China Loves West’s 99 Fine Gold

Commodities / Gold and Silver 2013 Aug 31, 2013 - 12:21 PM GMTBy: Richard_Mills

According to Bloomberg, whose calculations were based on Hong Kong customs data, net gold imports into China more than doubled in the first half of 2013 to 493 metric tons, up from roughly 239 tons over the same period in 2012.

According to Bloomberg, whose calculations were based on Hong Kong customs data, net gold imports into China more than doubled in the first half of 2013 to 493 metric tons, up from roughly 239 tons over the same period in 2012.

The China Gold Association said gold consumption in China jumped 54 percent to 706.36 metric tons in the first six months of 2013.

Bloomberg reported takeovers and asset purchases by China's gold mining companies reached a record $2.24 billion this year, up considerably from 2012's record of $1.96 billion worth of M&A activity.

Domestic Chinese gold deposits are less than five percent of the global total and cannot supply growing Chinese consumer demand so Chinese producers are aggressively buying up gold companies and mines.

Bloomberg

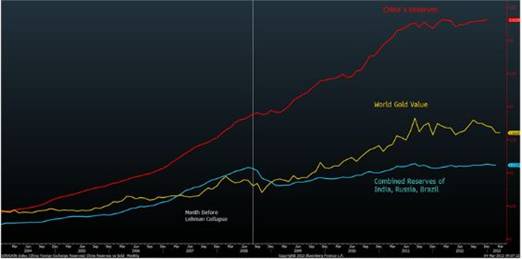

And China has a large foreign reserve bank account with which to work... According to Bloomberg China's foreign reserves (30.2 percent of the world total at the end of 2012) surpassed the value of all official bullion holdings in January 2004 and rose to $3.3 trillion at the end of 2012. Two-thirds of China's assets are dollar-denominated, that's a lot of U.S. dollars that they can turn into physical assets and they are working hard to do so.

The World Gold Council (WGC) estimates Chinese consumer demand may top 900 tons this year handily beating China's record 778.6 tons of demand in 2011. Owning gold was banned in China for most of the 20th century so the Chinese are playing catch up to India's average yearly imports of 963 tons of gold - 2013 could be the year China imports more gold then India.

Premiums paid by jewelers for physical supply in the first half of 2013 jumped fourfold in China - up 45 percent.

In the second quarter of 2013 consumer demand for gold jumped 71 percent in India, last year's biggest gold buyer, but over the same time period gold demand gained 87 percent in China, 2012s second largest buyer.

"Mainland Chinese purchasers have been ferocious. First, they emptied stores in their own country. Caibai, Beijing's largest gold merchant, had a queue 30 feet out the door on the morning of the 19th. "So many people in line," remarked a customer in Nanjing, where one person splashed out 2.9 million yuan on ten gold bars each weighing a kilogram. Retailers ran out of stock in Guangzhou. The China Gold Association reported that on the 15th and 16th retail sales of gold tripled across China. Daily sales soared to five times the usual level at one retail chain.

Volume on the Shanghai Gold Exchange, considered a proxy for the metal's demand in China, surged, setting consecutive records of 30.4 metric tons on the 19th and 43.3 tons on the 22nd. The previous record was 22.0 tons on February 18 of this year.

As Chinese emptied the shelves in their own country, they also went south and swarmed shops in Hong Kong, sometimes in groups. Chow Tai Fook, the world's largest jeweler by market capitalization, said some stores popular with Mainland Chinese ran out of gold bars and that demand had not been as strong since the late 1980s.

Demand for "9999" bullion--99.99% pure gold--was five times normal according to Haywood Cheung Tak-hay, president of the Chinese Gold & Silver Exchange Society. His organization effectively ran out of holdings as members tried to meet supply shortfalls. "In terms of volume, I haven't seen this gold rush for over 20 years," Cheung told the Financial Times. "Older members who have been in the business for 50 years haven't seen such a thing." Gordon G. Chang, 4/28/2013,China Goes Gold Crazy

It has been reported that on June 14th 2013 over 10,000 Chinese lined up, in the streets of Jinan, to buy gold bullion.

Australia & New Zealand Banking Group Ltd., Deutsche Bank AG and UBS AG opened new eastern gold vaults this year.

On the trail of the world's gold

According to Eurostat data U.K. bullion exports (London is the world's largest gold market) rose nearly tenfold through the first six months of 2013. The U.K. sent 798 tonnes (equal to almost 30 percent of global annual mined supply) of its gold to Swiss refineries in comparison to 83 tonnes for the first six months of 2012.

Four of the world's largest gold refiners, Metalor, Pamp, Argor-Heraeus, and Valcambi, are located in Switzerland (Swiss refineries process 70 percent of the world's gold supply) and only they can handle the massive volume of London Good Delivery 400 oz bars that needed to be melted down and recast into the smaller bullion products that Asian buyers prefer - physical gold bought by Asian buyers is usually in the form of small bars and coins.

Goldminersreport.com

Hong Kong shipped 91%, or 736 tonnes, of its total gold exports for the first 6 months of the year, to mainland China." ~ RJ Wilcox,A Giant Sucking Sound from the East

The world's gold is being swallowed up by China - a very large chunk of the world's supply of the golden metal is heading from the U.K. to Switzerland to Hong Kong and then into mainland China.

Where is most of this gold coming from?

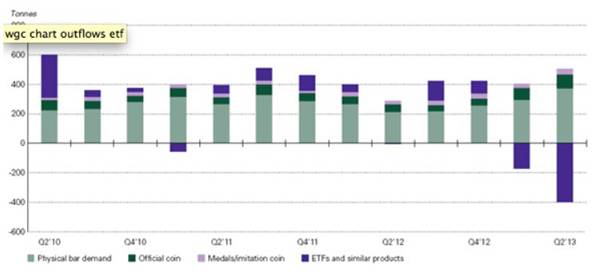

Four words - Gold Exchange Traded Products or ETPs as they are commonly known.

World Gold Council

Conclusion

In 'Subterranean Homesick Blues' Bob Dylansang "You don't need a weatherman to tell you which way the wind blows." Well, the winds are blowing western gold eastward and the Chinese consumers who are the beneficiaries of a lack of western foresight and centuries of accumulated financial survival knowledge aren't complaining one little bit.

Across the globe individual nations added 534.6 tons to reserves in 2012 - the most since 1964 - and will likely add an additional 350 tons in 2013. Chinese consumer demand may top 900 tons this year.

Consider:

- China is the world's biggest gold producer country and soon is going to be its largest consumer of gold.

- We're seeing a physical transfer of gold - this is not a paper exercise, the world's gold is disappearing into Communist mainland China.

- China's demand for gold is insatiable and demand is going to keep increasing. Expect this increasing demand to last for many years

The Chinese people rightly believe the best way to protect and preserve wealth is through owning gold bullion. Their communist leaders believe in a future where the yuan is fully convertible, freely traded and gold backed. A future where the yuan is the world's reserve currency.

I've got some gold, getting even more is on my radar screen, it should be on yours as well. If things go to hell are you going to be able to get your hands on some gold? Probably not is my guess. How about displaying some Eastern common sense and preserving/protecting your family's wealth? Get proactive, the winds of war are blowing, globally the economic and political landscape is a mess.

Maybe the best reason to buy some gold is simplicity at its best - buy gold just because the Chinese are. Over the last decade this investment strategy has worked for ahead of the herd readers in uranium, copper, rare earths etc. The best investment advice you'll ever get from me or anybody else is "Buy today what is dear tomorrow." That sounds like gold!

Is the buying of gold, and the shares of junior resource companies exploring for the precious monetary metal (historically buying the shares of precious metal juniors have offered the greatest leverage to a rising gold price), a priority on your radar screen?

If not, maybe one should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2013 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.