QE Party is Ending, Rising Interest Rates Means the Fed Could Go Bankrupt

Interest-Rates / US Interest Rates Aug 20, 2013 - 05:50 PM GMTBy: Graham_Summers

The QE party is ending. And the following hangover is going to be brutal.

The QE party is ending. And the following hangover is going to be brutal.

Since 2007 the Central Bankers of the world have operated under the belief that they can hold the financial system together by engaging in round after round of Quantitative Easing (QE) without losing control of the bond markets/ interest rates.

They believed this because:

1) We haven’t had a bear market in bonds in 30+ years

2) They believe that they (Central Banks) will never lose credibility with the markets.

This entire theory crashed into the wall in April 2013 when the Bank of Japan announced its “shock and awe” QE program.

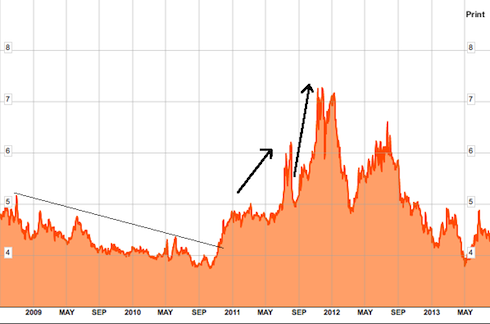

The yield on the ten-year Japanese Government bond has since violated its trendline and is now retesting former resistance. This is a classic breakout that typically precedes sharp moves higher. In the case of Japanese Government bonds, this would mean the bonds losing value.

Why does this matter?

This matters because bond markets have a nasty tendency of spinning out of control very quickly once things begin to unravel. A great example of this is Italy, which was considered a rock solid pillar of the EU for the better part of the last 15 years… and then, it lost all credibility in a matter of weeks and began to collapse.

As you can see, Italy’s ten-year bond yield broke its trendline in the autumn of 2011 when the EU crisis first began to spread outside of Greece. It hovered around 5% for a few months and then skyrocketed above 6%. Later it spiked again above 7%.

Both of these spikes occurred in just a few weeks’ time. What was thought to be “rock solid” for over a decade became bankrupt in a matter of months.

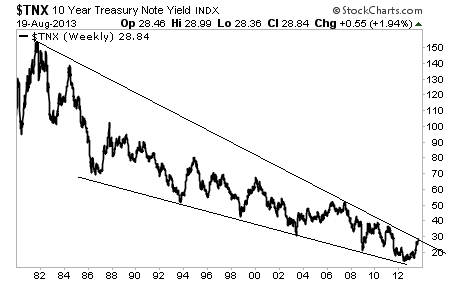

On that note, Ben Bernanke is praying to the Market Gods that the ten-year Treasury doesn’t take out the line below:

“So what?” many will think. What’s one trendline for bonds?

As the long-term chart shows. This isn’t just any trendline. This is THE trendline. Take it out and the 10 year will likely be yielding 5-6% in no time… which by the way is where it was for most of the ‘90s and very early ‘00s.

The only difference is that a drop like this would literally render the Fed bankrupt. The Fed currently owns 30% of all the ten year Treasuries in existence. If yields were to return to 5-6% on the ten year Treasury then the Fed would have literally lost several hundred billion Dollars on its Treasury holdings.

Sure, the Fed could print money to deal with this. But if Treasuries begin to collapse while the Fed is already buying them… and it can only buy more by money printing, then it’s GAME SET MATCH for Bernanke’s QE, the Fed, and the US economy.

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2013 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.