U.K. Gold 'Exports' To Switzerland Explode Due To Allocated and Asian Demand

Commodities / Gold and Silver 2013 Aug 20, 2013 - 12:43 PM GMTBy: GoldCore

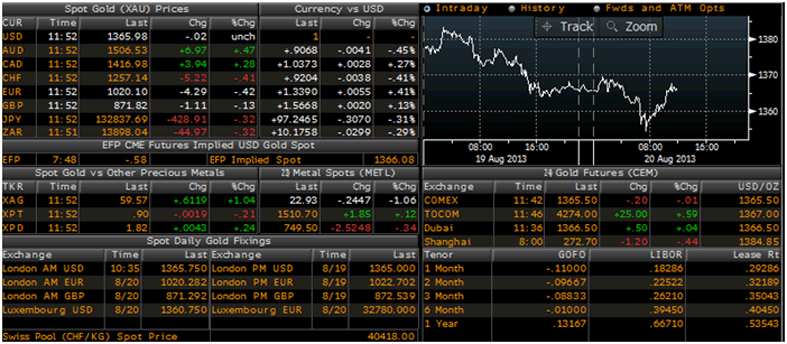

Today’s AM fix was USD 1,365.75, EUR 1,020.28 and GBP 871.29 per ounce.

Today’s AM fix was USD 1,365.75, EUR 1,020.28 and GBP 871.29 per ounce.

Yesterday’s AM fix was USD 1,375.25, EUR 1,031.39 and GBP 878.47 per ounce.

Gold fell $6.40 or 0.47% yesterday, closing at $1,366.60/oz. Silver edged down $0.02 or nearly 0.09%, closing at $23.16. Platinum fell $14.52 or 1% to $1,504.49/oz, while palladium was down $10.75 or 1.4% to $749.75/oz.

Gold in USD, 30 Days - (Bloomberg)

Gold and silver both pulled back yesterday on profit taking and as stop loss limits triggered selling. There were jitters among some market participants as President Obama met the heads of the CFTC, SEC, CFPB, FHFA, NCUA, FDIC, the Comptroller of the Currency and the Federal Reserve.

U.S. Mint data showed a drop in sales of American Eagle gold bullion coins in August to 3,000 ounces as of yesterday. This is down from the record levels seen in recent months and below the monthly average of nearly 100,000 ounces for the 7 months of 2013.

Liquidated ETF gold holdings are being shipped from the U.K to Switzerland for refining into smaller one kilogramme gold bars, Australian bank Macquarie wrote in a note yesterday. These were then sent to Asia and bought by Asian investors. The note confirmed, what has been known anecdotally for some weeks.

This is contributing to the increased tightness in the physical market as large London Good Delivery bars (400 oz) are air freighted to Switzerland for refining into smaller kilo bars (32.15 ounces) for the voracious Asian market.

There is also an increasing preference for allocated storage in Switzerland by high net worths and family offices. Switzerland still has much of the world’s gold refining capacity and remains a favourite destination of investors and savers concerned about sovereign risk - including sovereign risk in the EU, U.K. and U.S.

Most of the gold ETFs holdings were held in London vaults, and U.K. gold ‘exports’ to Switzerland exploded from 92 tonnes in all of 2012 to a whopping 240 tonnes in May this year alone and a very large 797 tonnes in the first six months of 2013.

Gold Prices/ Fixes/ Rates / Volumes - (Bloomberg)

It is worth noting that the 797 tonnes, while a large number in tonnage terms, for the very small physical gold market, is only worth $37 billion in dollars terms which is less than half the $85 billion in quantitative easing or money creation and debt monetisation that the Federal Reserve does every single month.

The 797 tonnes of gold “exported” from the U.K. to Switzerland is nearly 30% of total annual gold mining supply.

Rather than “exported,” the flow of gold to Switzerland is more a form of capital flight as, the safest form of money in the world, gold, flows out of the U.K. and into strong, store of wealth, hands in Asia and storing bullion in Switzerland.

Throughout history, capital, assets, currencies and gold have flowed to the individuals, governments and countries that have treated it most kindly.

Gold ETP sales were 681.4 tonnes for all of this year so far through August 19, data compiled by Bloomberg show and these sales have been greatly surpassed by physical coin and bar demand in China and India alone.

Demand from India and China in Q2 alone was 310 tonnes and 276 tonnes or 586 tonnes combined. There is also the not insignificant and increasing coin and bar demand from the rest of Asia, the Middle East, South America, Europe, the U.K. and the U.S.

Investors appear to be switching from ETFs to allocated accounts, which are often held in Switzerland, Bloomberg noted. GoldCore have direct experience of this as we have seen flows from clients liquidating ETFs in the U.K., the U.S. and even Switzerland into the safety of allocated bullion accounts in Zurich and Hong Kong.

“Bail-ins” and the risk of being an unsecured creditor of investment and savings providers is one of the reasons for the flight to allocated gold.

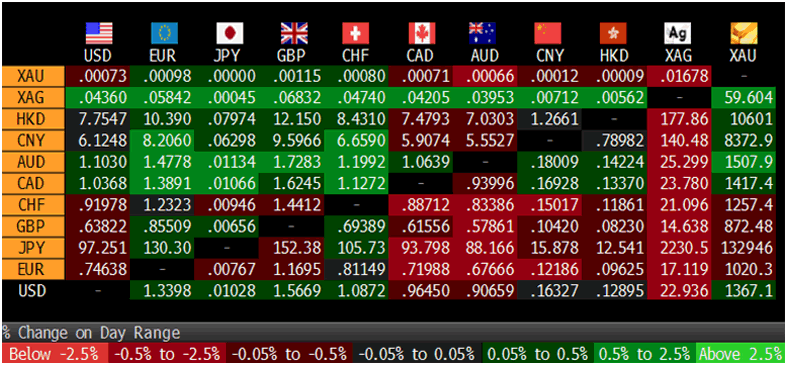

Cross Currency Table, 1200 GMT - (Bloomberg)

Prudent and risk conscious gold investors and store of wealth buyers continue to focus on ‘return of capital’ rather than ‘return on capital’ and are therefore switching from the more high risk, in terms of counter party risk, ETFs to the safety of allocated bullion.

Store of wealth bullion buyers will use weakness to accumulate physical again due to the strong fundamentals.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.