received 121% of Income Gains During the Recovery, Bottom 99% Lose .4%; How, Why, Solutions

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2013 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.