Investment Perspective- What to do in a Tough Investment Climate?

Stock-Markets / Stock Market Valuations Apr 06, 2008 - 11:53 AM GMTBy: Brian_Bloom

When the going gets tough, the tough get going. From an investment perspective, times are getting tougher; so what do we do?

When the going gets tough, the tough get going. From an investment perspective, times are getting tougher; so what do we do?

Well, “step 1” is to straighten out our thinking so that we can face the future with clear heads. There are times when an investor's orientation should be to increase his/her wealth; and there are times when that orientation is more appropriately focussed on preserving what you have. In this analyst's view, we are now facing a time when stock market investor orientation should be defensive.

My “opinion” (which I have been stating with a degree of confidence which might seem excessive to some) is that we are in the early stages of a Primary Bear market.

The “fact” is that the industrial markets have recently been showing signs of some bullishness.

Question: Is it appropriate for me to change my opinion?

Answer: No, it's important to keep perspective.

By way of explanation, some definitions are probably appropriate. In my own mind I differentiate between three approaches to “investment” on the stock markets:

- Tactical (short term)

- Strategic (medium term)

- Philosophical (long term)

A Primary Trend orientation is required to address the long term question of whether – as a matter philosophical principle – one should be “in” the market, or “out of” the market.

In my experience, if one looks at a typical 5-3-5 Primary move (5 waves up, 3 waves down, and 5 waves up in a Bull Market; and the opposite in a Bear Market), the following typically manifests:

- Most short term (tactical traders) make profits in the intermediate move using their computerised technical indicators, and many get wiped out in the intermediate technical reaction as their indicators give false signals right at the top and/or bottom of the intermediate legs.

- The medium term (arbitrageurs) buy and hold for a few years and then sell when prices look historically high. (In a bear market the opposite occurs). Those who do not sell become “long term investors.”

- The long term investors continue to make money in the long term if the Primary Trend is up. However, two things typically happen in a Primary Bear Market (and the opposite in a Primary Bull Market)

- Profitability begins to shrink at corporate level

- Price/Earnings ratios shrink.

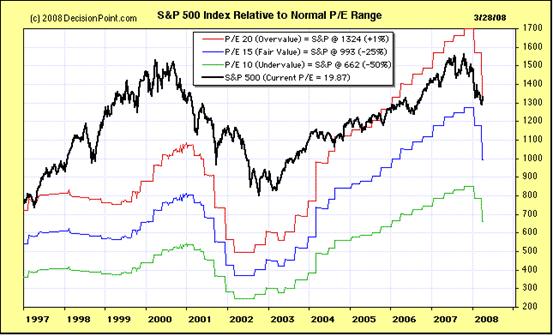

The following is a chart (courtesy decisionpoint.com ) of the S&P relative to its Price Earnings ratios

In terms of the above chart, if the P/E ratios were to pull back to “normal” levels, and assuming profits did not shrink, then the S&P could fall from 1324 to 993 or by 25%. If they were to fall to “historically undervalued” levels then the S&P could fall from 1324 to 662 or by 50%.

The undervalued level (P/E ratios of 8-10X) typically manifests near the bottom of a Primary Bear Market after corporate profits have fallen to below historical average. For example, this implies (if profits also fall by 50%) that if earnings of $1 per share were to fall to 50 cents, and P/E ratios were to fall from 19.87X to 10X then the share price will fall from $19.87 to $5.00 or by just short of 75%.

If we look at what that might do in terms of the Ultra Long Term chart below (courtesy decisionpoint.com ) then a 75% fall from 1324 will lead to a price of 331 – which would be below the 76 year rising trendline - which currently sits at 500.

Not to put too fine a point on it, this would be a disastrous outcome to anyone invested “for the long term”. (Readers should note that I am not making a forecast her. I am trying to make a point of principle.)

Question: What causes P/E ratios to fall?

Answer: “Structural pessimism”. Investors give up on the concept of making money out of capital gains on the stock market and look to dividends as the primary source of income.

But, in recent history, dividend yields have not been sufficient to offset inflation; and dividends in absolute dollars are unlikely to rise in a Primary Bear Market. Therefore, what happens is that dividend yield rises as stock prices fall.

And now we start to understand why the stock markets in the past 25 odd years have been rising in capital terms: There has been no purpose to be served in investing for dividends in an environment of structural inflation. Capital gains has been the name of the game, and this lunging for capital gains on the part of investors has been driving P/E ratios up – aided and abetted by an era of easy money facilitated by the US Federal Reserve Board. Importantly, this “easy money” policy is now built into the system and is part of modern life. There is a (theoretical) bullish bias to the equity markets given that the money has to go somewhere. For that reason alone, it seems unlikely that the equity markets will just collapse in on themselves.

But let's get back to the first chart. It is a fact (not opinion) that the red line was travelling below the black line between 1997 and 2006 (Prices were above the 20X multiple). It is also a fact that the P/E ratios have fallen sharply in the past couple of years, and that prices are now tracking the 20X P/E multiple.

This begs the question: Are prices going to rise to a level above the red 20X P/E line, or are they going to fall below (the now falling) red line?

Well, here are some more “facts” that are “driving” corporate profits in the USA:

- Between 60% and 66% of the USA's GDP is accounted for by consumer spending.

- Of the 300 million odd US consumers, roughly 28 million are having their income augmented by food stamps, up from 26.5 million in 2007. Source: http://www.shortnews.com/start .cfm?id=69699

- "A recession is possible," said Bernanke, who is under immense political and public pressure to turn things around. (Source: http://www.freep.com/apps/pbcs .dll/article?AID=/20080403 /BUSINESS07/804030354/1020 )

Given this information, I am not going to express my own opinion. I am going to pose four questions to the reader:

Question 1:

On a scale of 1-10, what do you think are the probabilities that the P/E ratios are going to rise from here? The question is not whether you think prices are going to rise, but whether you think P/E ratios are going to rise.

In answering this question, one needs to remember that P/E ratios expand against a background of optimism.

One also needs to bear in mind that so-called “contrary opinion” is a sensible approach at market extremes. Thus, if the market is extremely bullish, then it pays to be bearish. If the market is extremely bearish, then it pays to be bullish.

There has been a lot of talk about how “pessimistic” investors are at present. So let me pose another question.

Question 2:

Against a background where current P/E ratios are 19.87X and against a background of “fair value” P/E ratios of 15X – on a scale of 1-10, just how pessimistic do you think the average investor is right now? (As opposed to “fearful”)

If you score investor pessimism at around 8-9; then it pays to be a contrary investor and you should probably be buying – which implies that P/E ratios will likely rise from here to a level above 20X.

Question 3:

How optimistic do you think the average investor is right now?

If you score investor optimism at around 8-9; then it pays to be a contrary investor and you should probably be selling.

That, dear reader, is how contrary opinion works to the benefit of investors.

Question 4:

On a scale of 1-10, and given your answers to questions 2 and 3 above; what do you think is the probability that corporate profits are going to rise from here?

The reason I am writing this particular article is that I received an email from a reader wherein he characterised my investment views as somewhat “left field”. That caused me to stop and think and my answer to him, verbatim, is reproduced below:

“Strategic Positioning” of businesses or the economy is all about “being where the puck is going to be.” For a living, I am a strategic adviser. I peer into the future on behalf of small businesses who wish to grow to become large. Peering into the future, by definition, uses the present as a point of departure. The trick is to know which dots to connect to draw the trendlines that will be extrapolated into the future. As the world becomes more and more frenetic, I have found myself going back further and further into history to identify the “mega” trends. There is too much turbulence at the coalface today to pick the short term trends with any confidence. I find that when you stand back far enough, the trend becomes clearer. For example, here is a monthly chart of the S&P. By no stretch of the imagination can anyone argue that this chart is “bullish”. It might have some significant upside if the Fed can succeed in throwing enough money at it, but the “trend” is most certainly not up. The trend is not our friend here and, therefore, investment in mainstream industrial and commercial businesses is fraught with risk because of the potential for P/E multiples to contract.

All of which begs the question as to what we should do?

From a defensive perspective, buy gold and park your money in short term treasuries; preferably some which are not denominated in US$

But we can't just sit on our hands here. We have to plan for the (longer term) future. In this context, it seem sensible to invest in growth businesses where your entry point cost is less than a P/E Multiple of 10X. The smaller the business, the higher the risk of failure, and the lower should be the P/E. Do not invest in start-ups

Now, with the intention of pointing a direction of where to look to find such investments, here is one of my “left field” arguments about how to position one's self to be where the puck is going to be in today's frenetic environment.

By going back into history (as far back at 5,000 years ago) I have been able to identify more than one trend which is having an impact on our lives in 2008. I have done this by connecting the dots which date back – in some cases – to around 3,000 BC through the intervening centuries to the present day; and to extrapolate these trends into the future. It was not a trivial exercise, but it was necessary research for Beyond Neanderthal . (As an aside, the novel makes fascinating reading because joining the dots leads to several “Aha!” moments. You can register interest to acquire a copy by going to www.beyondneanderthal.com Editing is now complete and the 150,000 word novel is about to be handed over for layout design.)

One conclusion that I have drawn is that the age of “materialism” is drawing to a close, and an age of “ethical behaviour” is likely to replace it. (Remember we are looking 5-10 years down the track)

Here is my reasoning (Flowing from extrapolation of the factual trend) :

The Industrial Revolution dating back to the mid 1700s was built on the back of fossil fuels. For various reasons, the fossil fuel era is drawing to a close and, therefore, the age of consumerism is probably also drawing to a close. In an age of fossil fuel abundance, an attitude of profligacy was possible. For example, a used 20 cent plastic ballpoint pen could be disposed of without a second thought. Such behaviour was (and still is) encouraged. For example: One ad I see regularly on TV is: “xyz brand. The pen people love to pinch”.

In an age when we can no longer afford this kind of careless behaviour, “quality” and “durability” will become the watchwords. One implication is that consumers will also become more discriminatory about what they buy – because it will have to last. Therefore, “trust” will become of paramount importance. “If you tell me that your product represents value for my money and I find that it doesn't then I will not deal with you a second time; and I will probably tell all my friends and associates.” It follows that integrity and ethics are going to come to the fore. This is not an altruistic feel-good argument. It is a hard nosed, market driven argument. A sure as night follows day, if products are going to have to be built to last and deliver value for money, the survivors in commerce will be those people who are trustworthy.

So, if you want investment direction in today's market, what you need to do is answer the following question: What product/service/company /industry stands out as being the most trustworthy in today's environment?

To assist you, I have drawn up a (non exhaustive) table. Just answer the following simple question: On a scale of 1-10, how much integrity do you feel is inherent the following investment opportunities? When you have answered that question, rank your answers, and that's where you should be putting your money today – because, philosophically, that's what's going to be sought after in the future.

For the reader's benefit here is a dictionary definition of the word “integrity”:

“Moral soundness; honesty; freedom from corrupting influence or motive; -- used especially with reference to the fulfilment of contracts, the discharge of agencies, trusts, and the like; uprightness; rectitude.”

| Investment Target | Reader's own score, 1-10, (Based on perception of integrity) |

| Gold | . |

| Silver | . |

| US Treasury Bonds – Long Term | . |

| US Treasury Bills – Short Term | . |

| /td> | . |

| Real Estate which is funded 50% by debt and 50% by equity and the market rate of rental allows the debt to be serviced and paid down over 30 years. (Implication is that residential property prices will need to fall by around 25%-33% from current levels or rents will have to rise by 33%-50%) | . |

Alternative Energy technologies that substitute one ecological problem for another |

. |

New business where the management has no track record |

. |

Transport Logistics |

. |

Medical technology that will help to reduce the ratio of health services expenditure to GDP |

. |

High fashion business (Trick question. Check definition of integrity) |

. |

| Business that is opportunistically riding a fashion wave (Subtly different from the question above. It implies one-off opportunism) |

. |

The core difference between future thought processes and past is that, in the old “throwaway” thought paradigm, it was all about short term profits. Profits in the next quarter were the driver of stock market prices. Often these profits were massaged by management who lacked integrity. In an environment where ethics and integrity will be forced by the broader consumer market, such behaviour will not be tolerated. The paradigm will be: “I would rather have a lower level of income with a higher probability of receiving it.”

As integrity begins to emerge, we can expect a wave of profit write downs which will redress historical “fictions”.

The bottom line is this: “Risk” will take on a new meaning. And if people's thought processes are shifting to become risk averse, then the Fed can whistle Dixie. It doesn't matter how much money they print or how low a price they charge for the money, the predisposition to borrow it (in this analyst's view) will be lower.

By Brian Bloom

Beyond Neanderthal has been “under construction” since October 2005. Reading the now edited manuscript from cover to cover I find myself contemplating how far humanity has drifted from the ethical principles which were articulated in the various religious Testaments; and how much value they (all of them) have to offer us in 2008. When one looks below the surface of the dogma, there is no question that these tomes contain timelessly valuable information. By way of one small example: The Old Testament is crystal clear in explaining that silver (the shekel) was “money”. Beyond Neanderthal peels away the layers of dogma and demonstrates that gold derives its value from its unique physical properties. The nature of those properties is revealed, and the storyline demonstrates their importance from a technological perspective. Please register your interest to acquire a copy at www.beyondneanderthal.com

Copyright © 2008 Brian Bloom - All Rights Reserved

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.