Gold and the Return of Global Turmoil

Commodities / Gold and Silver 2013 Aug 31, 2013 - 12:13 PM GMTBy: Clif_Droke

The last several weeks have seen a return of all the ingredients for a gold rally, from an "oversold" technical condition which sparked a short-covering rally to a spike in Treasury yields which caused investors to look for safe haven investments. Gold has benefited from the rising interest rates as well as the weakness in the U.S. dollar. Now a new set of factors is playing into gold's favor....

The last several weeks have seen a return of all the ingredients for a gold rally, from an "oversold" technical condition which sparked a short-covering rally to a spike in Treasury yields which caused investors to look for safe haven investments. Gold has benefited from the rising interest rates as well as the weakness in the U.S. dollar. Now a new set of factors is playing into gold's favor....

I'm referring of course to the return of global financial market and political turmoil. From the fear of a tightening monetary policy in the U.S. to the currency slump in Asia to the military unrest in Syria and Egypt, investors are once again in a desperate search for a financial safe haven to park their capital until the volatility dies down. Gold has been the natural beneficiary of the world's safe haven money flows, particularly among foreign investors. There are signs, however, that U.S. investors are about to join the crowd in jumping back onto the gold bandwagon.

In a note to its investors on Monday, Eugen Weinberg of Commerzbank made reference to the return of global turmoil and its effects on precious metal prices when he wrote:

"[Gold] is clearly finding support from the geopolitical risks in the Middle East and North Africa, amongst other things. "Speculative financial investors have contributed to the rise in the price of gold and silver; they expanded their net long positions in gold by 28% to a three-week high of 48.4 thousand contracts in the week to 20 August. What is more, gold ETFs tracked by Bloomberg saw inflows of 4.7 tons last Friday, the highest to have been recorded since the end of November 2012. On balance, there have thus been no further outflows from the gold ETFs in the past two weeks, so investment demand appears to be gradually picking up again. Net long positions in silver were increased by 41% to a six-month high of 16.2 thousand contracts."

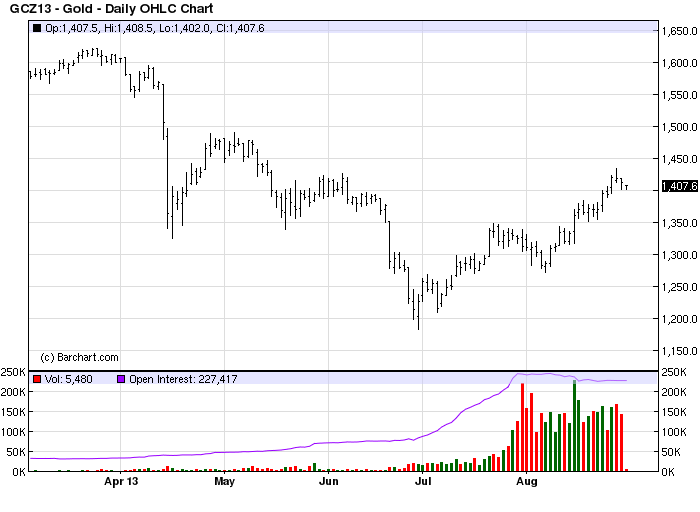

Meanwhile on the technical front, gold overcame a major psychological hurdle this week by closing above the widely watched $1,400 level. Now that this benchmark chart resistance has been overcome, gold will test the resistance from sellers at the nearby $1,440-$1,450 benchmark where the next line of overhead supply begins.

In the latest U.S. economic news, durable goods orders dropped 7.3 percent in July according to the Commerce Department, the steepest drop in nearly a year. Contributing to the drop were fewer orders for commercial aircraft and weakened demand for computers and electrical equipment among businesses.

The drop in durable goods orders is a definite sign that the business economy is losing momentum. Yet the New Economy Index (NEI), which measures the overall state of the retail/consumer economy, is still in fine shape. Why then is there such a disparity between the manufacturing economy and the retail economy?

Manufacturing typically slows before consumers start reigning in spending on discretionary items. What we're witnessing the beginnings of a slowing economy where the manufacturing sector will be the first to experience weakness. Then a spillover effect will eventually make its way into the everyday economy of consumer spending. It's a slow, gradual process akin to a large tanker ship doing a turn at sea: it takes time for the forward momentum to reverse before the shift in direction can be made.

Big ticket items and luxury goods are still selling mainly because high-end buyers - the driving force behind the current stage of the recovery - are always the last to exit when the Ferris wheel grinds to a halt. Big spenders are still spending like there's no tomorrow, which is why the stocks which comprise the NEI are still mostly in a rising trend. Eventually this trend will reverse, however, when these big money spenders realize the economic picture isn't as rosy as it was earlier this year.

In reality, the seeds to the next recession were sown when the Federal Reserve first hinted this spring that it would begin "tapering" the $85 billion/month asset purchases at some point later this year or early in 2014. The taper talk led to a major spike in Treasury yields, which has all but torpedoed the bubble in income-oriented investments. The yield spike has also begun to put cracks in the real estate recovery, as witnessed by the 13.4% plunge in new home sales for July. Higher mortgage rates are beginning to bite into potential homeowners' pocketbooks.

The seeds to the next recession - likely sometime in 2014 when the long-term Kress cycle bottoms - have already been sown by the very regulators who are supposed to keep the economy on an even keel. The relentless tendency of the central bank to zig when they should be sagging is having a negative impact already on investor expectations, which is where declines in spending and investment patterns always begin.

As Mr. Kress himself noted, gold should benefit from the final descending phase of the long-term deflationary cycle next year. An increase in global political, economic and financial turmoil would only add to gold's attractiveness as the financial safe haven of last resort. What we're seeing now is a short preview of that.

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets? Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you're buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the "smart money" pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you'll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.