Indian Rupee 20% Crash, Another 1997 Asian Financial Crisis?

Economics / Asian Economies Aug 21, 2013 - 09:29 AM GMTBy: Sam_Chee_Kong

I don't know whether you recalled how the last Asian Financial Crisis in 1997-98 affected us all. Our stock market dropped from 1385 to 295 points while our ringgit went down to as low as RM4.80 to the dollar. At the height of the crisis our interest rates went up to as high as 18%. After a break of 15 years are we going to see the same scenario again? I do not know the answer but one thing for sure is that it does have some resemblances such as depreciating currencies and interest rates hike across the region. The last time the Financial Crisis was started in Thailand and this time I reckon it will be in India.

I don't know whether you recalled how the last Asian Financial Crisis in 1997-98 affected us all. Our stock market dropped from 1385 to 295 points while our ringgit went down to as low as RM4.80 to the dollar. At the height of the crisis our interest rates went up to as high as 18%. After a break of 15 years are we going to see the same scenario again? I do not know the answer but one thing for sure is that it does have some resemblances such as depreciating currencies and interest rates hike across the region. The last time the Financial Crisis was started in Thailand and this time I reckon it will be in India.

In an attempt to stamp further outflow of funds, India has recently resorted to some limited capital control such as the following.

- Reducing the amount of money Indian residents can sent out overseas annually from $200,000 to $75,000

- Indian firms can only invest 100% of their net worth down from 400% previously

- Total ban on all importation of Gold coins and Medallions from abroad

However such measures are only temporary in halting further outflow of funds as it is counter-productive and slowed the economy. Part of the blame goes to the Multinationals that are allowed to operate in India during the opening of its economy in the 1990s. The Indian government states that instead of contributing to the Indian economy through the transfer of technology and also managerial skills they ended up raping the Indian economy high and dry. And when it is all done they now depart for greener pastures and as a result exacerbated the outflow of funds. India’s economic fundamentals have been deteriorating for the past couple of years. Let’s take a look at some of India’s economic indicators.

India’s Deteriorating Economic conditions

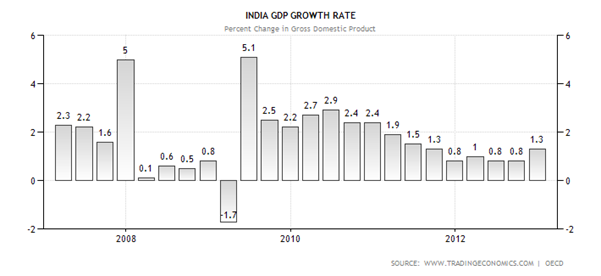

The following is the chart for India’s GDP Growth rate. Its GDP expanded 1.3% in the last quarter of 2012 which average at about 1% for 2012. It slowed since 2009 and the Indian Government has difficulty in achieving the growth set in previous years due to issues like corruption and nepotism.

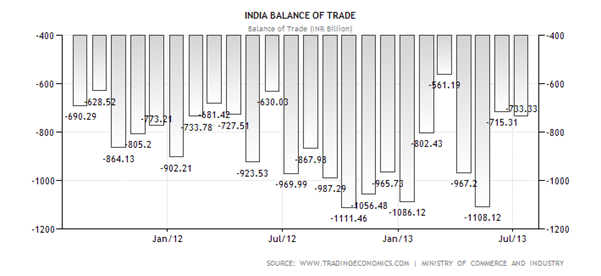

India recorded a trade deficit of INR 733.33 billion in July 2013. For the past 35 years, India’s trade deficit average about INR 120.83 billion. The following is India’s Balance of Trade Chart.

Although India’s Government Debt to GDP decreased from 68.05% to 67.57% but its external debt increased to USD 345 billion in 2012 from USD 305 billion in 2011. With a depreciating Rupee it means India has to pay more Rupees for its external debt which is quoted in dollars.

The following chart shows India’s Rupee performance for the past three years.

Since the beginning of the year India’s rupee has been on the decline. The latest for the USD/INR is quoted at 63.61 and this represents a record low for the Rupee. Since May this year the Rupee has lost about 20%. The Reserve Bank of India has the choice of either letting the market to decide on the level of the Rupee or increase its interest rate to stop the outflow of currency. Instead of letting the market forces to determine the exchange rate level, the Reserve Bank of India (RBI) chose to defend it. From the last Asian financial crisis we learnt that none of the affected countries successful in defending their currencies except Hong Kong with the backing of China.

As have been mentioned earlier in one of my article on the predicament of Central Bank policy makers. They can only choose either to promote internal stability through Monetary Policy or external stability through Exchange Rate Policy but cannot have both at the same time.

If the Reserve Bank of India choose to promote internal stability through Monetary Policy by increasing interest rates then it will cause a deep recession. This is also known as the ‘Volcker effect’ where former Fed Chairman Paul Volcker was credited for ending the stagflation crisis in the late 1970s. In order to end the inflation rate at 13.5% and an unemployment rate of more than 10%, he raised the prime rate to 21.5% in 1981. The end result is a severe recession which lasted until 1982 and after which the U.S economy expanded for the next 8 years.

The second option available to the RBI is the exchange rate policy where it will defend the Rupee through its open market operations by selling its foreign exchange reserves which is denominated dollars. However such a policy will only help deepen the financial crisis because it might start off a chain reaction of currency devaluation.

The current stand by the RBI to defend the Rupee can be disastrous as evident during the last Asian financial crisis after it spread from Thailand. As a result Malaysia, Indonesia and South Korea are also affected. Moreover this may result in a further hike of the interest rate as already been happening in some Asian countries as of late. Their 10 year bond yields have been soaring across the region in an attempt to fight currency sell off and even Malaysia is not spared. The following is the chart of the Indian Government 10 year bond.

As from May, India’s 10 year bond yield has appreciated close to 200 basis points (2%) with the latest being at 9.12%. Malaysia does not fared any better with its 10 year bond yield rally to about 4.1% from 3.5% in May. The following is the graph of Malaysia’s 10 year bond yield.

Why are 10 year bond yields important?

When the yield on the 10 year bond goes up it indicates that the long term interest rates is going up. When interest rates goes up it will affect a lot of investments in the economy. It will affect the stock market, the housing market, credit card, personal loans and so on. Due to the increased cost of borrowing it will affect investments in the stock market because the margin rate will also increase. It will affect the housing market because less people are willing to commit on new housing and as a result prices will have to come down. For those who have bought they will also be affected due to increased mortgage payments. Hence it will affect the overall economic activity.

In wrapping up, I reckon that India’s weak economic fundamentals and its structural problems will present itself as a target for currency speculators. With the foreign exchange reserves of only INR 15102 billion or about USD 238 billion it is not a large sum when you are under attack by currency speculators. This is because the foreign exchange market trades more than USD 5 trillion a day. So the threat of further weakening of the already record low Rupee is clear and present. Any attempt by the speculators to unstable the Rupee might be contagious and will destabilize the already tensed situation in Asia.

by Sam Chee Kong

cheekongsam@yahoo.com

© 2013 Copyright Sam Chee Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.