British Pound Bearish Reversal Forecast

Currencies / British Pound Sep 12, 2013 - 01:33 PM GMTBy: Gregor_Horvat

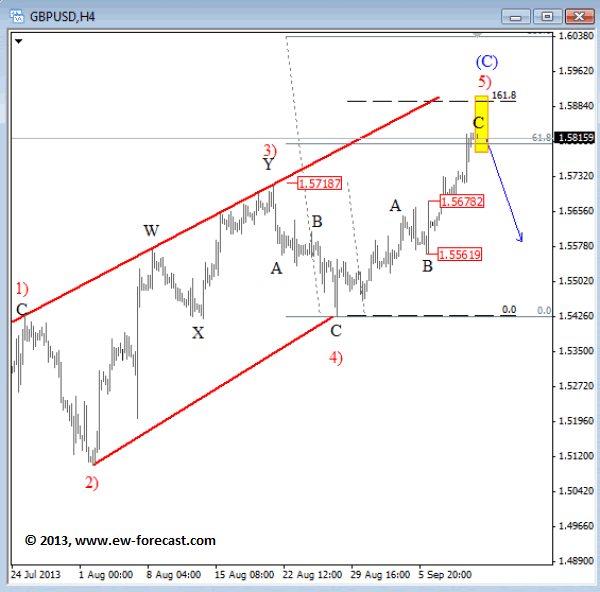

Pound (Forex: GBPUSD) is in bullish mode and reached our projected zone for this week; 1.5800-1.5900 which is actually a very important resistance zone in combination with the wave principle and Fibonacci levels. As you can see on the chart we are tracking a huge wedge pattern called an ending diagonal which usually predicts a very strong reversal. With that said, we are keeping an eye on potential sell-off on this pair from current resistance zone. This sell-off can happen soon if we consider that prices are in late stages of wave 5) now, testing 61.8% Fibonacci projection compare to wave 3) and also approaching 161.8 % extension of wave 4).

Pound (Forex: GBPUSD) is in bullish mode and reached our projected zone for this week; 1.5800-1.5900 which is actually a very important resistance zone in combination with the wave principle and Fibonacci levels. As you can see on the chart we are tracking a huge wedge pattern called an ending diagonal which usually predicts a very strong reversal. With that said, we are keeping an eye on potential sell-off on this pair from current resistance zone. This sell-off can happen soon if we consider that prices are in late stages of wave 5) now, testing 61.8% Fibonacci projection compare to wave 3) and also approaching 161.8 % extension of wave 4).

However as always only price can confirm the direction you anticipate. In other words, we need a five wave decline from the highs to confirm further bearish waves for the pair. Only then trader could be interested in short opportunities, until then stay aside.

GBPUSD 4h Elliott Wave Analysis

What is Diagonal Triangle?

A Diagonal is a common 5-wave motive pattern labeled 1-2-3-4-5 that moves with the larger trend. Diagonals move within two contracting channel lines drawn from waves 1 to 3, and from waves 2 to 4. There are two types of diagonals: leading diagonals and ending diagonals. They have a different internal structure and are seen in different positions within the larger degree pattern. Ending diagonals are much more common than leading diagonals.

Ending Diagonal

An ending diagonal is a special type of pattern that occurs at times when the preceding move has gone too far too fast, as Elliott put it. A very small percentage of ending diagonals appear in the C wave position of A-B- C formations. In double or triple threes, they appear only as the final "C" wave. In all cases, they are found at the termination points of larger patterns, indicating exhaustion of the larger movement.

Structure is 3-3-3-3-3

Structure is 3-3-3-3-3- A wedge shape within two converging lines

- Wave 4 must trade into a territory of a wave 1

- Appears primarily in the fifth wave position, in the C wave position of A-B- C and in double or triple threes as the final "C" wave

Written by www.ew-forecast.com | Try our 7 Days Free Trial Here

Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power.

Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders.

He was working for Capital Forex Group and TheLFB.com. His featured articles have been published in: Thestreet.com, Action forex, Forex TV, Istockanalyst, ForexFactory, Fxtraders.eu. He mostly focuses on currencies, gold, oil, and some major US indices.

© 2013 Copyright Gregor Horvat - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.