Stocks Sell of Begins as U.S. Bonds TLT Consolidates

Stock-Markets / Stock Markets 2013 Aug 21, 2013 - 09:34 AM GMT TLT/USB appears to have reached its Minor Wave 5 low and is due for a bounce back to the neckline of its Head & Shoulders formation. I was wrong in declaring that TNX/TYX would continue to rally through September 3. It now appears that yields will consolidate/correct through that date and resume their rise after the consolidation ends. At the moment, I don’t expect the rally to go beyond the neckline shown on the chart. There appears to be too much resistance at the 105.00 level. We’re only talking about a 9-day rally if it wraps up by September 3.

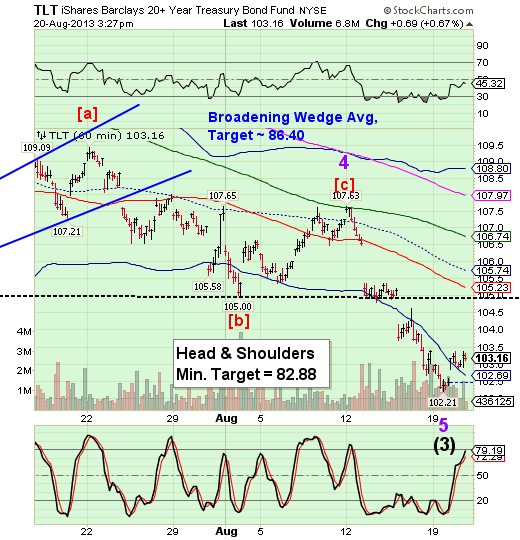

TLT/USB appears to have reached its Minor Wave 5 low and is due for a bounce back to the neckline of its Head & Shoulders formation. I was wrong in declaring that TNX/TYX would continue to rally through September 3. It now appears that yields will consolidate/correct through that date and resume their rise after the consolidation ends. At the moment, I don’t expect the rally to go beyond the neckline shown on the chart. There appears to be too much resistance at the 105.00 level. We’re only talking about a 9-day rally if it wraps up by September 3.

USO/WTIC was slammed this morning and the 8.6 month correction now appears to be over. This is such a massive correction that nearly all perspective is lost. The weekly chart shows an Orthodox Broadening Top with an average target of 20.88 for the bottom of Intermediate Wave (3).

SPX is starting its sell-off this afternoon. We may expect to see a strong decline in the overnight hours that may get investors’ attention. The Cycle from the 1696.81 top to today’s 1658.92 top only took 34.4 hours. The new decline should cover a lot more territory in the same span or less.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.