This is What the Fed’s QE Has Done for Our Economy

Economics / US Economy Aug 23, 2013 - 02:10 PM GMTBy: Money_Morning

Tara Clarke writes: The Fed's QE (quantitative easing) program has created multiple trillions of dollars since it first started in 2008.

Tara Clarke writes: The Fed's QE (quantitative easing) program has created multiple trillions of dollars since it first started in 2008.

But now there are signs the QE policy will finally come to a close.

On June 19, Federal Reserve Chairman Ben Bernanke announced the Fed may start to taper its QE by the end of the year if it met an unemployment target of 7%, while keeping a targeted inflation rate at 2%.

Indeed, today's (Wednesday) Fed minutes reflect that policymakers are forming a plan to taper the stimulus sometime this year and plan for a full stop come mid-2014.

At the outset, the Fed hoped to stimulate a stagnant U.S. economy by increasing the money supply.

And now, five years later, some mainstream media would have you think the economy is in decent shape...

A recent Associated Press article described the U.S. economy as "growing at a steady pace." Other analysts feel the economy is stable and a long shot from the 1970s, when the Fed churned out cash on a much smaller scale, which led to damaging rates of inflation.

But the truth is the economy only appears stable.

Beneath the surface, the Fed is roiling, building up to a breakdown that could be worse than 2008's subprime/solvency crisis.

Much like prodding a sick child, the symptoms of economic bad health are there, even if you can't see them at first glance.

Take U.S. car inventories, for example...

3.27 million new cars are presently glutting up dealerships across the U.S. - a greater excess than has been seen in nearly five years.

In fact, that's enough automobiles to equip every man, woman, and child in the state of Iowa, and nearly enough to equal the number of iPhones added to Verizon's network last quarter.

Last year, there were 2.7 million fewer vehicles in the nation's car inventory; back in 2011 it was a million fewer than that.

With 70% of the economy powered by consumer spending, the indications that auto consumers aren't spending is a danger sign.

And the retail sector continues to show mixed results that suggest consumer spending isn't rising to levels needed for a healthy economy.

When paired with another measure of economic health, this glut could very well feed into a scary cycle that will put a major drag on the economy - all this despite the Fed's attempts to goose activity with QE...

The Car Glut Will Affect Unemployment

Even though the unemployment rate fell to 7.4% in July - the lowest rate since December 2008 - U.S. joblessness is still a huge concern.

A significant part of the drop is due to discouraged workers exiting the labor force. Overall the labor force dropped by 37,000 in July, marking a 35-year low in the percentage of working-age Americans looking for jobs.

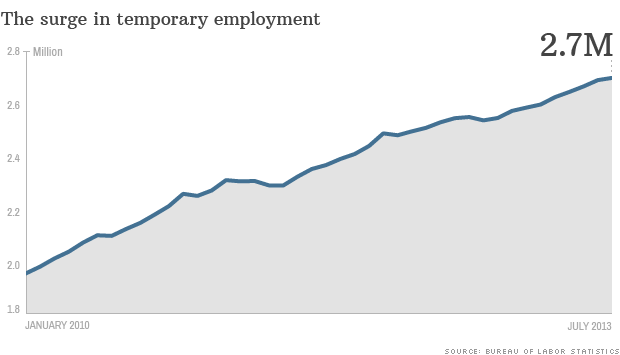

Moreover, the number of temporary workers who want full-time jobs continues to increase, as the below chart illustrates:

The Fed's QE program is supposed to stimulate the creation of high-paying, full-time jobs, but instead, we're getting a lot of part-time jobs: through the first seven months of 2013, 953,000 jobs have been created; a full 731,000 of those, or 77%, have been part-time.

In sum, over 4 million people have been out of work for more than six months, and a doleful 11.5 million are looking for work in total.

22.1 million Americans are either unemployed or underemployed.

And numbers like the car inventory glut show us joblessness is about to get worse...

Come September, most 2014 models will hit the market. The excess cars will have to be sold at big discounts. Automakers will also cut back on production to deal with the glut.

This means lower profits, which translate to lower share prices.

And because automakers are part of a grand supply chain - from plants that assemble cars to parts-makers and suppliers - lower profits and share prices will also affect other sensitive businesses.

For instance, during 2008's economic downturn, suppliers were forced to consolidate operations. They closed plants, laid off workers, and reduced capacity by as much as 30%.

A squeeze on the auto supply chain, joblessness, and a dissatisfied work force are all factors lining up to drag down the U.S. economy.

On top of that, Bernanke's signal of the end of QE starting in 2013 has had an immediate effect on interest rates, driving them higher. Borrowing costs will rise in turn.

This will slow the economy even further.

So what has the Fed's QE done for the economy? It's placed Americans at great risk.

Meanwhile, Bernanke's printing presses are still running...for now.

We figure you've only got a few months before he pulls the plug for good, and the markets go on a death spiral. Money Morning's top experts put together a "safety plan" you can use to protect your wealth right away.

Source :http://moneymorning.com/2013/08/21/brace-yourself-this-is-what-the-feds-qe-has-done-for-our-economy/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.