Market Manipulation on Hedge Funds Margin Calls to Trigger Distressed Selling

Stock-Markets / Credit Crisis 2008 Apr 05, 2008 - 11:50 AM GMTBy: John_Mauldin

Thoughts on the Continuing Crisis

Thoughts on the Continuing Crisis - If the Rules are Inconvenient, Change the Rules

- Let's Re-arrange the Deck Chairs

- Regulations Coming to a Hedge Fund Near You

- More Fun in the Unemployment Numbers

- A Muddle Through Recession

- How Much do we Borrow for a $1 growth in GDP?

There is so much that is happening each and every day as the Continuing Crisis moves slowly into month 8, so much news to follow, so many details that need to be followed up that it can get a little overwhelming. Where to begin? Maybe with a "minor" change of the rules on how we value assets, then a look at the proposed changes in regulations, some comments to my hedge fund friends, a quick look at the employment and ISM numbers which are clearly showing we are in a recession and then finish up with some thoughts as to what it all means. There is a lot of ground to cover, so we will jump right in without a "but first" today.

If the Rules are Inconvenient, Change the Rules

Several times in the past few months I have reminded readers of the problem that developed in 1980 when every major American bank was technically bankrupt. They had made massive loans all over Latin America because the loans were so profitable. And everyone knows that governments pay their loans. Where was the risk? This stuff was rated AAA. Except that the borrowers decided they could not afford to make the payments and defaulted on the loans. Argentina, Brazil and all the rest put the US banking system in jeopardy of grinding to a halt. The amount of the loans exceeded the required capitalization of the US banks.

Not all that different from today, expect the problem is defaulting US homeowners. So what did they do then? The Fed allowed the banks to carry the Latin American loans at face value rather than at market value. Over the course of the next six years, the banks increased their capital ratios by a combination of earnings and selling stock. Then when they were adequately capitalized, one by one they wrote off their Latin American loans, beginning with Citibank in 1986.

The change in the rule allowed the banks to buy time in order to avoid a crisis. It did not change the nature of the collateral. They still had to eventually take their losses, but the rule change allowed both the banks and the system to survive. I have made the point that the Fed and the regulators would do whatever it has to do to manage the crisis.

All the major new multi-hundred billion dollar auctions at the Fed where the Fed is taking asset backed paper as collateral for US government bonds does not make the collateral any better, of course. It just buys time for the institutions to raise capital and make enough profits to eventually be able to write off the losses.

Thus it should not come as a surprise to you, gentle reader, that the rules have been changed in much the same way as in 1980. In an opinion letter posted on the SEC website last weekend clarifying how banks are supposed to mark their assets to market prices is this little gem (emphasis mine):

"Fair value assumes the exchange of assets or liabilities in orderly transactions . Under SFAS 157, it is appropriate for you to consider actual market prices, or observable inputs, even when the market is less liquid than historical market volumes, unless those prices are the result of a forced liquidation or distress sale. Only when actual market prices, or relevant observable inputs, are not available is it appropriate for you to use unobservable inputs which reflect your assumptions of what market participants would use in pricing the asset or liability." (The full letter is at http://www.sec.gov/divisions /corpfin/guidance/fairvalueltr0 308.htm .)

So, now banks can simply say that the low market prices for assets they hold on their books are actually due to a forced liquidation or distress sale and don't reflect what we believe is the true value of the asset. Therefore we are going to give it a better price based on our models, experience, judgment or whatever. In today's Continuing Crisis, nearly every type of debt and its price can be classified as a forced liquidation or distressed sale.

Does this make the asset any better? Of course not. But it buys time for the bank to raise capital or make enough profits to eventually take whatever losses they must. And who knows, maybe they will get lucky and the price actually rises?

There are two problems with this rule. First, it clearly creates a lack of transparency. The whole reason to require banks to mark their assets to market price rather than mark to model was to provide shareholders and other lenders transparency as to the real capital assets of a bank or company.

Second, can a forced liquidation or distress sale be from a margin call? Obviousy the answer is yes. But as Barry Ritholtz points out, this opens the door for some rather blatant potential manipulation. If a bank makes a margin call to hedge funds or their clients to make the last price of a similar derivative on their own books look like a forced liquidation, do they then get to not have to value the paper at its market price? Is this not an incentive to make margin calls? One price for my customers and a different one for the shareholders? If a hedge fund was forced to sell assets and then they find out that the investment bank is valuing them differently on their books than the price at which they were forced to sell, there will be some very upset managers and investors. Cue the lawyers.

Is this a bad ruling? Of course. But is it maybe necessary? It just might be. My first reaction was that this tells us things are much worse than we think. The struggle to get the mark to market ruling only to abrogate it in certain circumstances less than a year later has to gall a lot of responsible parties. It seems like it is 1980 and Latin America all over again. Let me repeat: The Fed and the Treasury (who oversees the SEC) will do what it takes to keep the game and the system going.

Let's Re-arrange the Deck Chairs

Treasury Secretary Hank Paulson put forth a number of "new" ideas for changes in the regulatory structures. Nothing I saw will help all that much in the current crisis. It's more like re-arranging the deck chairs as the ship is going down. It seems like most of it is being proposed to prevent another crisis like the one we are in from occurring in the future. That simply insures that Wall Street will have to invent whole new ways to create a crisis in the future. I am sure they will be up to the task.

Most of the proposals are basically good ideas that have been discussed for a long time, like merging the CFTC (Commodity Futures Trading Commission) and the SEC. We are the only country with such a bifurcated regulatory system. Good luck with getting that through Congress, though. The Agricultural Committees in the Senate and the House oversee the CFTC and futures trading, dating back to the 1930's when all that was traded was agricultural products. Now the CFTC oversees a vast derivatives market, which of course makes campaign donations to members of those committees. Think those Congressman want to see their major campaign donors go away? Of course, that means the Finance Committees would get new donors. It will be amusing to watch and see who "wins."

The really interesting item is the potential for the Fed to regulate investment banks, which makes some sense if they are going to loan them money at the discount window. Left unsaid and up for future negotiation is whether that would mean investment banks would have to reduce their leverage. Right now, investment banks utilize about twice the leverage as commercial banks. That leverage is what makes them so profitable. Take that away and they lose a lot of their profit potential.

A great part of the continuing crisis can be laid at the feet of too much leverage in too many places. The world is de-leveraging fairly rapidly. In some circles, it looks more like an implosion. The Fed and the SEC have made it very clear they want to have more authority to oversee all sorts of funds and investment banks so they can get a handle on the amount of leverage in the system. What you do with that information is another thing, but they want it and will use the Continuing Crisis to get that authority. My bet is that investment banks are going to be forced to reduce their overall leverage "for the good of protecting the system from itself" or some such twisted logic.

So, let's sum it up. The problem is so severe with the financial companies assets that the SEC is going to allow some of them to "cook the books" so they can survive. That means there are going to be large and continuing write-downs for many quarters to come. There is a minimum of another $3-400 billion in write-downs (and maybe a lot more) coming from mortgage related assets, not to mention credit cards and other consumer related debt. And the investment banks may be forced to reduce their leverage and thus their profitability?

Putting money in the major financial stocks is not investing. It is gambling on a very uncertain future. There is simply no way to know what the value of the franchise is. There are other places to put your money.

Regulations Coming to a Hedge Fund Near You

The SEC pushed through rules last year to regulate hedge funds. The courts ruled (properly, I think) that the SEC did not have congressional authority to do so. The hedge fund industry fought tooth and nail to avoid regulation and dodged the bullet.

I think the mood in Congress is going to be such that as the authorization for many of Paulsen's proposed changes make their way through Congress, some of them are going to allow the SEC the authorization they need to regulate hedge funds. The Continuing Crisis almost makes it a sure thing.

So, a quick note to my friends in the hedge fund industry. Forget fighting regulation and start negotiating. Recognize that regulations are coming and do what you can to make them as rational as possible. Also, make sure you (we) get the rights of other regulated funds, like the ability to advertise and not be so secretive, at a minimum. And maybe a more reasonable interpretation of the research analyst rules, which I note that many seem unaware of the implications on hedge funds and private offerings of the research analyst rules.

I am regulated by FINRA (the former NASD) which is overseen by the SEC, the NFA (the self-regulatory arm of the CFTC) and various state financial authorities. It seems like we get a regulatory audit almost every year from someone. My small firm survives, and so will hedge funds. Does it cost a lot of money and time to be regulated? Sure. But that is the price of doing business.

Will making hedge funds register make them any safer? I doubt it. Think of Enron and WorldCom. REFCO was registered and somehow hid a $500 million dollar bogus loan from regulators, their investment bankers and auditors. But it will make them more transparent. If we are going to have to pay the costs of being regulated let's make sure we get the benefits.

More Fun in the Unemployment Numbers

Payrolls tumbled by 80,000 today, more than forecast and the third monthly decline, the Labor Department said today in Washington. The unemployment rate rose to 5.1%, the highest level since September 2005, from 4.8%. The household survey shows the number of unemployed people rose by 438,000. (That is not a typo!) In March, the number of persons unemployed because they lost jobs increased by 300,000 to 4.2 million. Over the past 12 months, the number of unemployed job losers has increased by 914,000.And of course, when you look into the numbers it is worse than the headlines implies.

Prediction: we will see 6% unemployment before the end of the year.

There were negative revisions totaling 67,000 job losses for the last two months, making those months even worse. This means that the Bureau of Labor Statistics (BLS) is clearly over-estimating the number of jobs in the first announcement. That is because they have to extrapolate based on recent past data. And as I continually point out, as the economy softens, they are going to continue to overestimate the number of jobs. It's one of the problems of using past performance to predict future results.

Job losses since December are now at 286,000 in the private sector and 232,000 overall, counting for growth in government. What was up? Health care (23,000) and bars and restaurants (23,000 also). Initial unemployment claims are up by almost 25% for the last four weeks over last year, and this week were over 400,000. Given the job losses, this is not surprising.

This month the BLS hypothecates 142,000 jobs being created in their birth/death model. You can guarantee this will be revised down. For instance, they assume the creation of 28,000 new construction jobs as the construction industry is imploding. Total construction spending has fallen for the last four months in a row. Somehow they estimate 6,000 new jobs in the finance industries. Does anyone really think we saw a rise in employment in mortgage and investment banks?

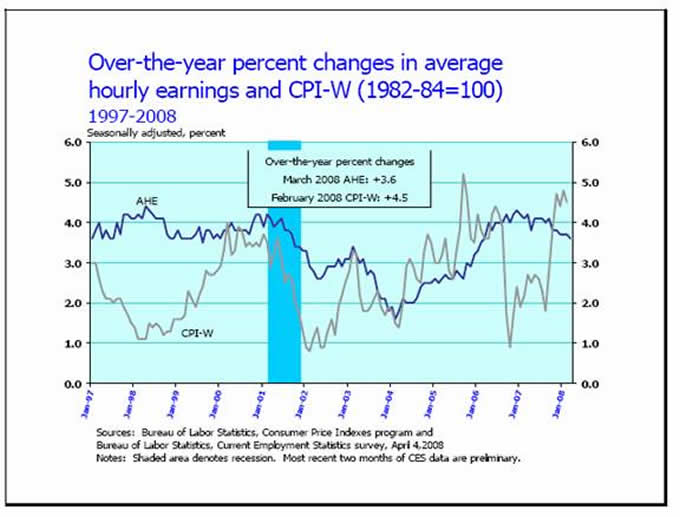

Buried in the data is a picture of a squeezed consumer. Inflation is now running ahead of the growth in wages. As the chart below shows, average hourly earnings were up just 3.6%, but inflation was 4.5%. That means consumers must struggle to maintain their standard of living. No wonder retail stores shed 12,000 jobs last month. Light vehicle retail sales are down by 20% form last year. This all paints a picture of a very challenged consumer.

A Muddle Through Recession

The business sector is clearly in recession. The ISM manufacturing index came in at 48.6. Anything below 50 means manufacturing is in decline. There was a sharp drop in new orders. New orders have been below 50 for four months. Employment has been below 50 for four months. Backlog of orders has been well below 50 for six months. Yesterday the ISM service index was again below 50 for the month of March.

Given all the data, why then do I still think we will not see a deep recession? Because corporate America is in much better shape than in the beginning of past recessions. Lower inventories, better cash to debt ratios, not as much as excess capacity, and so on. As Peter Bernstein notes in his latest letter, nonfinancial corporate debt is at its lowest level in 50 years, and four standard deviations below the average from 1960 to 2000.

The recession we are now in is a consumer spending led recession driven by a falling housing market which is infecting the entire country. Can anyone still claim that the subprime problems would be contained as many did just last summer? Consumer spending is going to fall even more as credit becomes harder to get.

The situation is neatly summer up by Bernstein:

"The debate over whether we are or are not in a recession continues. There is, however, no debate about resumption of rapid economic growth in the near future. That's without question the most unlikely outcome. Yes, there are some bright spots, such as exports in the governmental largess that lies just ahead - and the likelihood of additional government assistance in some form. The Federal Reserve is also doing its part to lubricate the snarls in the financial markets.

"But the household sector is in deep trouble and will remain in trouble for an extended period of time. The combination of falling home prices, the complex problems in the mortgage area, limited financial resources and high debt levels, new constraints and higher costs on consumer installment credit, and probably rising unemployment already sluggish growth and jobs tend to restrain spending by the largest and most important sector of the economy.

"Imagine what would happen if all of these adverse forces struck a business sector stuffed with inventories, busy installing a massive amount of new productive capacity, with labor costs rising and productivity falling, and an overload of new debt to service. A difficult situation in the rest of the economy could be rapidly converted into a deep recession. But the business sector has kept inventory accumulation to a moderate pace, has limited in capacity growth, and has been conservative in adding to debts outstanding. How lucky can you get?

"Some observers are convinced that we are heading toward a deep depression in any case. We are not so sure. We believe the likely duration of these troubles is a greater concern than the depths the system might reach. The condition of the business sector as pictured above is the primary reason for this more hopeful outlook."

But a recession for at least two quarters and a Muddle Through Economy for at least another 18 months is not going to be good for consumer spending, job creation and most especially corporate profits. I continue to predict more disappointment for corporations that are tied to consumer spending and industries that are associated with housing.

S&P analysts continue to project earnings to be up by 15% in the third quarter of this year and by almost 100% for the fourth quarter this year over last year. Yes, I know there are a lot of one time charges and write-offs in the last two quarters of last year which make comparisons difficult. But in a recession and a slow recovery, how likely is it that we will not see even more "one-time" write-offs. And as noted above, there are more than twice as much subprime losses in our future as we have written off as of yet.

As I have written about at length in past issues, bear markets are made by continued earnings disappointments. It typically takes at least three difficult quarters to truly disappoint investors. We are just in the early stages. The recent drop in the stock market has been primarily caused by the Continuing Crisis in the credit markets, and only modestly by disappointing earnings. We need a few more quarters of disappointment to really get to a bottom in the stock market. It could be a long summer.

How Much do we Borrow for a $1 growth in GDP?

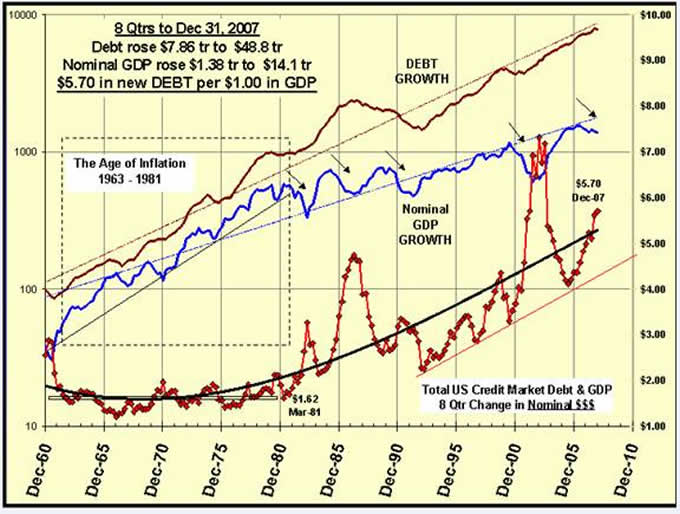

Finally, I want to give you a chart from my old friend Ian McAvity from his latest newsletter Deliberations, which he has been writing for 36 years! Basically, it makes the point that the amount of new debt in relationship to GDP is rising. We borrowed in one form or another $5.70 for each $1 rise in GDP last year.

Debt in all forms rose $7.86 trillion for the previous 8 quarters to $48.8 trillion dollars. Nominal GDP was only $14.1 trillion. This is of course unsustainable. At some point, debt growth must slow dramatically. As the world deleverages, decreasing debt and the resultant slowing of consumer spending will become a head wind for GDP growth.

London, Switzerland and South Africa

Next Wednesday I head out to California for my 5 th annual Strategic Investment Conference in La Jolla. It is completely sold out for the first time. My partners in the conference, Altegris Investments have been doing yeoman work to make it come off in high fashion, and I thank them. I return and immediately head over to London and then Switzerland. I will be speaking for Bank Sarasin at a resort in Switzerland in the Interlaken area, and will stay on for a few days to be tourist and take some needed R&R and fly back on Monday evening.

I will be in South Africa in Johannesburg from May 5 - 8 and in Cape Town from May 12 - 14. If you are interested in attending my presentations you should contact Prieur du Plessis. You can use the contact button on his excellent blog: www.investmentpostcards.com .

I am going to try and play golf for the first time in at least a year. I will be terrible, but I will be playing with good friend and savvy commodity trader Greg Weldon and I look forward to it. Then in the afternoon two of the best Science Fiction writers and futurists in the world, Vernor Vinge and David Brin are going to join me, serious technology maven Dr. Bart Stuck and financial guru and brilliant thinker Rob Arnott for two hours of rambling conversations about the future. My daughter Tiffani wants to record it, and if we do (and with everyone's permission) we will post it on the net. Then 240 new and old friends gather Friday and Saturday to hear some really interesting speakers and enjoy each other's company. It looks to be a great week.

I hope you can enjoy your week as much as I will. And make it a good one. Now if the Rangers can just win their home opener on Tuesday, it will get even better.

Your amazed at how lucky I am analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.