Fed Hits the Markets WE Kill Switch

Stock-Markets / Quantitative Easing Aug 22, 2013 - 06:31 PM GMTBy: Clif_Droke

On Wednesday the Fed released the minutes from its July 30-31 policy meeting. Minutes from the meeting showed that most members of the FOMC agreed that a reduction of the stimulus was not yet appropriate. Only a few thought it was time to “slow somewhat” the pace of the stimulus policy.

On Wednesday the Fed released the minutes from its July 30-31 policy meeting. Minutes from the meeting showed that most members of the FOMC agreed that a reduction of the stimulus was not yet appropriate. Only a few thought it was time to “slow somewhat” the pace of the stimulus policy.

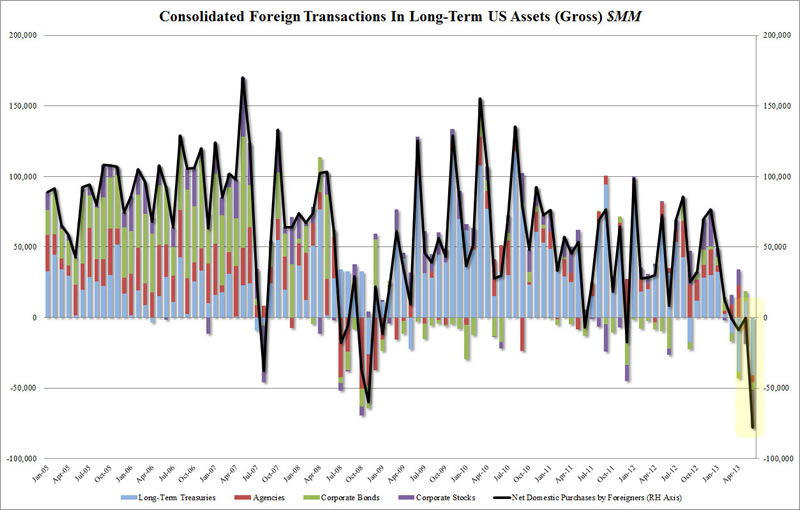

Investors continue to fear that the Fed will start to slow its $85 billion monthly asset purchases, with most predicting September as the beginning of the end of the aggressive quantitative easing (QE) program. This fear was manifested beginning in June as foreign investors sold U.S. Treasuries to the tune of $489 billion in that month alone. The annualized rate of Treasury notes and bonds sold over the last three months was $271 billion. In more recent days, Asian currencies have declined as investors fear tighter Fed policy will starve emerging markets of investment funds.

Zero Hedge’s Tyler Durden observed: “Somehow to foreigners, Bernanke’s Taper Tantrum was a more shocking event than the biggest bankruptcy filing in history (one which launched the global central bank scramble to buy up everything that is not nailed down).” See chart below.

Although Wednesday’s FOMC minutes provided no concrete timetable for the slowing of QE3, the handwriting is clearly on the wall. Investors, particularly foreign investors, sense the end of the Fed’s easy money policy is near and have acted accordingly by selling stocks and bonds. U.S. investors have been much slower to react but even they are beginning to sense that QE’s days are numbered.

The rising Treasury yield since May is not, as some economists affirm, the result of a strengthening economy. Rather it’s a consequence of the market’s anticipation of the withdrawal of stimulus by the Fed. To put it in colloquial terms the market senses the Fed will soon “kick over the milk pail” if it hasn’t already.

Consider: during the boom year of 1999 the Federal Reserve under Chairman Greenspan began tightening money and eventually succeeded in precipitating the 2000-2002 “tech wreck” and recession. Then after a period of loose money in 2002-2003, the Fed started tightening money again in 2004 and continued to do so until the onset of another recession and bear market in late 2007.

After dousing the flames of the credit crisis in late 2008/early 2009, the Fed under Chairman Bernanke has largely embraced a looser monetary policy in the last four years. But once again the Fed is telegraphing its intention of ending its easy money policy, just in time for the upcoming deflationary cycle bottom in 2014. Either the Fed is averse to prosperity as its critics have alleged or else its leaders have the worst sense of timing. As I mentioned in a previous posting, tight money is properly defined as “reduced expectations of future spending.” Based on this definition, the Fed has already begun tightening.

Unfortunately, kicking over the proverbial milk pail is what the Fed excels at and it’s a likely bet that it will once again undermine what, for the most part, has been a successful recovery effort. A premature ending to QE3 would all but guarantee a resumption of economic weakness with the potential for deflationary pressures to accelerate next year as the long-term deflationary cycle makes its final descent.

Gold

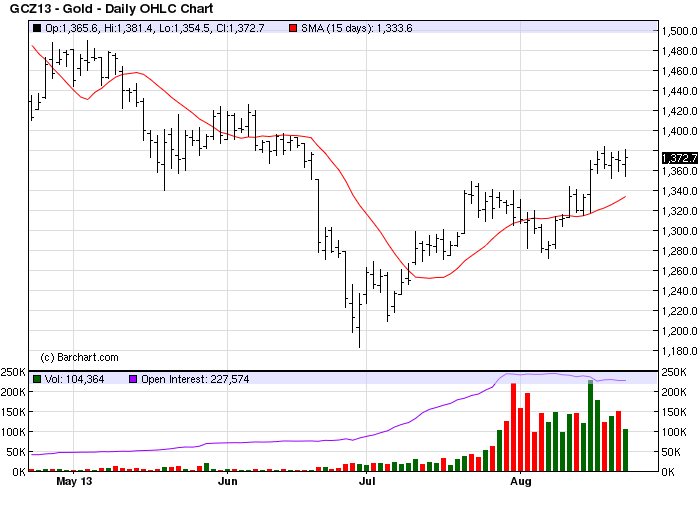

As Wall Street continues worrying about the winding down of the Fed’s QE3 stimulus program, bond yields around the world have been surging and the dollar has been falling. In the wake of higher yields equity prices have been driven lower. The upshot of higher yields and a weak dollar has been higher gold prices as investors run to safety. Weaker earnings reports in the U.S. and increasing violence out of Egypt have also contributed to increasing demand for the yellow metal.

Since the gold price bottom of late June, the daily correlation between the gold price and the S&P 500 index has inverted once again, i.e. as stock prices have fallen gold prices have risen. Since gold’s price low of June 27, gold futures rallied 12.34 percent while the S&P 500 Index is up only about 3% as gold returns to favor among investors.

While some of gold’s recent rebound can be attributed to the increased desire for safety in light of Wall Street’s worries about the Fed’s money policy, much of the rally is a result of the unwinding of short positions from the last couple of months. There are no guarantees when it comes to near term price predictions, but a test of the nearby chart resistance zone at the $1,420-$1,425 area is a distinct possibility in the immediate-term (1-3 week) outlook. While some analysts are betting on even higher prices if this zone is overcome on the upside (on the assumption that additional short covering will be triggered), I recommend we play it safe and continue to raise stop losses on our conservative long position in the gold ETF in the event that this event fails to materialize.

2014: America’s Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to – and following – the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America’s Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form – namely the long-term Kress cycles – the worst part of the crisis lies ahead in the year 2014. The book is now available for sale at:

http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.