Elliott Wave Forecast On USD-CAD: Two Scenarios, Both Bullish

Currencies / Canadian $ Sep 11, 2013 - 01:14 PM GMTBy: Gregor_Horvat

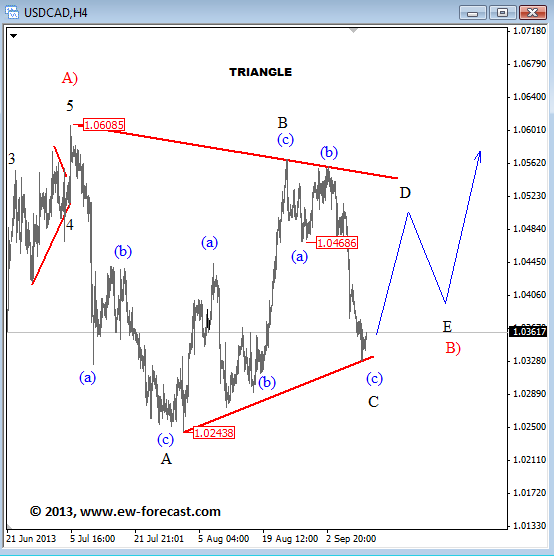

USD-CAD is in bearish mode since Friday which means that move from 1.0243 was actually made only in three waves, so this rally is now part of a larger complex correction, either a flat or a triangle. For now we will focus on a triangle but need to see an evidence of a low around 1.0300 zone and rally back to 1.0468 to confirm idea of a contracting triangle.

USD-CAD is in bearish mode since Friday which means that move from 1.0243 was actually made only in three waves, so this rally is now part of a larger complex correction, either a flat or a triangle. For now we will focus on a triangle but need to see an evidence of a low around 1.0300 zone and rally back to 1.0468 to confirm idea of a contracting triangle.

USDCAD-Triangle

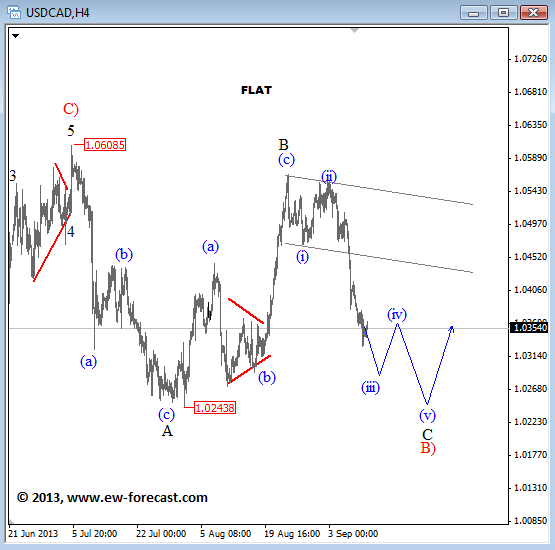

On the other hand, if pair will continue straight down in impulsive fashion toward 1.0250 then we will be looking for a flat correction in red wave B where pair can reach levels beneath 1.0240 and even around 1.0200 before bulls come back in view.

In either case both patterns are corrective and both suggests that USDCAD just stopped in larger temporary pause and that sooner or later pair will turn bullish for 1.0650 maybe even 1.0700.

USDCAD 4h Elliott Wave Analysis

What is a Triangle Pattern?

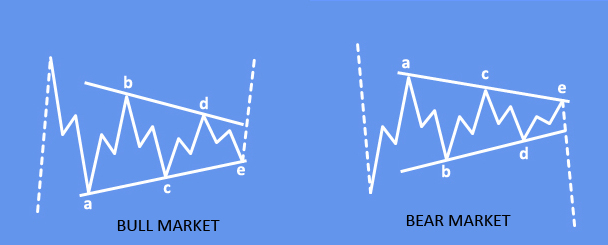

A Triangle is a common 5 wave pattern labeled A-B-C-D-E that moves counter-trend and is corrective in nature. Triangles move within two channel lines drawn from waves A to C, and from waves B to D. A Triangle is either contracting or expanding depending on whether the channel lines are converging or expanding. Triangles are overlapping five wave affairs that subdivide 3-3-3-3-3.

Contracting triangle

- Structure is 3-3-3-3-3

- Each subwave of a triangle is usually a zig-zag

- Wave E must end in the price territory of wave A

- One subwave of a triangle usually has a much more complex structure than others subwaves

- Appears in wave four in an impulse, wave B in an A-B-C, wave X or wave Y in a double threes, wave X or wave Z in a triple threes

What is a Flat Pattern?

A Flat is a three-wave pattern labeled A-B-C that generally moves sideways. It is corrective, counter-trend and is a very common Elliott pattern.

Regular flat

• structure is 3-3-5

• wave B terminates about at the level of the beginning of wave A

• wave C terminates a slight bit past the end of wave A

• appears in wave two or four in an impulse, wave B in an A-B-C, wave X in a double or triple zig-zag, or wave Y in a triple threes

Written by www.ew-forecast.com | Try our 7 Days Free Trial Here

Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power.

Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders.

He was working for Capital Forex Group and TheLFB.com. His featured articles have been published in: Thestreet.com, Action forex, Forex TV, Istockanalyst, ForexFactory, Fxtraders.eu. He mostly focuses on currencies, gold, oil, and some major US indices.

© 2013 Copyright Gregor Horvat - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.