Silver Prices - The $100 History

Commodities / Gold and Silver 2013 Aug 21, 2013 - 05:15 PM GMTBy: DeviantInvestor

Step into the “Wayback Machine” and journey back in time to:

Step into the “Wayback Machine” and journey back in time to:

| 1932: | Silver was selling for about $0.25 per ounce (average annual price per Kitco.com). Our $100 bill would buy about 400 ounces. |

| 1962: | Silver was selling for about $1.20 per ounce. Our $100 bill would buy about 83 ounces. |

| 1982: | Silver was selling at about $10.60 per ounce. Our $100 bill would buy about 9 ounces. (Early in 1980 silver spiked to about $50 per ounce for a day or so and then crashed.) |

| 2012: | Silver was selling for about $31 per ounce. Our $100 bill would buy about 3 ounces. |

| Today: | Silver prices have been volatile. Our $100 bill will buy perhaps 4 ounces of silver. |

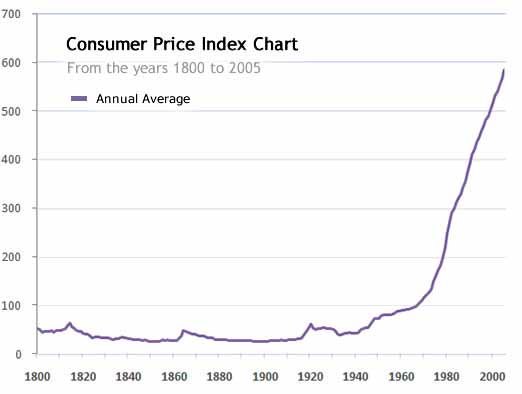

Over the course of the last 100 years, during which we have been blessed with the Federal Reserve and massive government spending, our $100 bill no longer buys 400 ounces of real physical silver; now it will purchase only about 4 ounces.

What have we learned from our quick survey of the history of silver prices?

- Prices are volatile – they can go drastically higher and then crash.

- On average, $100 buys less silver with each passing decade because the currency is worth less each decade.

What can we expect for the price of silver? It seems obvious that:

- All paper currencies eventually decline in value to their intrinsic value – approximately zero. Voltaire understood this concept almost three centuries ago. Several hundred unbacked paper currencies have become worthless since the time of Voltaire.

- Governments and banks represent the status quo so very little will change without a crisis or collapse. Governments spend more than their revenues and borrow the difference, thereby increasing total debt and the money supply. The status quo involves the creation of more and more currency, all of which is backed by debt, not assets.

- US Government Revenue, Expenses, Official Debt (rounded in $Billions):

| 1971 | 2012 | |

| Expenses | 210. | 3,500. |

| Revenues | 187. | 2,400. |

| Official Debt | 408. | 16,100. |

- Inflation and debt are “hardwired” into our monetary system. Don’t expect government spending or total debt to decrease unless there is a massive financial crisis.

- Official debt is shown but it does not include unfunded liabilities for Social Security, Medicare, Pensions and so forth. The total debt including unfunded liabilities has been calculated in the $100 – $200 Trillion range and rapidly rising.

- As the money supply and total debt increase, average prices increase. Hence silver has increased from a few cents to many dollars per ounce. Five cent coffee and $0.19 gasoline are ancient history.

- The process will continue until it no longer can – perhaps a few years, perhaps a decade. Don’t bet on the imminent demise of a system that enriches banks and the political elite while it increases governmental power.

- Plan on reduced purchasing power of unbacked fiat currencies.

- Bet on the inevitability of higher silver and gold prices – because the value of the paper currencies is decreasing every year.

For the Future

Eighty years ago $100 purchased 400 ounces of silver while today that $100 purchases about 4 ounces. Someday soon $100 will purchase only one ounce of silver.

Depending on how rapidly the money supply is increased and how quickly confidence in paper money evaporates we may see the day when it takes ten, or more, $100 bills to purchase a single ounce of silver. Hyperinflation has happened in many countries in the past 100 years and many good analysts believe that it COULD occur again in Europe and the United States. If hyperinflation occurs, your silver and gold will be worth much more in nominal dollars and will, to some extent, protect your purchasing power. Unfortunately, life in a hyperinflationary economy is likely to be exceedingly difficult for most people.

Prepare by purchasing physical silver and gold and storing it outside the banking system.

Read: Silver: The Noise Is Deafening

GE Christenson aka Deviant Investor

If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail© 2013 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.