Planned Attack on Gold Begins, Waiting for Manipulation to End

Commodities / Gold and Silver 2013 Sep 12, 2013 - 06:30 PM GMTBy: Toby_Connor

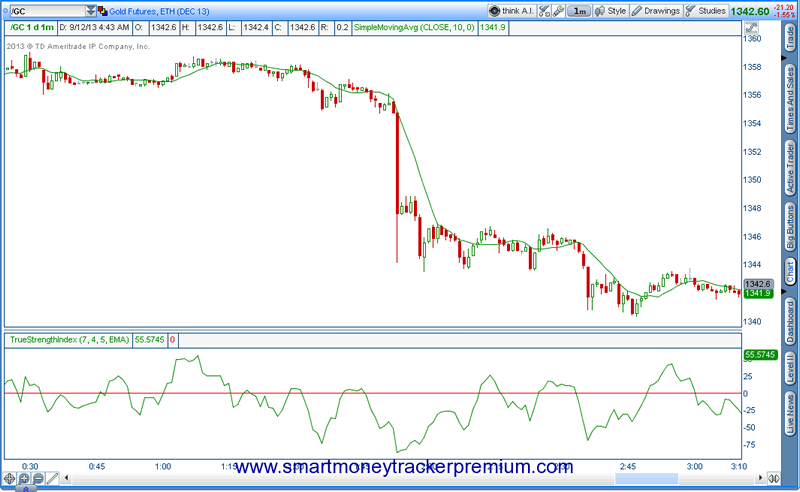

As I was afraid would happen, gold suffered an overnight hit that drove it back below the $1350 support zone. The drop occurred in the span of one minute so it's pretty obvious this was a planned attack with the intent of taking out that support zone in the thin overnight market when there would not be any buyers to defend the against the attack.

As I was afraid would happen, gold suffered an overnight hit that drove it back below the $1350 support zone. The drop occurred in the span of one minute so it's pretty obvious this was a planned attack with the intent of taking out that support zone in the thin overnight market when there would not be any buyers to defend the against the attack.

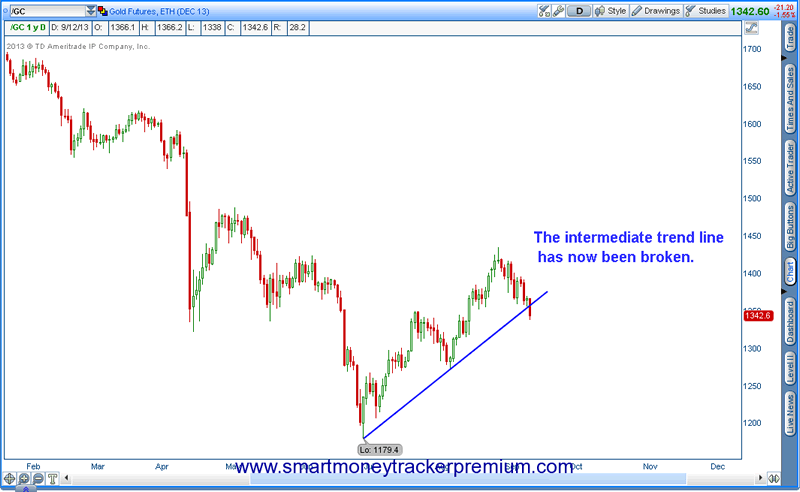

This has also broken the intermediate trend line which should take out all the technical traders as few will want to buy a broken trend line.

At this point I think we need to align our goals with those of the manipulators. This doesn't mean selling short, but it does mean delaying gratification until the manipulation has accomplished its goal. That goal, I'm almost certain, is to setup the trade of the century. By lowering the starting point before the bubble phase of the bull market begins this manipulation is creating more and more profit potential once it ends and the bubble phase begins.

Yes, this entire debacle has stolen a load of money from those depending on freely traded markets. But this is also going to setup the conditions to make back all of those losses and many multiples more during the bubble phase of the bull. Instead of fighting the manipulation we just need to accept that it is happening and why it's happening. Wait patiently until it's done, and then get positioned to profit from it right along with the forces that have orchestrated this charade.

At this point I doubt we will get a cycle bottom until the FOMC meeting next Wednesday and maybe not until OEX next Friday. The bounce out of the daily cycle low I expect will fail to reclaim that $1350 resistance zone and gold will head back down to test $1179. At that point I think we can safely assume we will see another one of these overnight attacks to break that support. This will probably trigger a waterfall collapse back down to the prior C-wave top around $1030ish.

That's the point where we will back up the truck as that is the logical level for shorts to cover and longs to enter in preparation for a final bottom and the beginning of the bubble phase.

So at this point I'm ready to cheer for the criminals running this scam because I know they are not only setting up the trade of the century for themselves, but I'm planning on taking advantage of it myself. Now we just have to be patient and wait for setup to develop.

I signaled an exit into strength last Tuesday and got subscribers out of the way of this attack. We are now sitting on the sidelines waiting for the manipulation to run its course and preparing to enter long once it has.

The $10 one week trial subscription is still available for anyone who is interested in trying the nightly premium report. There are still plenty of opportunities in the meantime while we wait for this to run its course.

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2013 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Toby Connor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.