Seniors Are Stealing From Our Young, the Looming Entitlement Spending Catastrophe

Economics / Demographics Sep 12, 2013 - 08:44 AM GMTBy: Bloomberg

Hedge fund icon and former Chairman, President and CIO of Duquesne Capital, Stan Druckenmiller joined Bloomberg Television's Stephanie Ruhle and Erik Schatzker on "Market Makers" for a full hour and said, the government must address entitlement spending "This is the first generation where a 30-year-old's net worth is less than his parents...If you look at the older people, there net worth has doubled." Druckenmiller also said it would be a big deal for financial markets if the Federal Reserve were to completely end its asset purchases over the next 12-months.

Hedge fund icon and former Chairman, President and CIO of Duquesne Capital, Stan Druckenmiller joined Bloomberg Television's Stephanie Ruhle and Erik Schatzker on "Market Makers" for a full hour and said, the government must address entitlement spending "This is the first generation where a 30-year-old's net worth is less than his parents...If you look at the older people, there net worth has doubled." Druckenmiller also said it would be a big deal for financial markets if the Federal Reserve were to completely end its asset purchases over the next 12-months.

Druckenmiller said he sees no bear market as long as fed prints money, prices will respond to actual QE exit, he doesn't see many investing opportunities, he is very focused on who the next Fed Chairman is, and thinks there are too many hedge fund managers.

On Next Fed Chair: "I am a little concerned that the Fed chairmanship could be hung up. It has become a complete circus. You have economists and politicians and newspaper people pining on it. My God, Obama should just go in the rose garden and appoint whoever he wants to appoint. That is his privilege and his job."

Druckenmiller on why his college tour is so important:

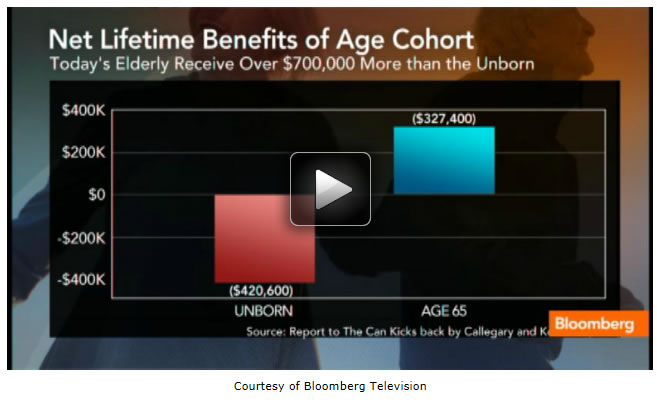

"It really solidified to me during the sequester period when the whole debate was going on about cutting government spending in our fiscal issues, and that is when I first came to understand the lack of knowledge on this topic, not just from seniors, but future seniors. If you listen to the sequester debate in spending and where the debt is, I find it inconceivable they didn't know the facts, including I would be surprised if the President knew the facts given the statements he was making. During the sequester, you may remember he said, we are not going to balance the budget on the backs of our seniors. If you look at the situation where we are today, seniors are doing very, very well in the last 30 years. It has been a remarkable accomplishment. And because the mandate went well, the poverty rate is down from 35-percent to 9-percent for seniors. But their wealth is also increasing dramatically. Looking forward, we have a very though picture because of the demographic situation, seniors about to explode as a portion of the population and the benefits we promised them, there is no way to cover them given the current situation we have."

On whether he blames the voters or politicians for being ignorant and uninformed:

"I would say both. This is a country of special interests, as we all know. As we all know, old people vote or seniors vote. They vote consistently and young people don't. Young people have other interests than say the future economic situation at the age of 20. I sure did. They're not necessarily focusing on the stuff."

On whether his goal is to get young people out to vote, to vote with their consciences:

"It won't be their conscience. They should be mad as hell. Part of what I'm doing is to inform seniors of the situation... I'm sure they care. Maybe some don't. But I would bet a lot of money that 85-percent of seniors today, if they knew the numbers were going to go over, they wouldn't be comfortable with this this what they were leaving to their grandchildren and great-grandchildren."

On what he is most uncomfortable about: *chart discussed is at the 4 minute mark of video "seniors are stealing from our young"

"Let's first set the table and looking at what is going on in the last 35-years. Then I want to get into the demographic problem and why it is so scary from here and why I don't understand the current dialogue that is taking place over the situation. It is completely uninformed. This chart on the screen is federal government entitlement transfers and percent of government budget outlays. If you go back to 1960 when I was sever years old, about 20-percent of the federal budget government outlays were transfer payments or what we call entitlement. That number has gone up to 72-percent over this 35 year period. The problem with that, first of all, the good news on that, as I said, seniors are much better off, it's been a tremendous accomplishment, poverty rate is way down for seniors, but these are transfer payments and there is no productive investment or no looking to future coming out of this. If you look at how we get form 20-percent to 70-percent, almost all of that money went to the elderly. If you took an elderly person back in 1960, 40-percent of government outlays per capita went to them. That number is 71-percent all stop where did that come out of? It came out of children, came out of investments and things like education, infrastructure, thing like that. And that crowding out effect creates a problem going forward because these are not productive investments."

On response he is getting from influential youths:

"The answer is, I don't know. Jeff Canada and I, my partner, well, I am sort of the tagalong, we went up to Bowdoin College to see where this went. I had a number of people contact me after your show. I did not expect that... We went up to Bowdoin college and give a presentation just trying to outline the facts of what we're looking at the next 30 or 40 years. The response was overwhelming. So based on that, we're going to do about 10 to 12 colleges in the next two months. Mr. Zuckerberg is focused more on immigration than this stuff."

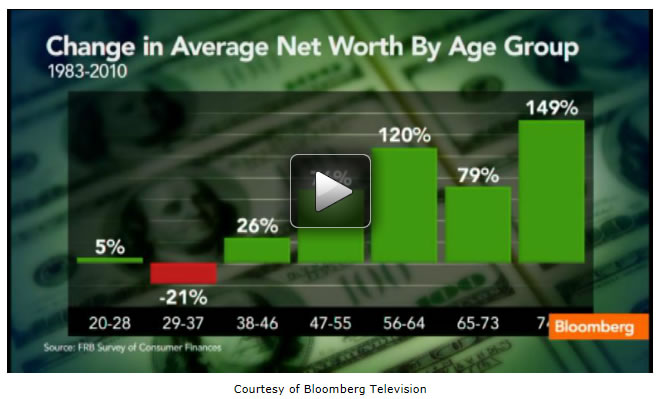

On the net worth by age group: *chart discussed is at the 7 minute mark of video "seniors are stealing from our young"

"It is important shaping the debate. We have always heard the term, 'you don't want to leave the next generation with less than the current generation.' This chart when it was first shown to me, and it is from the Federal Reserve board survey of consumer finances, it is kind of shocking. Because of the previous chart I showed where these transfer payments have gone primarily to the elderly and have been substantial, look at what has happened. If you are A 29-37 year old in this country, your net worth is less than 29-37 year old in 1983. Those are staggering statistics. This is the first generation where a 30-year old is worth literally is worth less than his parents. If you look at older people, their net worth has doubled over this timeframe. Again, because this money has been transferred.

On whether he worries that people will overlook what he is saying because he is a billionaire:

"Well, modestly, the way I would answer that is the way I made my money in the industry wasn't necessarily in stock s. I made most of my money in the bond and currency markets trying to forecast future economic trends and problems that I saw happening. And one thing I'm not very proud of if oyu look at my record, the big years were in bear markets and chaos. I tend to take rate advantage of catastrophes happening in the marketplace. In other words, for whatever reason, maybe I have a dysfunctional personality; I was good at looking around corners and protecting them. And this is much longer a timeframe, but it is the easiest lay-up I have ever seen of something we have got to address and a problem we have got to deal with...My record speaks for itself on forecasting."

On what changed his opinions of President Obama since 2008:

"I was drinking the hope and change Kool-aid. I was thinking of a younger generation. I think in hindsight, looking back, he probably needed more experience for this job. I also thought he would be more Clinton-like a move to the center. Clearly, he hasn't...I am an independent and just hoping one candidate on either side in 2016 shows up."

On what he is doing investing wise:

"Not a lot. I don't want to hedge, but I probably have the smallest positions I've had. I had some big decisions earlier in the year. I'm sort of sitting and waiting. There is a lot of uncertainty over who the next fed chairman will be. What their attitude toward the diminution of QE will be. You have the whole Syria thing. I like to be patient and when I see something, go little bit crazy. I just don't see anything right now.

On whether it matters who the next Fed chairman will be:

"It totally matters. When you think back of what Paul Volcker, Alan Greenspan and Ben Bernanke have meant to markets, it is pretty naïve to say the next Fed chairman won't matter. It may not know why it matters and I may not know why, but it is a really, really important appointment."

On whether he has an idea on who the next chairman will be and what impact they will have on financial markets:

"I don't. There is a market consensus, and I have my views, but I probably wouldn't want to share them on National television."

On what he is doing if he is not completely sitting on cash:

"Ok, so my guess is, and I believe the market is topping. The stock market predicted seven out of the last three recessions; I predicted seven out of the last three bare markets. I started in a bear market, so I have a bearish bias. Where I am on the market is if you gave me a stock I really like, I will buy it. If you give me a stock I really hate, I'll short it. In terms of having some big position, long or show indez, or some exposure to the stock market right now, I am lost. I don't play when I am lost. I know in the future I won't be lost.

On whether other managers can say 'I'm going to take 2 and 20 and not invest:

"I don't know. The way I always approach a business is, you give me a pile of money and I'm going to try and pound the money for you overtime as best I can. This whole quarterly performance and risk-adjusted stuff invading the hedge fund, I don't get it. I can't imagine why anybody would pay two and 20 to what is out there. When I started in the business, there was me, George Soros, Paul Tudor Jones, Bruce Kovner. We were expected to make 20-percent a year in down markets. There was none of this 'Oh, I've got a risk-adjusted return of 8. That is how to two plus 20 came about.

On why Hedge Fund managers are less successful:

"There are too many, there were eight to ten back then. Somehow, 9000 people are pricing their product off of eight to ten people historic performance. I noticed a lot of the smart early investors and hedge fund clients were leaving, but they were more than replaced by state pension funds, sovereign wealth funds and so far they have been perfectly happy to get returns that our early investors would have never tolerated."

On whether he invests in other funds:

"Yes. I do"

On how he makes the decision of whom and want to invest with:

"I meet with them. Luckily, I've been in the business 35- years so I think I have a pretty good edge about what makes them just go over their investment philosophy and see whether they can make money over time."

On what makes of the media circus around credits like Herbalife and the personalities getting involved:

"To each his own. I am surprised because I always thought publicizing your positions was not a good thing. It might be great for a day or two, but these people forget, you have to get out of these positions... The only time I really got interested in Herbalife is when you guys did the show on Bill Stewarts. That got my attention. The guy was not looking to do a day trade or somebody shorted this or that. That was a s serious, serious investor. That will get my attention."

On what else is getting his attention:

"I'm very focused on the new fed chairman and I'm perfectly willing to wait a few weeks to find out."

On how close are we right now to a bear market:

"As long as the fed is printing money, not very close. That is why the issue of tapering and where we go with it, is so important. I don't really care whether we got to 70 or 65 in September. But if you tell me QE is going to be removed over nine or twelve month, that is a big deal. It is my belief that QE has subsidized all asset prices and when you remove that, the market will go down."

On what we see in asset prices is illusory:

"My first mentor and boss, Dr. Ellison from Pittsburg used to tell me, it takes hundreds of millions of dollars to manipulate a stock up but the minute you have this phony buying stock, it can go down on no volume. It can just re-price immediately. I personally think as long as this game goes on, assets will stay elevated. When he removed that prop, let's face it, the Fed says they're targeting asset prices. Those prices can adjust immediately. June was instructive. If you did not believe before the exit was going to be tough, the mere hunt that maybe in three months, if the economy is good, we might go from $85 billion a month to buying $65 Billion a month, cause that kind of havoc and risk around the world./ How in the world does anyone think when the actual exit happens that prices are not going to respond? It is silly."

On what he has big positions in:

"I don't have what I would call it takes courage to be a pig position in anything. I am long some Japanese equities. I am short some yen. In terms of big outside bets like I had earlier in the year in something like Australian dollar or, frankly, my bet in Japan were bigger earlier in the year, everything is sort of down and waiting for the next big shot."

On whether hedge funds are a force for good or for evil:

"I would say they are neither. I am surprised George [Soros] said that. I'm sorry I missed that show. What I would say, and because George is more in the macro world, is that specifically, he's probably talking about currencies. I would think that is the best example. I have made some currency bets if you don't have the fundamentals with you they're not right, you may win for a little while, but you're going to lose."

On what asset class has been manipulated most because of QE:

"I would say stocks. I have been really wrong on the bond market in the last three or four months. I have been waiting for this decline for two years and completely missed it. First of all, the stuff we were talking about earlier in the show, that is too far down the road in my opinion, for the bond market to pay attention. I have always found in bonds, if you can predict a relative change in the economy, relative to consensus, you will make money in bonds if you get that equation right... Yes [even in the world of QE]. Two or three months ago, I thought people were overly optimistic on the U.S. economy. It is my judgment that assessment turned out to be correct. But bonds went down anyway for not economic reason because we have the unwind going on. For whatever reason. While I anticipated down the road, I did not think it would happen while the economy was softening."

On whether he is concerned were too focused on Syria to focus on the economy:

"I think we will always be focused on the economy. I am a little concerned that the Fed chairmanship could be hung up. It has become a complete circus. You have economists and politicians and newspaper people pining on it. My God, Obama should just go in the rose garden and appoint whoever he wants to appoint. That is his privilege and his job."

On how his investment philosophy reflects his personal views:

"I wouldn't say it is my investment philosophy, it is just a concern I have. Let me say when Al Hunt said this is easily fixable, I think it is a mistake most people make in investments. They look at the present instead of the future. If you analyze the debt is stated out there, it looks like it is fixed. We do a little change here and change there. That is not the case. Those charts we showed earlier had no demographics in them. What is going to happen now, because 1947 is when the baby boom start and fertility rates were over three than and are two now, 11,000 seniors every day come and we will have 11,000 new seniors. This will make the numbers of seniors who are getting entitlements explode relative to the working population. Instead of having give workers supporting entitlements, you will have 2.5 workers, and that is not on the government sheet. When you hear about the National debt being $16 Trillion or $12 Trillion, if you actually took what we promised to seniors and future taxes, present value to both of them, that number is $200 Trillion. That is the problem when you take the debt of future payments to seniors and put them on the balance sheet, and for god's sake, they should be on the balance sheet. I mentioned the can kicks back organization. They sponsored a bill in Congress, the Inform Act, which will bring that."

"True transparency. We need to at least get that on the books so people see it. The other thing that annoys me on this problem and then we can move on, all of these solutions, even Paul Ryan who got absolutely lambasted pushing grandma off the cliff, even he said, let's exempt everybody 55 and older. They already have this huge share of the pie. The problem is compounded away. If you don't address it today, the problem is going to be much bigger in 10 years, 20 years, 30 years."

On how he looks back on the last five years since the financial crisis:

"So I find the situation somewhat bizarre. It is a little bit colored by how I thought we got into this. I actually did well in the financial crisis because I believe this was the reason we got into it. I'm not saying it was the major reason, but a necessary condition have a financial crisis, in my opinion, is too loose monetary policy that encourages people to take undue risk and go on the risk curve and do silly things. We should have shut this down in 1998, 1999. The NASDAQ bubble, we should have raised rates, we didn't."

Seniors Are stealing from our Young

A Looming Catastrophe in Entitlement Spending

Fed Choice Totally matters to Market

I've Been Really Wrong on Bonds

Is Monetary Policy too loose?

Copyright © 2013 Bloomberg - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Bloomberg Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.