U.S. Treasury Bonds Are Oversold

Interest-Rates / US Interest Rates Aug 24, 2013 - 12:26 PM GMTBy: Sy_Harding

Has there ever been an asset class bombarded by such intense negativity in such a short period of time? Fed Chairman Bernanke’s warning in May that the Fed would soon begin to ‘taper’ its QE bond-buying stimulus program brought ‘The End of Bonds’ headlines out in force. And bond investors responded.

Has there ever been an asset class bombarded by such intense negativity in such a short period of time? Fed Chairman Bernanke’s warning in May that the Fed would soon begin to ‘taper’ its QE bond-buying stimulus program brought ‘The End of Bonds’ headlines out in force. And bond investors responded.

A record $69 billion was pulled out of bond mutual funds and bond ETF’s in June, and the bailout continued in July and August. According to TrimTabs Investment Research, bond funds are on pace for the biggest withdrawals since 2004 and 2009.

The bailout has been justified so far, with 20-year bond prices down 17% since May.

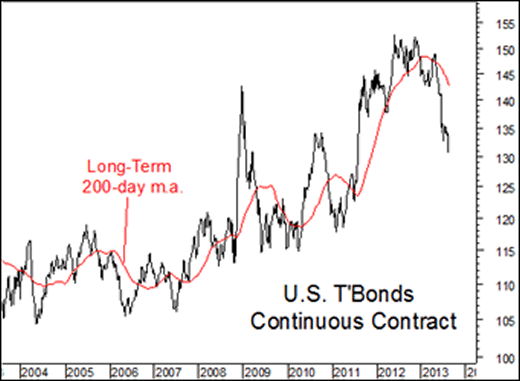

However, at this point the panic and sell-off appear to be overdone. Bonds are significantly more oversold beneath their long-term 200-day moving average than at any time in at least the last 15 years.

And investor (and media) sentiment for bonds is incredibly pessimistic, nothing but negative opinions on bonds being seen.

Let’s consider a few other situations beyond the technically oversold condition and extreme investor pessimistic sentiment for bonds.

The Fed has warned it will soon begin tapering back its bond-buying. But Fed Chairman Bernanke drew a clear distinction between the Fed’s asset purchases and rate hikes, which seems to have been ignored. He went to great pains to stress that interest rates are a separate tool from its bond-buying program, stressing that interest rates will be held at current near-zero levels at least until the unemployment rate declines to 6.5% (which it does not expect until 2015), and further that the Fed will be in no rush to hike rates even after that threshold is reached.

How can the Fed hold bond yields low (prices high) if the Fed has been the biggest buyer of newly issued bonds, and begins to taper back its bond-buying?

A better question might be can the Fed taper back its buying as quickly as the Treasury Department tapers back its issuance of bonds? If not the QE stimulus will increase even as the Fed tapers.

The Treasury Department had to continuously issue record amounts of new bonds to finance the bailouts from the 2008 financial meltdown, and the rising budget deficits created by increased government spending to stimulate the economy, in a period when tax revenues were suffering from the slow recovery from the Great Recession.

However, the budget deficits are now rapidly declining as the government cuts back on spending, and tax revenues from the improving economy are rising. The Treasury Department reported its tax revenue over the last ten months totaled $4.3 trillion, about 14% more than the same period a year ago. And government spending fell as the cuts called for under the ‘sequester’ went into effect March 1. The Congressional Budget Office estimates a federal budget deficit of $642 billion this fiscal year, compared to $1.1 trillion last year.

If the budget deficit is now averaging $54 billion a month, down 40% from $90 billion monthly a year ago, it would seem Treasury will need to issue a significantly smaller amount of bonds to finance government operations.

If the Fed does not taper back its bond-buying as fast as Treasury tapers its issuance of new bonds, the Fed will be buying an even larger percentage of Treasury bond sales, even though it tapers back its bond-buying. So to the degree that the Fed’s bond-buying creates low bond yields (higher bond prices), that effect is not likely to be impacted by the Fed’s gradual taper plans.

Then there is the slowing economy. Bonds typically rally when the economy is weak. Note the spike up in bond prices in 2008’s recession, and the bond rallies the last three summers when the economic recovery stumbled.

And lastly, we have the situation with the ‘risk on’ sentiment for the stock market.

According to the Investment Company Institute, which keeps track of such things, public investors not only held onto their equity mutual funds and etf’s through the 2008-2009 bear market, but bought more all the way down.

But beginning in early 2009, as the new bull market began and institutional investors were putting money back into stocks, public investors finally began pulling money out, and continued to do so until last fall. Then they finally began pouring money back into stock funds and etf’s, that inflow reaching a near record pace in the first six months of this year, the fastest pace since 2007.

That had investor sentiment for stocks at high levels of bullishness, and the S&P 500 extremely overbought above its long-term 200-day moving average, while sentiment for bonds is at high levels of pessimism, and are extremely oversold beneath their 200-day m.a.

Yet the talk of recent months has been of a ‘Great Rotation’, a long period ahead of rotation out of bonds and into stocks.

Don’t be surprised if there is indeed a great rotation, but in the opposite direction.

In the interest of full disclosure, I and my subscribers have a position in the iShares 20-year Bond etf, symbol TLT.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2013 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.