Sell Gold, Buy Stocks: Really Dumb Idea

Commodities / Gold and Silver 2013 Sep 06, 2013 - 05:06 PM GMTBy: Ned_W_Schmidt

With delusions running rampant, the investment community gave into the pressures for conformity in June to embark on another one of their ongoing errors of judgement. Selling Gold and buying equities became an emotionally driven mania, void of reason. Rather than assessing rewards and risk for their clients, the "teenage" traders running "hedge" funds again chose the wrong strategy.

With delusions running rampant, the investment community gave into the pressures for conformity in June to embark on another one of their ongoing errors of judgement. Selling Gold and buying equities became an emotionally driven mania, void of reason. Rather than assessing rewards and risk for their clients, the "teenage" traders running "hedge" funds again chose the wrong strategy.

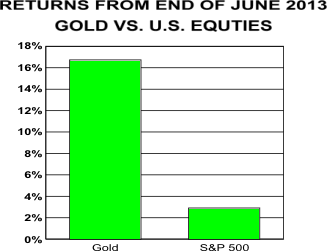

Chart to the right portrays the investment results since the Great Gold Dump of June 2013. Apparently the "teenage" traders dumped Gold at a major bottom, which likely was the beginning of a new bull market leg for Gold. In any event, the funds simply got it slightly backwards. Correct strategy for their clients' money is to buy low and sell high. Over the past two year they bought high and sold low. Maybe they will get right next year, assuming their clients have any money left with which they can play at investment management.

While that is what happened the past few weeks, what are the opportunities ahead? Following chart portrays the year end ratio of $Gold to the S&P 500 as well as the most recent observation. The black line is the average of those almost 70 years of experience. When the ratio is below that average, Gold is the under valued asset. As we write, $Gold is the most undervalued relative to the S&P 500 that it has been in six years. And think about that. Which would you rather own for the future?: The Facebook fantasy or a real asset?

While many are preoccupied with Fantasy Football at this time of the year, the investment world is focused on a bigger game: Fantasy Monetary Policy. In this game pseudo experts attempt to select a monetary policy that will insure prosperity and enhance the value of paper equities. With U.S. unemployment continuing at record levels, the FOMC might be better off playing Fantasy Tennis at their meetings.

In the next two weeks an avalanche of articles and commentaries will near drown us in pseudo wisdom on the impact of tapering by the Federal Reserve. Regardless of their decision, the risky asset under reduced bond buying by the Federal Reserve is the over value asset, equities, not the under valued one, Gold.

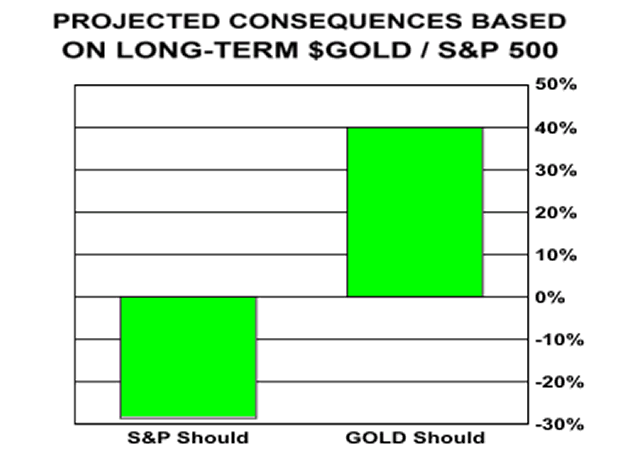

The asset that has been supported and experienced artificially inflated prices is equities, not Gold. If we use the data portrayed in the previous chart on the ratio of $Gold to the S&P 500 we can estimate relative over or under valuation. That has been done in the chart below.

If we use the average of that ratio, an approximation of relative valuation can be calculated. Using that ratio and assuming that Gold is correctly priced, the S&P 500 is over valued by 30%. Alternatively, if the S&P 500 is correctly priced, Gold is under value by 40%. That situation seems reasonable as equity values have clearly been inflated by the pseudo economic science of the Keynesian economists running the Federal Reserve.

Investors have a simple choice. Play Fantasy Economics with the "teenage" traders and the Federal Reserve, or own real assets. With two massive financial failures already achieved by the Federal Reserve, do you want to bet your wealth that they will get it right this time? When the central bank of a nation repeats the same mistake over and over wealth insurance is a necessity.

By Ned W Schmidt CFA, CEBS

Copyright © 2013 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.